Callinex Mines (CNX.V) has now filed the technical report containing the Preliminary Economic Assessment on its Nash Creek zinc project in the Bathurst mining camp in New Brunswick, and will immediately advance the property through a 3,500-7,000 meter drill program in 20-40 holes.

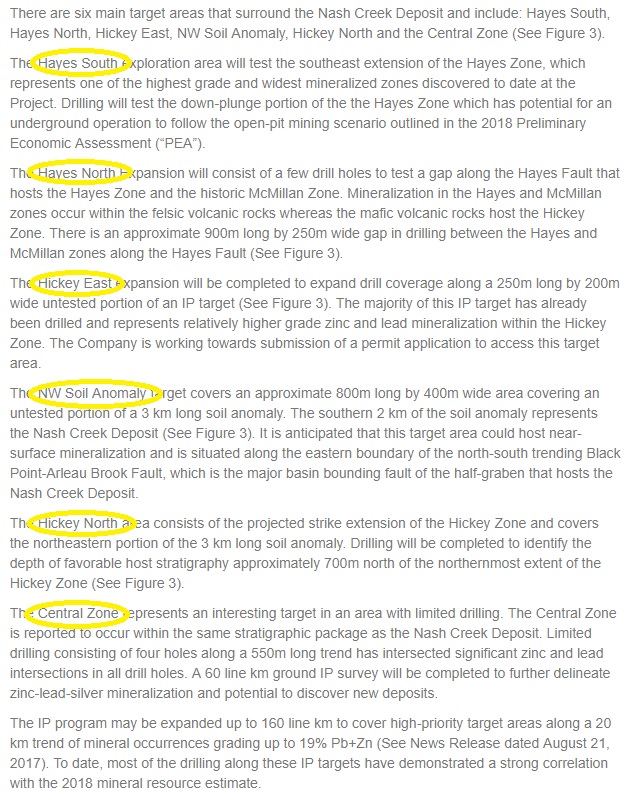

Additionally, approximately 160 line kilometers of IP surveys will be completed as well, with a specific aim to discover potential satellite deposits in the greater Nash Creek area. Six targets are now actually surrounding the Nash Creek deposit, and Callinex Mines will drill-test every target. The company does an excellent job in explaining where it will be drilling and why:

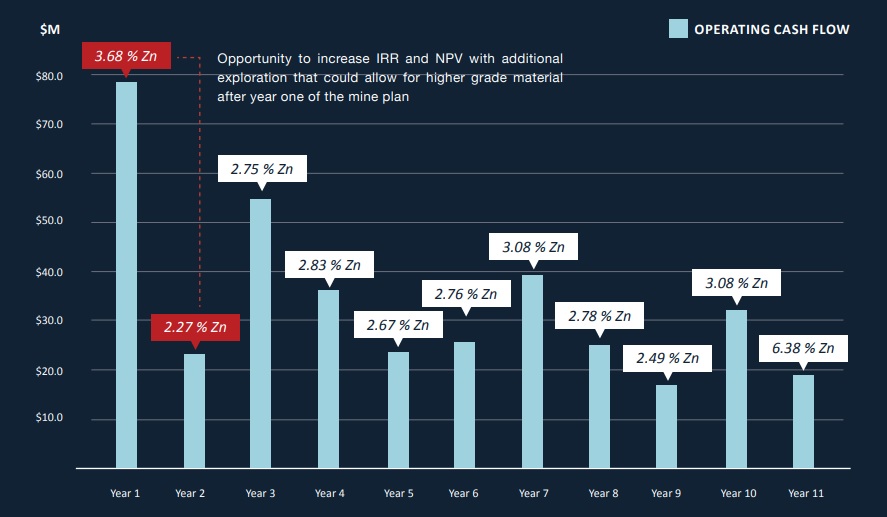

The positive PEA was just the beginning for Callinex Mines, and expanding the resources should have a positive impact on the Net Present Value of the project. Additionally, finding more higher grade ore could also allow the company to re-think its mine plan, to bring forward as much of the cash flow as possible (producing from more higher grade areas in the first few years of the mine life will boost the cash flows and result in a lower total discounting factor).

The zinc price hasn’t been cooperating lately, and Callinex Mines is definitely feeling the impact, as its share price slipped below the 20 cent level. This means Callinex currently has a market capitalization of approximately C$17M, but with C$5.4M in working capital (as of at the end of March), its enterprise value appears to be just C$12-15M (depending on the current working capital and cash position).

Go to Callinex’ website

The author has a long position in Callinex Mines. Callinex is a sponsor of the website. Please read the disclaimer