Canada Nickel (CNC.V) has entered into a Memorandum of Understanding with Glencore (GLEN.L) which owns and operates the Kidd concentrator in Ontario, approximately 40 kilometers away from the Crawford nickel project owned by Canada Nickel.

Although this is just a very preliminary MOU where both companies will explore opportunities to work together, it would make a whole lot of sense for Canada Nickel to try to use an existing processing plant as although the operating expenses would be higher, the initial capex would be substantially lower so the decision to either build a plant themselves or use an existing plant will be based on tradeoff studies: is the upfront capital saving enough to justify the higher operating cost per tonne (transportation, the fee per tonne payable to Glencore, etc). Considering Canada Nickel is a micro-cap company, keeping the initial capex low will probably be the best move as it will make it easier to finance the construction of a mine.

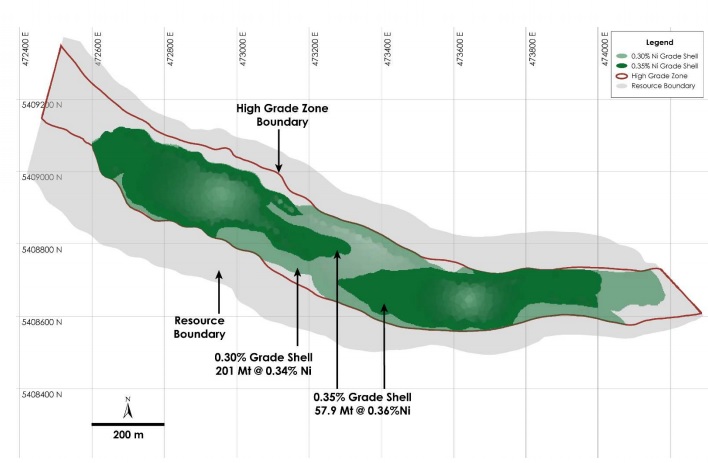

The study to figure out if the Kidd concentrator can be updated to accommodate Canada Nickel’s rock should be completed in March. Meanwhile, the company has announced the results of updated metallurgical test work at Crawford where 52% of the nickel was recovered (slightly higher than the 46% and 51% obtained during the previous test work) of which about half (46%) reported to a high-grade concentrate exceeding a 35% nickel content. The other half of the recovered nickel will report to the more standard 13% nickel grade concentrate. The PEA should be out soon, let’s see if the resource envelope of low-grade nickel mineralization (0.34-0.36%) will return attractive economic results applying the known recovery rates.

Disclosure: The author holds a long position in all stocks mentioned in this article. Please read our disclaimer.