Cancana Resources (CNY.V) has completed a first exploration program on the BMC project area in Brazil’s Rondonia province where it has been producing high-grade Manganese in a joint venture with Ferrometals. Cancana had established a team to evaluate the potential of the BMC property beyond the manganese occurrences which are currently being mined.

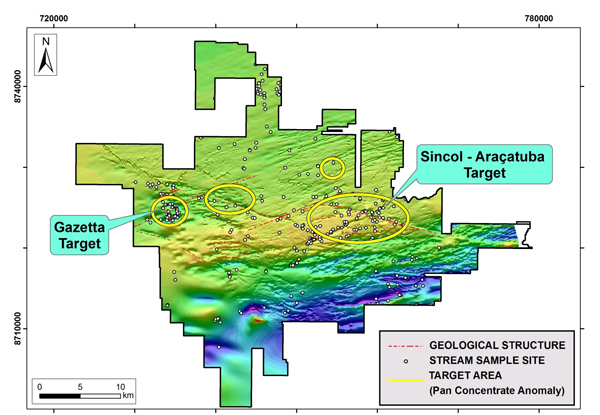

Cancana’s exploration team has now announces roughly 2/3rds of the in excess of 1,500 samples have returned anomalous results for gold occurrences, along a 10 kilometer long trend. The company has now started to map the occurrence in an attempt to define the source of the gold mineralization, where after Cancana’s team will start to focus on potential tin occurrences on the land package.

The company also announced it will merge its stake in the BMC with Ferrometals stake with Cancana being the publicly listed vehicle which will then own 100% of the BMC project which will now fully benefit from the recent increase of the Manganese price. By owning 100% of the property, Cancana should have better access to capital to continue to advance the project towards a major producer of high-grade manganese. Ferrometals will acquire all of Cancana’s shares (on a pro-rata basis using the project ownership rate) and assume the company’s listing on the TSX Venture exchange.

As the company’s share price is now trading approximately 110% higher compared to the 19 cents when we released our first blurb on the website, it might make sense to take a bit of cash off the table if the share price reaches the C$0.50 mark again, as that would technically value the merged entity at C$191M. That being said, it should be easier for the ‘new’ Cancana to raise cash to fast-track an additional expansion at the project (the company has been producing manganese at a rate of in excess of 1,000 tonnes per week lately) so, we do think the merger is a good move in the longer term.

Go to Cancana’s website

The author has a long position in Cancana Resources. Please read the disclaimer