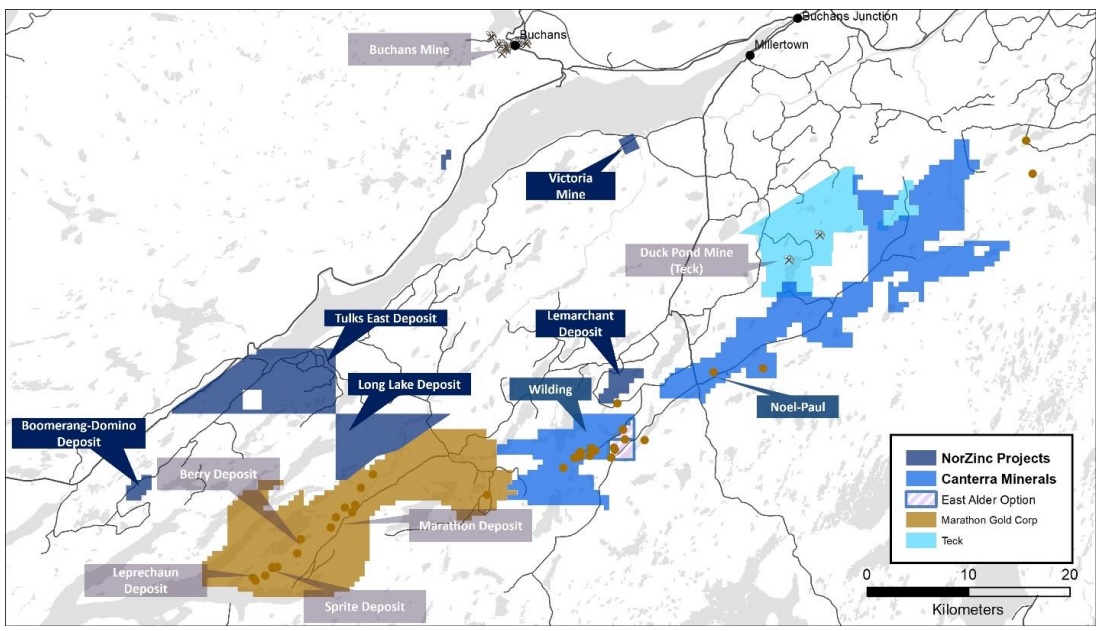

Canterra Minerals (CTM.V) transformed itself overnight from an early stage grassroots gold exploration company to a resource-stage company as it acquired a series of deposits in a transaction with NorZinc (NZC.TO). All the deposits are in close proximity to Canterra’s own exploration projects and at first sight, the existing resource estimates on the deposits looks very interesting.

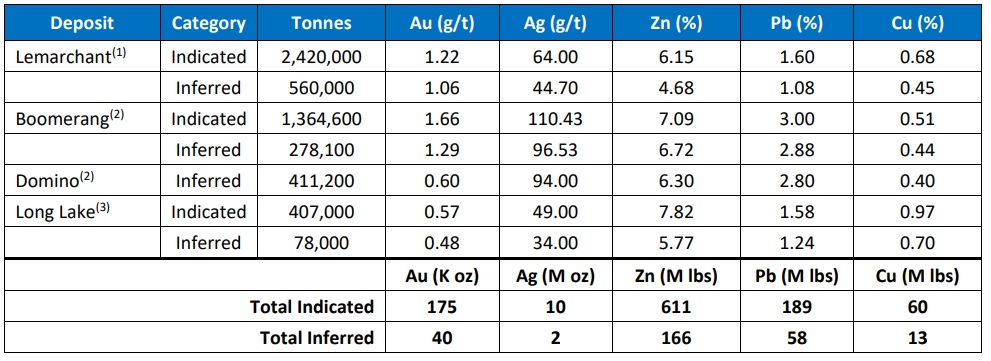

Canterra only mentioned the 175,000 ounces of gold in the indicated category and the 40,000 ounces of gold in the inferred resource category in the headline of its press release, but the table below shows the deposits have much more meat on their bones. In fact, on a gross metal value, gold isn’t even the primary metal, zinc is (although the net value of the zinc in the ground will be substantially lower given the anticipated recovery rates and the standard 15% deduction by the smelters for zinc in concentrate).

The indicated resources of the project contain, on top of the 175,000 ounces of gold, 10 million ounces of silver, 60 million pounds of copper, 611 million pounds of zinc and 189 million pounds of lead. The inferred resources could add about 20-25% to all the metals.

And that’s an excellent starting point for Canterra. It suddenly transformed itself overnight to a more advanced stage exploration company in Newfoundland, but the existing resources on the four newly acquired projects could work as a backstop to the valuation.

Of course, with just 4.2 million tonnes of rock in the indicated category and 1.3 million tonnes in the inferred category, the projects still lack the critical mass to consider the development. But as very little work has been done on the projects in the past few years, there must be some low-hanging fruit to rapidly add tonnes. The grades are good (to excellent), but ideally, the resources need to grow to about 10 million tonnes to consider a development scenario.

A good acquisition at a very reasonable price: Canterra will issue 6.6 million shares (representing a 9.1% ownership interest) and will make a C$250,000 cash payment to NorZinc.

Disclosure: The author has a long position in Canterra. Please read our disclaimer.