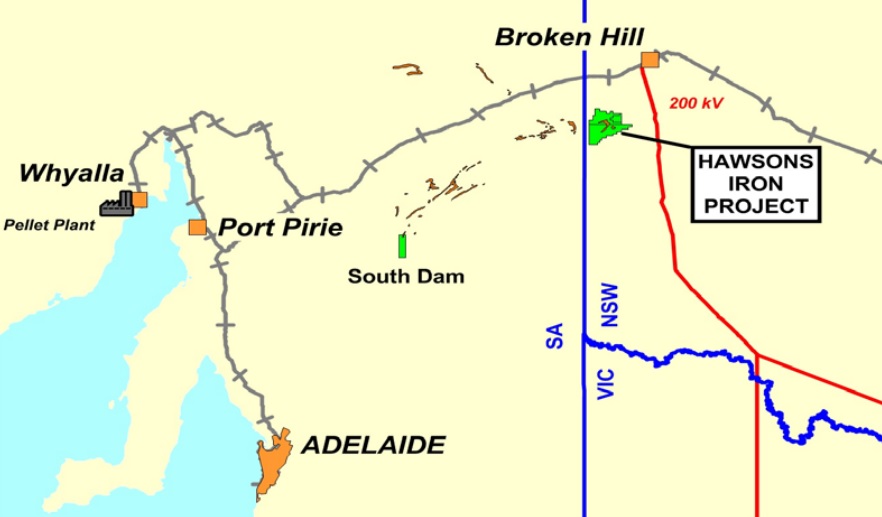

Carpentaria Exploration (ASX:CAP) is continuing to work at its Hawsons iron project in Australia and now expects to release the results of its pre-feasibility study by the end of this month. This PFS will look at the possibility to build a 10 million tonnes per year mine as a first phase.

The PFS was originally expected to be completed by the end of last month, but Carpentaria’s wish to use a new mine plan (with a slightly lower cut off grade of 9.5% DTR mass recovery vs 10%) has delayed the study by a few weeks, which would allow it to add no less than 120 million tonnes to the resources (which would otherwise have been discarded as waste).

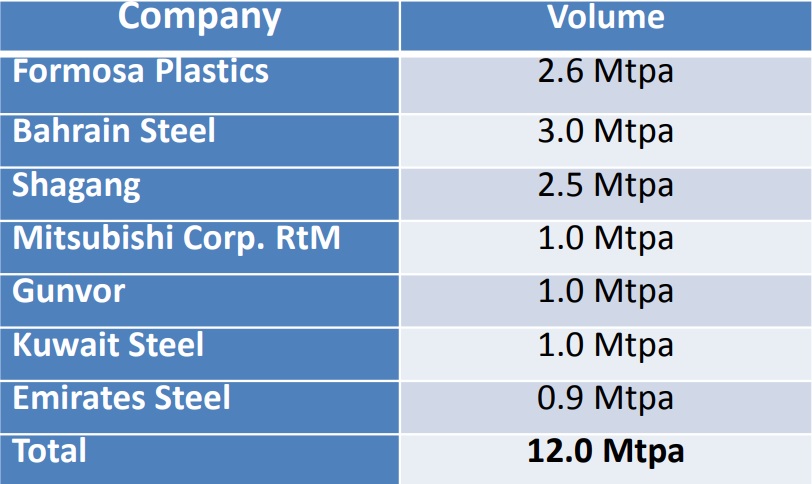

This was confirmed in an official resource update, as the 0.5% decrease in the cutoff-grade will add 120 million tonnes of ore to the mineable resource and result in an additional output of 12 million tonnes of Supergrade product (concentrate with an average grade of 69.7% Fe), for which Carpentaria has already negotiated sales contracts for a total of 12 million tonnes per year.

Hawsons is a very interesting project, and we’re looking forward to see the results of the pre-feasibility study as the initial capex will be the main hurdle to overcome. Fortunately the iron ore price is trading much higher now which should result in attractive economics for Hawsons as its Supergrade product could fetch a price of $72-78/tonne after taking shipping costs into consideration.

Go to Carpentaria’s website

The author has no position in Carpentaria Exploration. Please read the disclaimer