As you know, Eldorado Gold (EGO, ELD.TO) has made an offer to acquire all outstanding shares of Integra Gold (ICG.V) it doesn’t already own, but it looks like not everyone really understands the details of the offer.

We received several e-mails from readers who wanted to know why Integra Gold is trading at C$1 ‘if Eldorado offered C$1.2125 per share’. You should keep in mind the C$1.2125 isn’t a ‘fixed price’, but was merely the value of the deal the moment it was announced. Let’s have another look at the details:

‘to be satisfied by delivery to the holder of one of the following, at the election of the holder: (i) 0.24250 of an Eldorado share, (ii) C$1.21250 in cash, or (iii) 0.18188 of an Eldorado share and C$0.30313 in cash. Eldorado will issue an aggregate maximum of 77 million shares and pay an aggregate maximum of C$129 million in cash, equal to approximately 25% of the total consideration.’

So, considering the cash payment has been capped, it would be safe to assume the cash payments will be pro-rated. Unfortunately there’s no real fail-proof method to calculate how many investors will request to be paid in cash (very likely almost all of them), so we will just explain the offer which includes the Eldorado shares as part of the consideration.

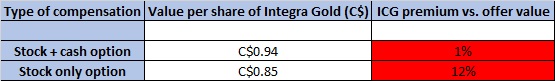

If you would request the combination of cash and stock, you will receive 0.18188 shares of Eldorado Gold, and C$0.30313 in cash. If you’d request the stock-only option, you will receive 0.2425 shares of Eldorado Gold, per share of Integra Gold. The next table visualizes what this means for you, using Eldorado’s closing price on the TSX of C$3.50 per share.

Considering two of the three options include cash, we think it’s fair and realistic to assume Eldorado’s cash payment will be capped, and the default option will be pretty close to the offered option of cash + stock (and you’d be pretty stupid to request the stock option right now, as you’d be better off by selling Integra Gold and buying Eldorado Gold on the open market).

And finally, we would like to share two closing remarks with you. First of all, the cash payments will be pro-rated. It doesn’t matter if you requested a cash payment the first minute or the day before the offer closes, the time of tendering your shares has no impact on the cash allocation. Secondly, as you can read in Integra Gold’s official paperwork, there were two other companies showing an interest in acquiring Integra Gold. Now the value of the Eldorado-bid is substantially lower than when it was announced, it’s not impossible one of both other interested parties could try to re-negotiate a new deal – in which case a C$18M break fee would be payable to Eldorado Gold.

Go to Integra’s website

The author currently has no position in Integra Gold. Integra Gold is a sponsor of the website. Please read the disclaimer