Cornish Metals (CUSN.V, CUSN.L) has released an updated Preliminary Economic Assessment on its flagship South Crofty tin project in Cornwall.

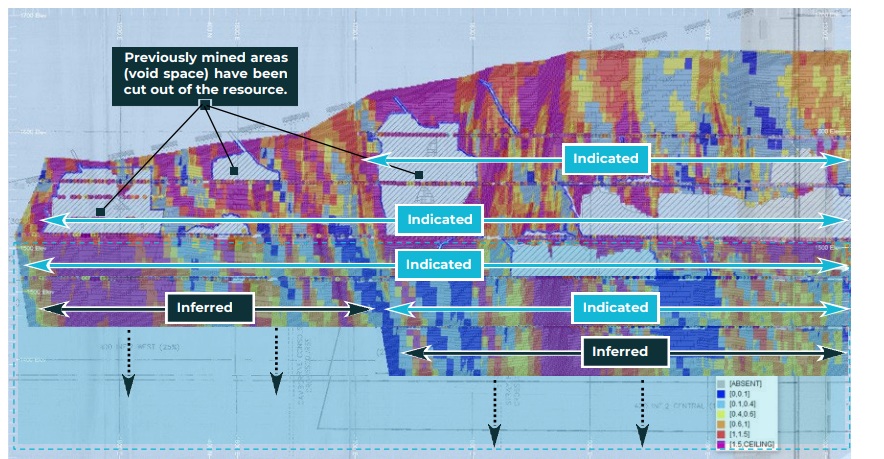

The initial capex is now estimated at 198M GBP (including a contingency of just 10%) which will allow the company to produce just under 4,700 tonnes of tin per year in the first few years of the mine life. The total cumulative tin production will be just under 50,000 tonnes while South Crofty will also produce just under 9 million pounds of copper and 7 million pounds of zinc over the entire 14 year mine life. As South Crofty primarily is a tin mine, the impact of the by-product credits is negligible as zinc and copper sales will represent just a few million dollar in additional revenue per year.

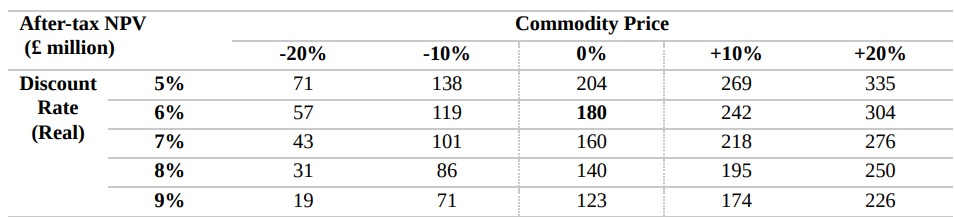

Using a tin price of $33.900/t, the PEA outlines an after-tax NPV6% of 180M GBP and an IRR of 20%. The payback period is approximately 3.3 years, while the mine will generate a total of after-tax free cash flow of 558M GBP.

The sensitivity analysis shown above provides a good overview of how the after-tax NPV varies depending on the discount rate and used commodity price. It is clear why Cornish Metals didn’t want to use the 8% discount rate (the standard discount rate for non precious metals projects), as that would result in a 40M GBP lower NPV. The sensitivity table also shows the leverage South Crofty offers on the tin price. Applying a price of just over $37,000/t would add 55M GBP in after-tax NPV8%, but this of course works both ways. A 10% lower tin price of just over $30,000/t removes 54M GBP from the NPV8%.

Disclosure: The author has no position in Cornish Metals. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.