Cypress Development (CYP.V) has closed its (upsized) bought deal financing earlier this week raising a total of C$19.55M by issuing 15.64 million units priced at C$1.25. Each unit consisted of one common share and a full warrant which will allow the warrant holder to acquire an additional share of Cypress Development at C$1.75 for a period of three years (until March 22, 2024). Should all warrants eventually be exercised (the exercise price is obviously out of the money), an additional C$27M would hit the company’s bank account.

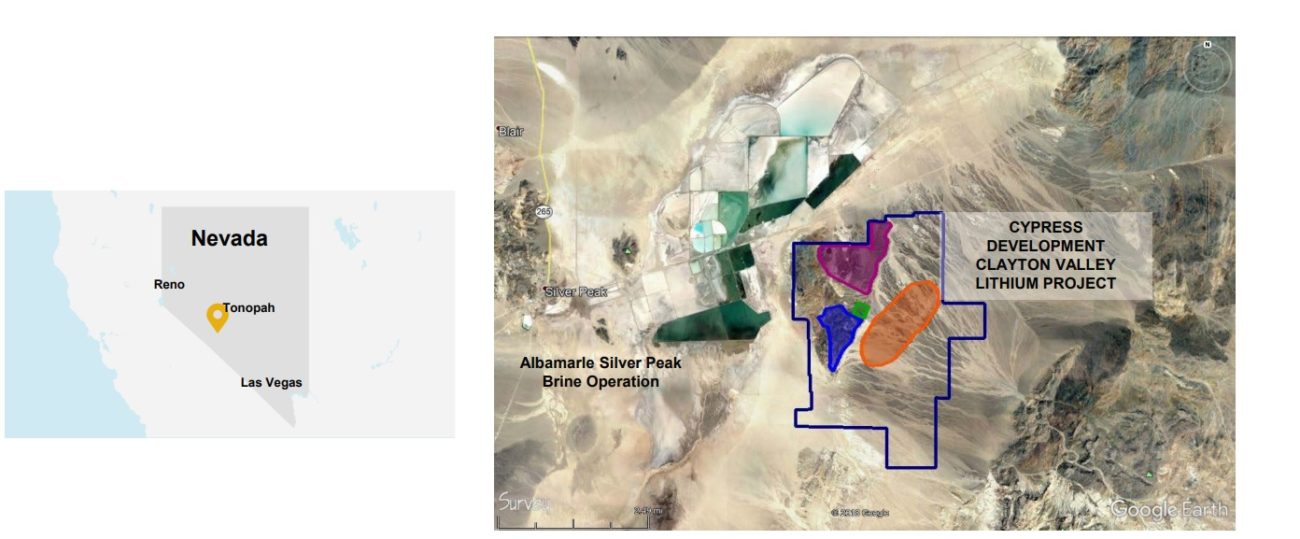

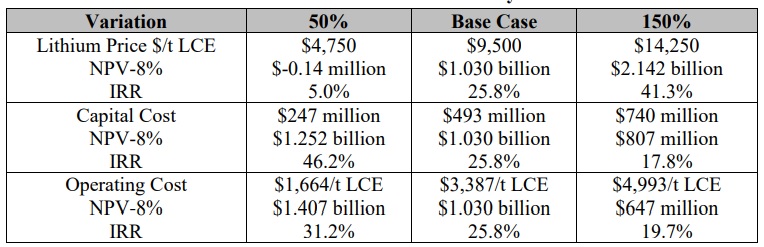

The cash will be useful to continue to advance its Clayton Valley lithium project in Nevada where a May 2019 pre-feasibility study outlined a 27,400 tpa LCE production profile for an initial capex of just under US$500M and an operating cost of just under US$3,400 per tonne of LCE. Using a base case lithium price of $9,500 per tonne, the after-tax NPV8% was estimated at US$1.03B while the relatively low initial capex had a payback period of just over 4 years, resulting in an IRR of 25.8% on an after-tax basis.

That’s a good start, but keep in mind the NPV was based on a 40 year mine life which means the final few years of the mine life contribute hardly anything to the NPV: in year 36, the cash flows are discounted by a factor of 16: should the project generate $100M in cash flow, applying an 8% discount rate would result in just over $6M being added to the NPV calculation. Now the interest in lithium stories has returned, we will soon review and provide an update on the recent progress made by Cypress.

Disclosure: The author has a long position in Cypress and participated in the recent capital raise. Cypress is a sponsor of the website. Please read our disclaimer.