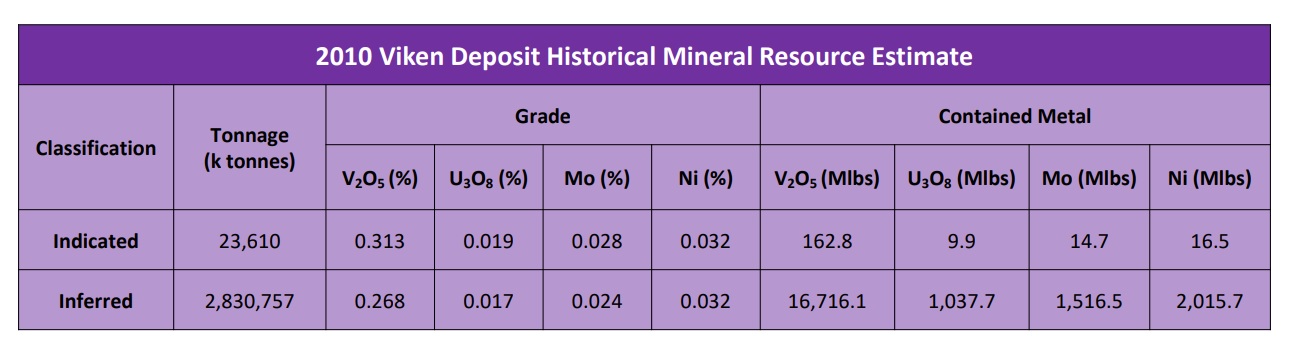

In the mining sector, it usually is a good idea to raise money when you don’t actually need it, and District Metals (DMX.V) has applied that old adage just this week. It initially announced a bought deal financing for C$4M but immediately upsized this to C$4.5M (and still had to turn investors away). The financing was priced at C$0.22 per unit with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.30 during a three year period. This financing comes hot in the heels of District Metals securing 100% ownership of the Viken deposit which contains in excess of a billion pounds of low-grade uranium.

District Metals didn’t need the cash. According to its most recent publicly filed financials, the company ad a positive working capital position of C$2.3M as of the end of September 2023 and has barely been burning any cash. This allowed District to raise the money from a position of strength and the current working capital position of approximately C$6M will allow District to hit the ground running when the uranium moratorium in Sweden gets lifted. Those rumors are gaining pace and hopefully we see some political movement this quarter.

Disclosure: The author has a long position in District Metals. District is a sponsor of the website. Please read the disclaimer.