District Metals (DMX.V) has been on a real rollercoaster lately as there still isn’t any clarity on the official lifting on the moratorium. We hope to catch up with CEO Ainsworth as soon as there are more details on the lifting of the moratorium beyond the initial rejection of a ‘declaration to the government’ (by what could essentially be considered a sub-committee) where the proposal to lift the moratorium was bundled with a bunch of other ideas and suggestions. According to District, there has been no change in the government’s stance on lifting the uranium moratorium but there is no definitive timeline towards this.

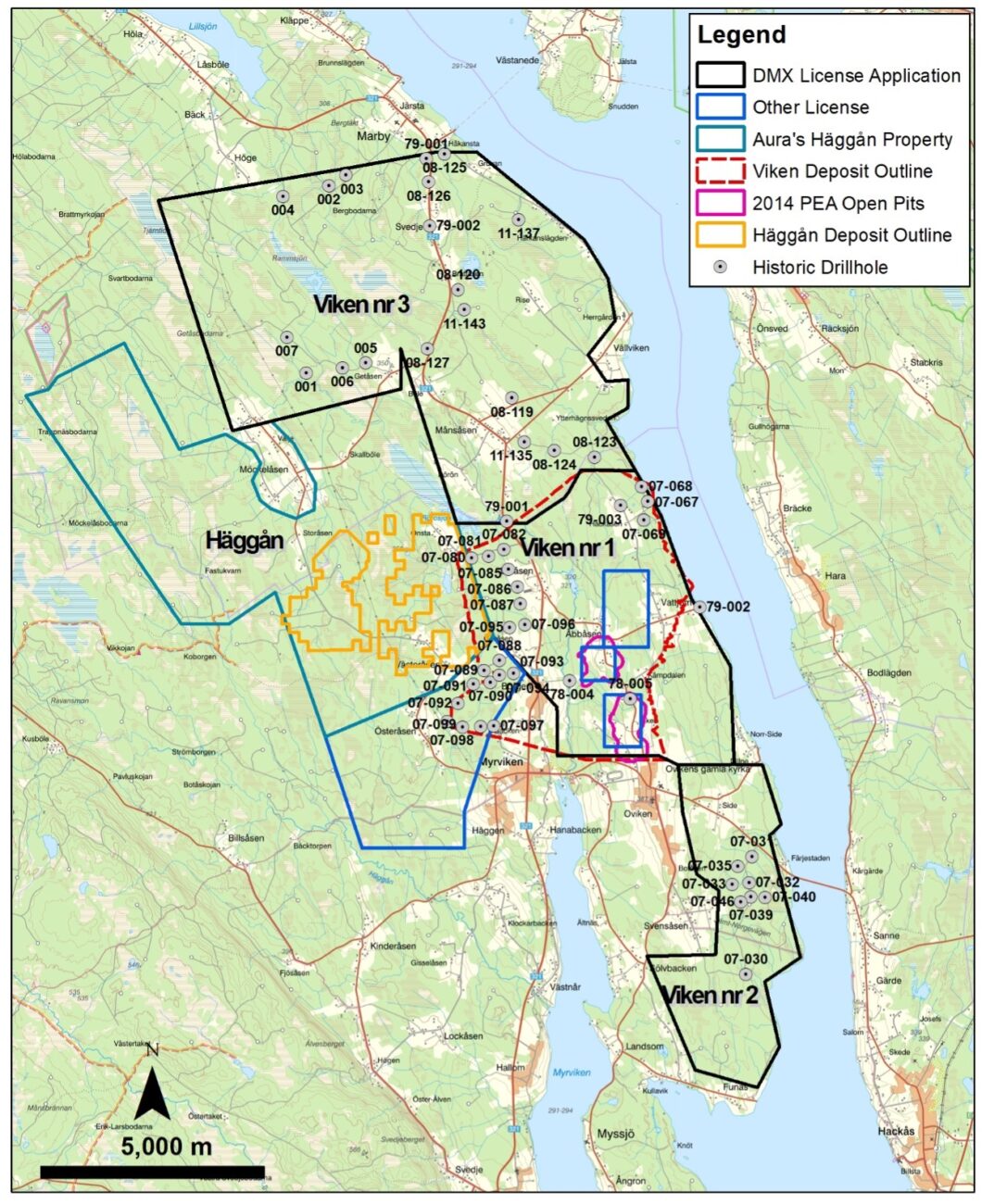

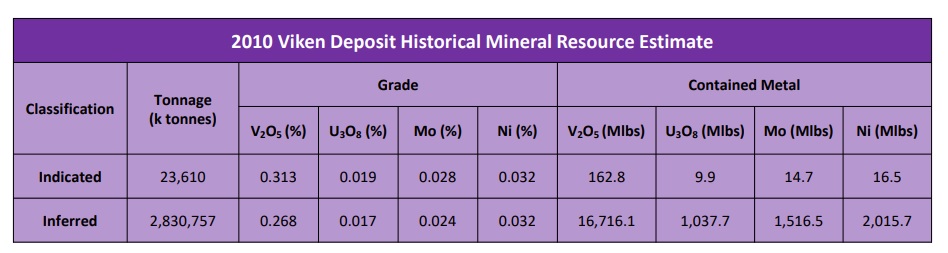

The company also received the official approval for the Viken nr 1 licence which covers almost 70% of the known Viken Deposit (the resource estimate for 100% of the deposit is shown below). Receiving the approval means the process in Sweden is pretty streamlined and this means we will likely see the approval for the nr 2 and nr 3 licenses in the next few months as well. The approval for Viken 1 grants the company a three year license on the asset and the dust on the process to lift the uranium moratorium should for sure be settled by then.

Meanwhile, it’s business as usual for District Metals. The company made the smart decision to raise C$3M at C$0.15 so even if DMX would have to go into hibernation, the current cash position could last for several years. That of course is not the company’s intention and we expect to hear more about the upcoming exploration programs in Sweden over the next few weeks and months.

Disclosure: The author has a long position in District Metals. District is a sponsor of the website. Please read our disclaimer.