Vanstar Mining (VSR.V) has now kicked off its initial 4,000 meter drill program at the Bousquet-Odyno gold project in Québec where the company is earning in towards a 75% stake in the project from IAMgold (IMG.TO, IAG).

As per the agreement, Vanstar can earn a stake of up to 75% in the project. An initial 25% stake will be obtained by spending at least C$2M in exploration expenditures on the project before March 11th 2024 where after Vanstar can earn an additional 50% stake (for a total of 75%) by spending an additional C$2M within four years after the effective date (which was March 11, 2022).

IAMgold has retained the right to back in and increase its ownership to 50% again by spending four times the amount spent on exploration after the initial 75% stake has been established. So if Vanstar spends the C$4M required to get to 75% and spends an additional C$1.5M before IAMgold exercises its back-in right, IAMgold would have to cough up C$6M to exercise its right to go back up to 50%. That sounds like a good deal but if IAMgold elects right away to get back up to 50% immediately after Vanstar completes the C$4M earn-in, Vanstar likely won’t see too much cash. But at that point a 50/50 joint venture will be established and both partners will contribute in equal parts to the exploration programs.

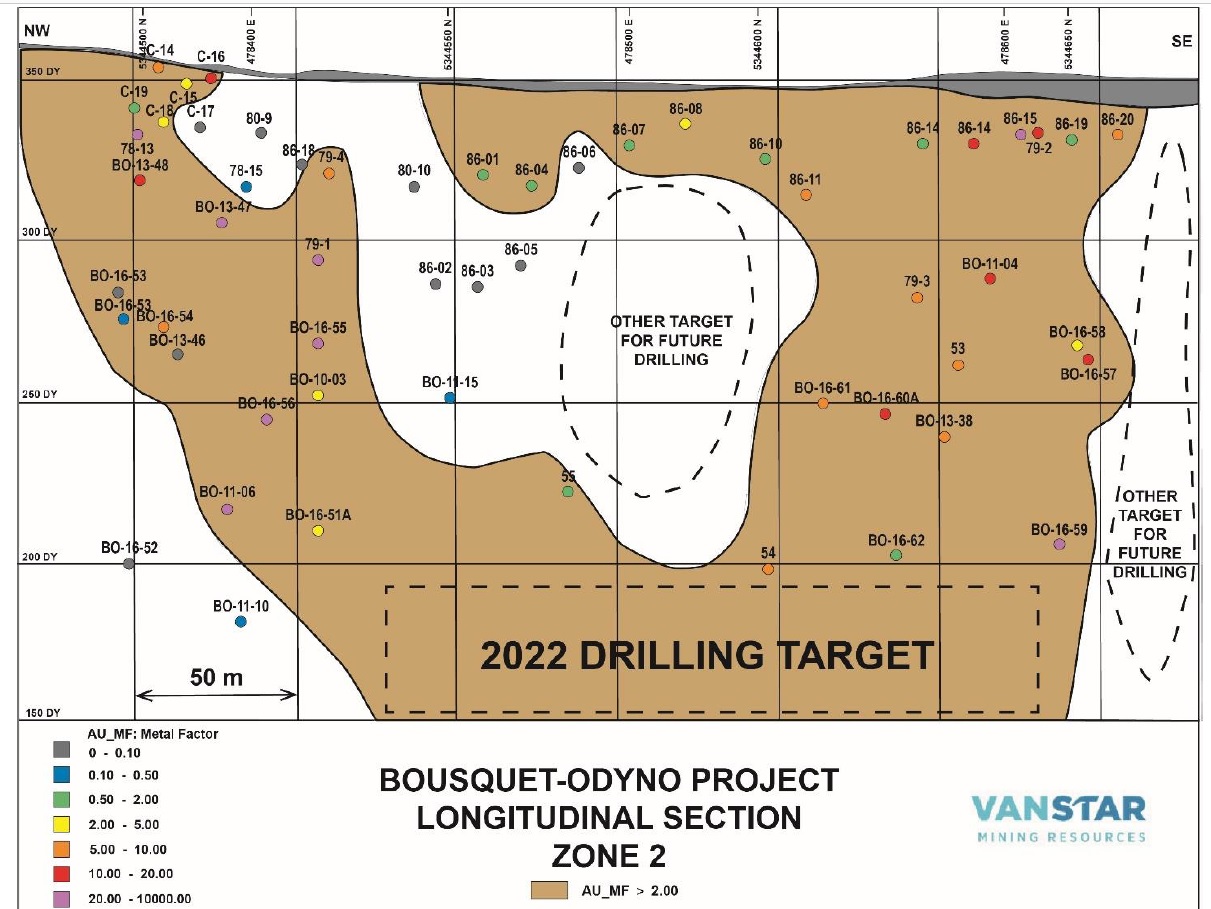

The current drill program will focus on the areas down plunge from the known high grade zones at Bousquet-Odyno. Historical drill results from IAMgold-executed drilling for instance encountered 3.3 meters of 29.3 g/t gold and 16.5 meters of 9.6 g/t gold. No drilling has taken place since 2016 and Vanstar Mining is obviously hoping to replicate the historical drilling success and expand the mineralized footprint.

Disclosure: The author has a long position in Vanstar Mining. Vanstar is a sponsor of the website. Please read our disclaimer.