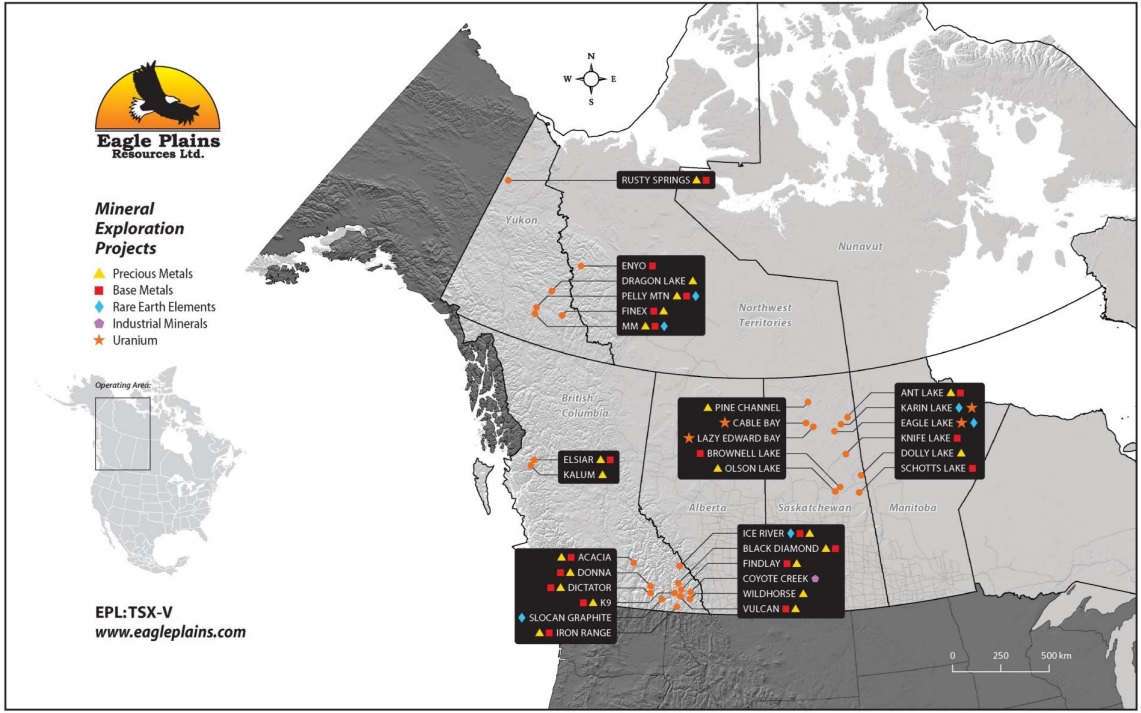

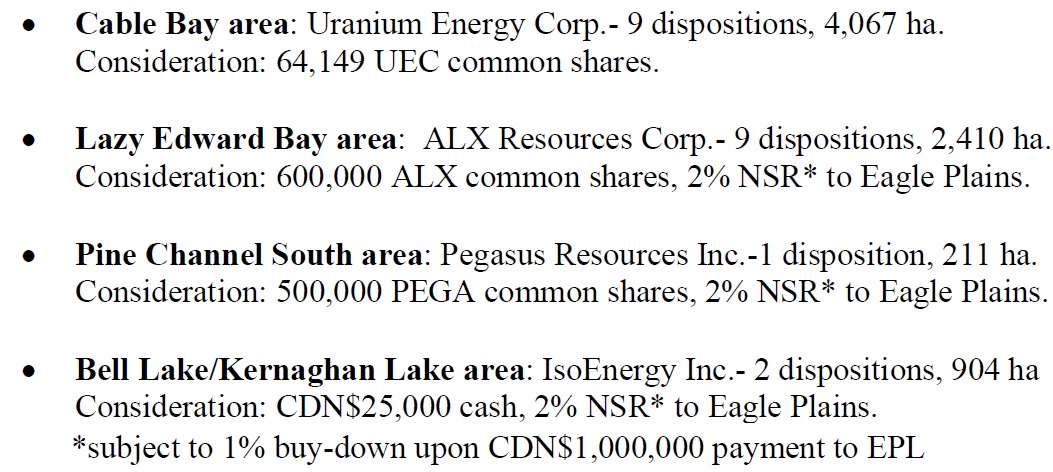

Eagle Plains Resources (EPL.V) has entered into definitive agreements with four separate groups to sell four of its uranium assets in Saskatchewan’s Athabasca Basin. The four claims didn’t have any strategic of meaningful value to Eagle Plains, but the locations of the assets was appealing to the buyers as some of them have contiguous claim packages. The company retains a Net Smelter Royalty on three of the assets, receives C$25,000 in cash and a bunch of stock with a market value of just under half a million Canadian Dollar (although we’ll have to be mindful of trading volumes and liquidity on the markets.

Monetizing these assets seems to be a good idea – as none of the assets are even mentioned on the Eagle Plains website, the exploration properties are clearly non-core assets. Exploring for uranium in the Athabasca Basin can be very expensive and rather than spending millions of dollars themselves, it makes sense to get some cash and stock while other companies spend their money.

Disclosure: The author has a long position in Eagle Plains. Eagle Plains Resources is a sponsor of the website. Please read our disclaimer.