Eclipse Gold (EGLD.V) is now fully cashed up after completing a C$12M bought deal. The cash was raised at C$0.75 by issuing almost 16 million shares in a no-warrant deal. Net proceeds to Eclipse will be just under C$11.5M as the underwriters will receive a 6% fee on funds they raised and 3% on the president’s list.

As this was a bought deal with free trading stock, it’s perhaps not surprising to see the share price remaining virtually unchanged between 75 and 80 cents as some participants may be selling some of the stock for marginal gains, or selling down an earlier position after getting confirmed in the bought deal.

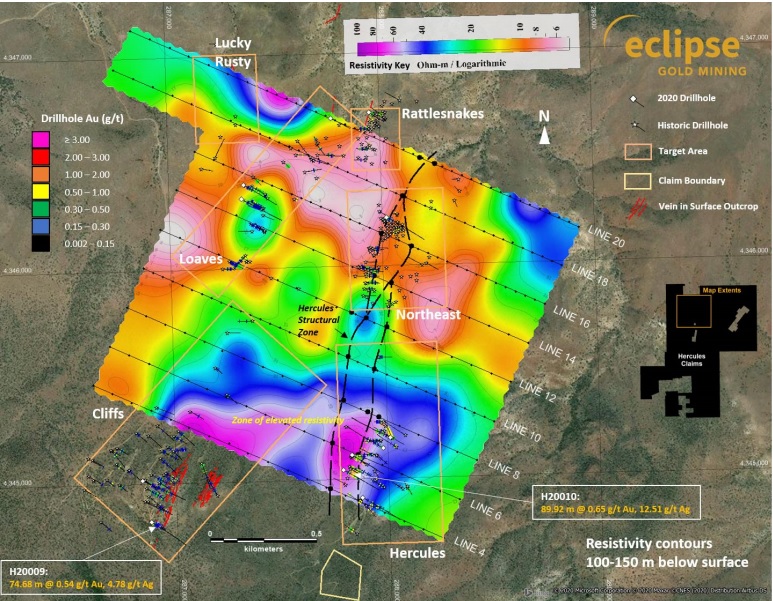

Meanwhile, Eclipse continues its Hercules exploration program and the company has just completed an IP survey on a 2.8 square kilometer zone of the Hercules project. The results of the IP survey are currently being interpreted and should be helpful to Eclipse Gold to further refine the drill targets at Hercules where a first pass drill program indicated the mineralisation appears to continue along trend and at depth of the first few holes.

The initial interpretation (not by the company’s geologists but by a third party) reveals the presence of two parallel zones trending towards the north-northeast and steeply dipping to the west, and this has now been called the Hercules Structural zone which passes through the main Hercules target and to the west of it. This structural zone could represent a feeder structure for the mineralization encountered at Hercules, and more drilling will have to be conducted to follow up on this. Another important takeaway from the IP survey appears to be the interpretation the Cliffs and Hercules zones may be connected at depth.

Disclosure: The author has a long position in Eclipse Gold and participated in the bought deal financing.