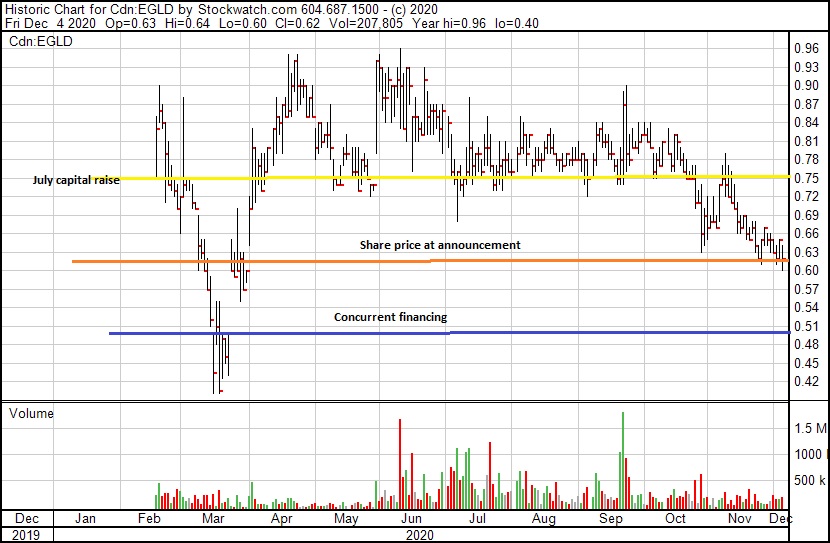

Eclipse Gold (EGLD.V) has reached an agreement with Northern Vertex Mining (NEE.V) whereby the latter will acquire all outstanding shares of Eclipse by issuing 1.09 of its own shares for a no-premium deal. In fact, it may even be a take-under as Eclipse Gold is raising money at C$0.50 in a subscription receipt private placement and upon closing the sale to Northern Vertex, these shares will convert into Northern Vertex stock.

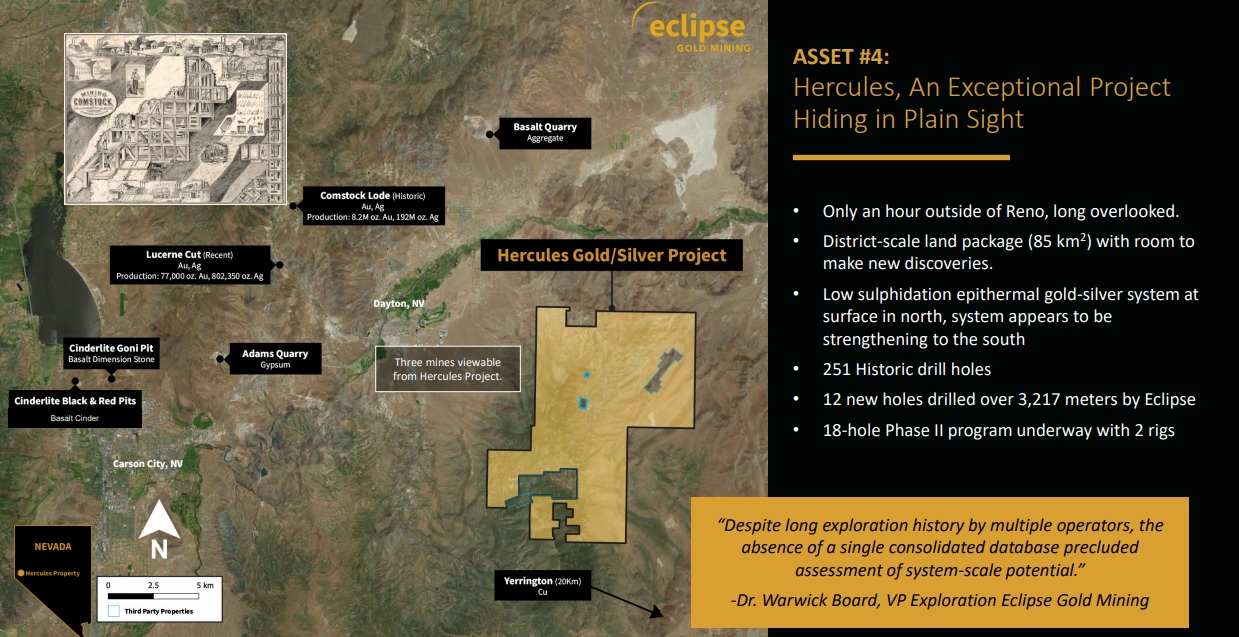

Although some people call this a ‘1 + 1 equals more than 2’ and we can see the rationale for the transaction, it is a blow to the face to Eclipse Gold shareholders as well. Shareholders bought into Eclipse on the promise Hercules was a district-scale gold exploration project and with C$11M cash in the bank (according to the most recent corporate presentation) there was plenty of time and cash to work towards effectively exploring the gold system rather than selling the company at what almost is an all-time low.

Except for the few days in March when the world was coming to an end, Eclipse Gold has consistently traded over C$0.50 (the price of the concurrent financing) and even C$0.62 (the share price when the sale to Northern Vertex was announced). Additionally, the new concurrent financing is priced 33.3% below the most recent capital raise in July, when Eclipse raised C$12M at C$0.75. Shareholders that bought into the financing at C$0.75 were doing so in order to provide the company with funds to continue to explore the property, and not to sell it less than six months later below that price.

This begs the question why a company with C$11M in cash and a property it thinks is one of the best in Nevada is selling the company at a bargain price and -except for a few trading days in March – at an all-time low, less than 10 months since its first trading day?

Either Hercules is not as good as Eclipse Gold thought it was and the sale of the company to Northern Vertex is an elegant way out, or the latter is getting quite a deal by picking up ‘an exceptional project’ at an enterprise value of just C$20M. Something doesn’t feel right about this deal and although there’s something to be said about teaming up with a producer, Northern Vertex generated just C$5M in free cash flow in the September quarter. And if it is so important to team up with a producer, why is a concurrent C$20M raise at an even lower price necessary?

As Eclipse Gold has a bunch of strong shareholders, we expect this to be a ‘done deal’ and this transaction likely will move ahead. But that doesn’t mean we have to like it.

Disclosure: The author has a long position in Eclipse Gold, and no position in Northern Vertex. Please read our disclaimer.