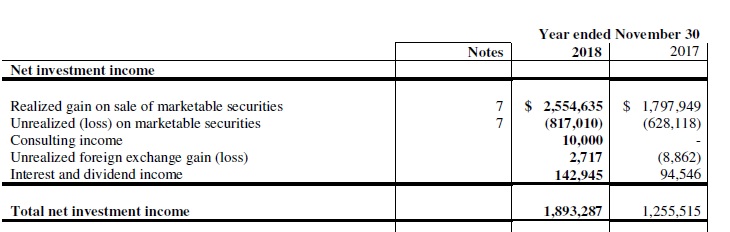

Elysee Development Corp (ELC.V) has just announced its audited financial results for its fiscal year 2018, which ended in November. The company’s investment strategy is clearly paying off as the net income increased to almost C$1.3M, which is the equivalent of approximately 6 cents per share. This has put the company in an excellent position to declare a final dividend of C$0.02 per share, which brings the full-year dividend once again at C$0.03 per share. Using the most recent closing price of C$0.385 as starting point, Elysee’s dividend yield is currently approximately 7.8%.

This is the sixth consecutive year wherein Elysee remains profitable, and posting a net income of C$1.3M is a massive outperformance of the TSX Venture index, which decreased by 25% over the same period. Additionally, an index doesn’t incur the operating expenses Elysee incurs, and during FY 2018, Elysee spent approximately C$600,000 on operating expenses. Excluding these expenses, the income would have been closer to C$2M which, on a weighted portfolio total of approximately C$13M indicates a return of approximately 15%, for an outperformance of 40% over the TSX-V returns in the same period.

Despite this excellent performance, the bonuses for the management team did not increase compared to the previous year. That’s refreshing, as not only did Elysee post an excellent financial performance, the same team was also able to successfully close a C$1.7M no-warrant capital raise without paying a single dollar in finders fees. This raise boosted Elysee’s cash position, which stood at C$4M as of the end of November. Since then, Elysee has invested C$1.25M in its new vanadium venture in the United States while maintaining the flexibility to take advantage of opportunities in the current volatile market.

As the total share count increased to 26.6M shares, the 2 cent dividend will cost Elysee approximately C$535,000 in cash, indicating the total cash position should still be in excess of C$2M. The shares will go ex-dividend on February 19th, and the payment date has been set at February 28th, enabling shareholders to immediately spend it again on coffee and investment opportunities at the upcoming PDAC conference in Toronto.

Go to Elysee’s (new) website

The author has a long position in Elysee Development. Elysee is a sponsor of the website. Please read the disclaimer