EMX Royalty Corp (EMX, EMX.V), the company that sold the Tomtebo project in Sweden to District Metals (DMX.V) remains active and back in September the company announced it was selling the Queensland Gold project to a private Australian company for a combination of cash payments and retaining a Net Smelter Royalty on the project.

The private company has paid A$65,000 in cash to EMX Royalties, and has committed to complete at least A$0.5M in exploration expenditures during the first year of the earn-in agreement. Upon the first anniversary, an additional A$235,000 will have to be paid to EMX in cash or stock (in the event Many Peaks Gold will be listed by the first anniversary). Between the first and third anniversary of the agreement, Many Peaks will be required to make additional payments in cash or stock of A$500,000 while an additional A$2M will have to be spent on the property.

Once all these conditions will have been satisfied, Many Peaks will own 100% of the Queensland gold project subject to a 2.5% Net Smelter Royalty issued to EMX (which obviously is what EMX is really after). And EMX seems to have negotiated a good deal as Many Peaks will have to make advance royalty payments of 30 ounces of gold until a first JORC compliant resource has been completed. If that first resource contains less than 1.5 million ounces of gold, advance royalty payments equivalent to 50 ounces of gold will have to be made, and should the resource exceed 1.5 Million ounces, the required advance royalty payment increases to 65 ounces of gold per year (almost US$125,000 per year based on the current gold price). Many Peaks will be allowed to repurchase 0.5% of the 2.5% NSR for a payment of 1,000 ounces in gold (or the equivalent cash amount, obviously).

Another good deal for EMX Royalty where it will earn some cash, but more importantly, a partner will advance the project towards hopefully a resource that would confirm the potential of the project.

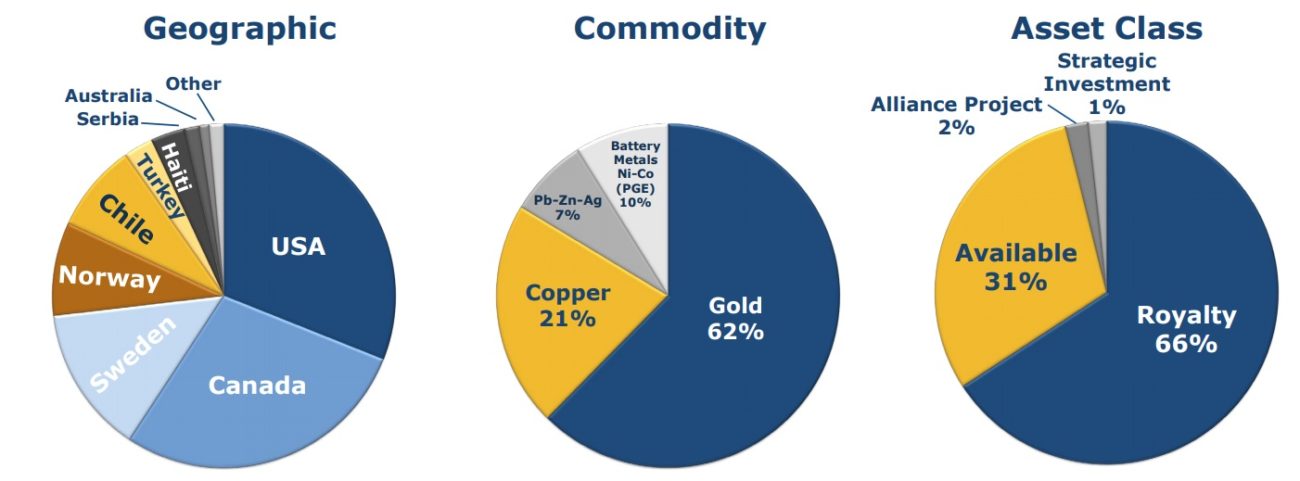

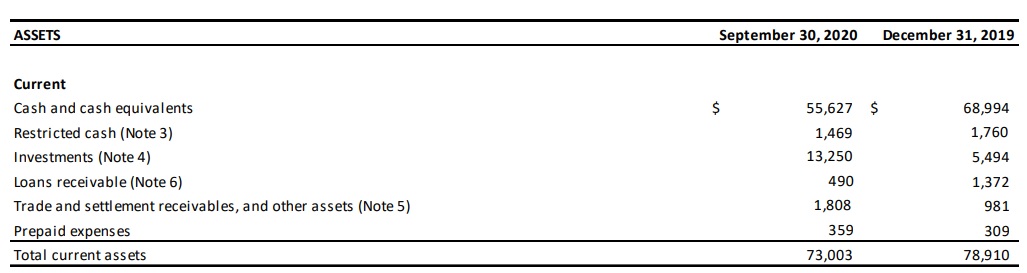

EMX’s balance sheet remains extremely robust as the company had a working capital of just over C$69M as of the end of September, of which in excess of C$55M was held in cash. This net cash represents around C$0.65 per share and makes EMX Royalty very well capitalized.

Disclosure: The author has no position in EMX Royalty Corp. Please read our disclaimer.