EMX Royalty Corp. (EMX, EMX.V) has released its FY 2023 results wherein it generated a total revenue of almost $27M but a net loss of $4.6M but more importantly, the company also provided its guidance for the current financial year.

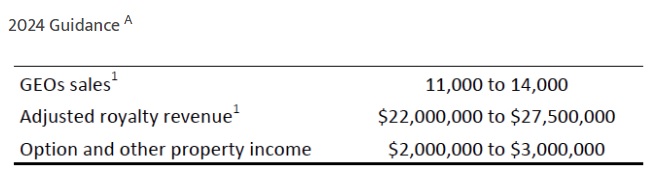

EMX plans to report an attributable production of 11,000-14,000 ounces of gold-equivalent resulting in an adjusted revenue of $22-27.5M based on a gold price of $1939 per ounce and a copper price of $3.89 per pound. As both the gold price and copper price are currently trading at substantially higher levels, it would be realistic to aim for the higher end of the full-year guidance. On top of that, EMX expects to generate $2-3M in option and property income. Meanwhile EMX Royalty can look forward to getting the increased royalty payments from the 0.83% Caserones NSR while solving the issue on the Timok royalty will also improve visibility. The additional 0.0531% NSR in Caserones was acquired for $4.74M and based on that valuation, the 0.8306% NSR has a pro forma value of US$74M.

Disclosure: The author has a long position in EMX Royalty. Please read the disclaimer.