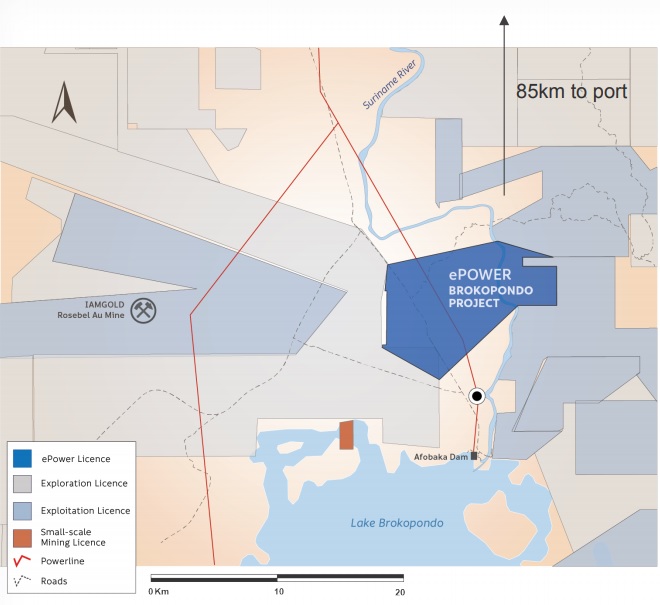

ePower Metals (EPWR.V) announced a surprising move last month as the company has identified and acquired a large cobalt-manganese laterite project in Suriname. As ePower has staked the target, the acquisition costs are minimal (less than C$50,000) and on top of that, the project has been explored for bauxite (aluminum) and gold in the past, which means the access roads and roads amenable to move drill rigs around have already been created. Additionally, the licenses are located just 20 odd kilometers away from the large Rosebel gold mine, owned and operated by IAMgold (IMG.TO, IAG), and that will undoubtedly make the logistics part much easier.

The land claims totalling almost 9,000 hectares were staked based on a 25 year old report of the US Geological Survey which described a large laterite-hosted cobalt-manganese target with average grades of 0.5-1.5% cobalt. An open pit grade of 0.5% cobalt would be excellent, 1.5% would be phenomenal, and although it would be nice to see such a high grade deposit close to or even at surface, anything above 0.25% cobalt could definitely work as that would represent an in situ rock value of around $200/t, excluding any by-product revenue from manganese and/or nickel.

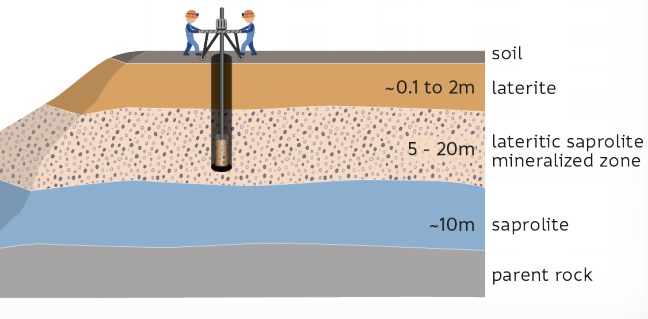

As Laterite deposits occur very close to (and actually at) surface, most laterite projects are cheap to mine; there’s extensive evidence of low-cost nickel laterite mines all over the world.

ePower’s reason to go to Suriname is pretty simple. The northern part of South America was connected to the West Coast of Africa, and the gold and oil deposits that have been discovered in West Africa were actually duplicated in the northern part of South America (it really isn’t a coincidence to see several multi-million ounce gold deposits in Venezuela, Suriname and French Guyana). ePower’s exploration theory is based on discovering a similar type of cobalt laterite deposits as West African properties, and ePower mentions Geovic Mining as its main example.

That company owned a large and high-grade project in Cameroon, with almost 60 million tonnes at an average grade of 0.24% cobalt and 0.68% nickel (and some manganese, which we are leaving out of the equation for now). There’s obviously no guarantee ePower Metals will discover a similar high-grade laterite deposit, but at least the company has a valid exploration theory.

Go to ePower’s website

The author has a long position in ePower Metals. Please read the disclaimer