EQ Resources (EQR.AX) has released the outcome of its bankable feasibility study on the Mt Carbine expansion project which takes the fully owned Andy White pit and the 50% owned low grade stockpile into consideration.

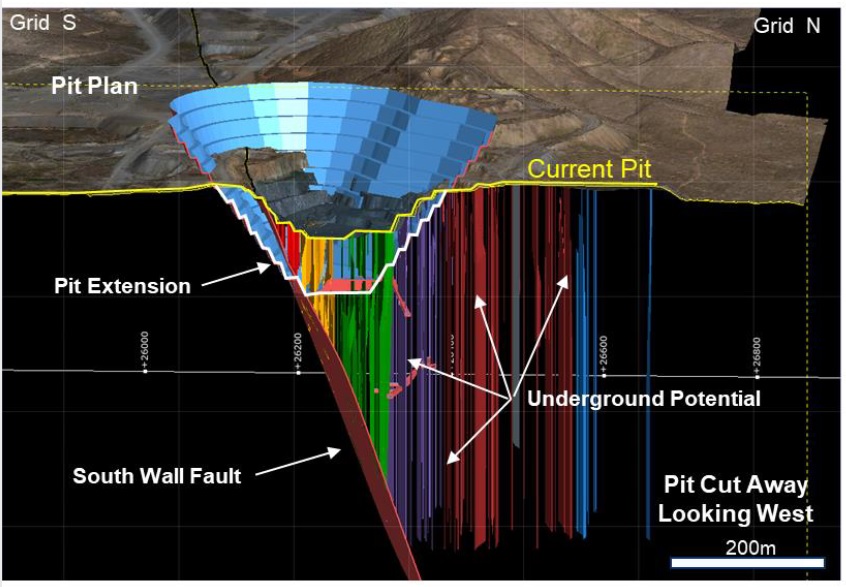

The feasibility study outlined a 12 year mine life resulting in an NPV8% of just over A$131M with an IRR of in excess of 150% although less than 20% of the in situ mineral resource was included in the study. Additional tonnes may come into the mine plan as EQ generates cash flow by picking the low-hanging fruit first. EQ anticipates the cash flow from Phase I and II will help to develop a third phase at Mt Carbine which would see an expansion of the open pit and the reopening of select underground workings.

The initial capex is estimated at A$211M which should be sufficient to produce an average of 2,200 toonnes per year of concentrate at a grade of 50% WO3. The C1 cash cost is anticipated to be just US$113/mtu and the assumed sales price is US$315/mtu on an APT basis with a payability of 70-75%.

Disclosure: The author has no position in EQ Resources. Please read our disclaimer.