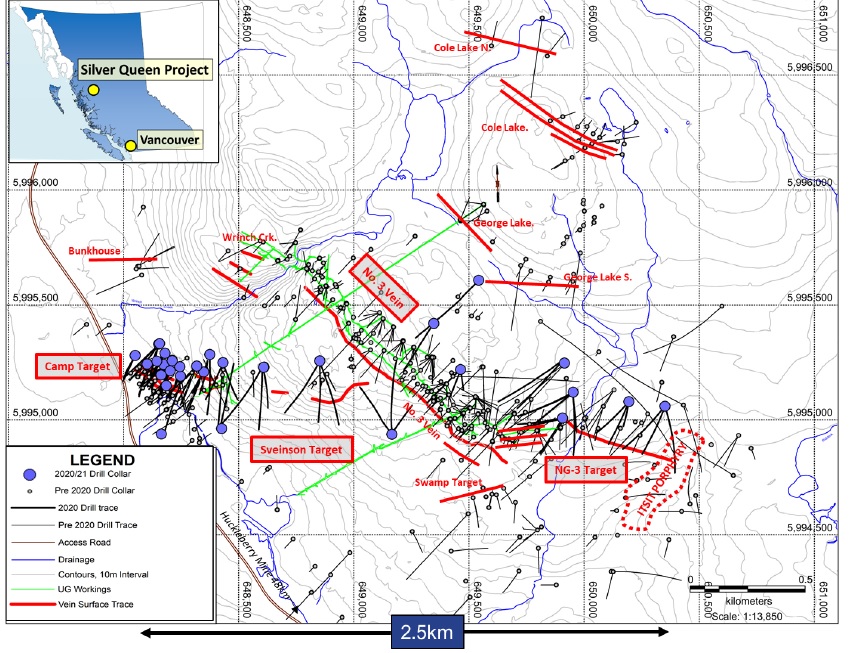

Equity Metals (EQTY.V) has released its long-awaited resource update on its flagship Silver Queen project in British Columbia. The updated resource estimate includes data from in excess of 25,000 additional meters of drilling completed since the previous resource estimate was completed a few years ago.

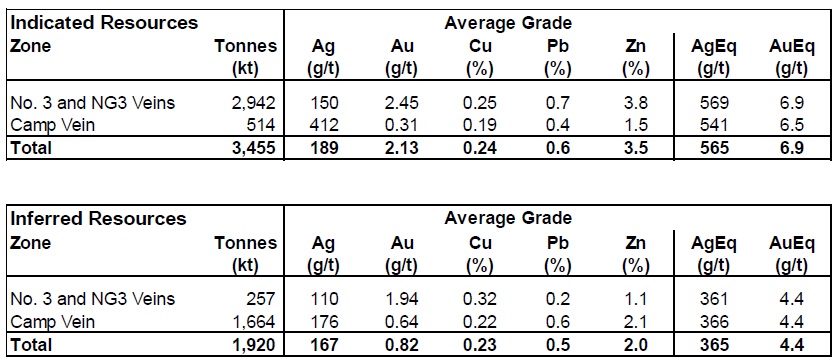

Not only was Equity Metals able to increase the total resource, it also more than quadrupled the total amount of tonnes in the indicated resource category. In the updated estimate, the indicated resources now contain just under 3.5 million tonnes of rock at an average grade of 189 g/t silver, 2.13 g/t gold, 0.24% copper and 4.1% ZnPb for a total of 21 million ounces of silver, 237,000 ounces of gold, 18 million pounds of copper, 48 million pounds of lead and 267 million pounds of zinc. This represents a silver-equivalent content of 62.8 million ounces or about 767,000 ounces gold-equivalent.

There is an additional inferred resource containing 1.92 million tonnes at an average grade of 162 g/t silver, 0.80 g/t gold, 0.23% copper and 2.5% ZnPb or a total of 10.3 million ounces of silver, 50,000 ounces of gold, 10 million pounds of copper, 23 million pounds of lead and 84 million pounds of zinc for a total of 22.5 million ounces silver-equivalent or 273,000 ounces gold-equivalent.

Combining both resource categories (which is not allowed as per the NI43-101 rules), the global resource contains just over 85 million ounces of silver-equivalent or just over 1 million ounces of gold-equivalent. That’s an important increase from the less than 440,000 ounces gold-equivalent or 39 million ounces silver-equivalent in the 2019 resource estimate, indicating Equity Metals has done a good job in creating value for its shareholders. According to the company, the discovery cost since 2019 was just C$0.15 per silver-equivalent ounce and C$11 per gold-equivalent ounce.

At the current metal prices, silver is most definitely the dominant metal on a gross rock value basis, but it will be interesting to see how the ratio changes on a post-recovery and post-payability basis as some of the silver will report to the zinc concentrate which would result in a lower amount of silver payable. In any case, it clearly is a silver-gold project with a substantial by-product component thanks to the base metals.

Just two months ago we were surprised to see Equity Metals was trading at just five cents despite the looming resource update. Back in September we mentioned we would be happy to see 60-80 million ounces of silver-equivalent at a good grade, and with 85 million ounces across all categories with in excess of 70% of those ounces in the higher-rated indicated resource category, the resource update exceeds our expectations.

We will follow up on this resource update with Equity’s management and provide a more extensive update soon.

Disclosure: The author has a long position in Equity Metals. Equity is a sponsor of the website. Please read our disclaimer.