Right before Christmas, Equity Metals (EQTY.V) announced it had closed the final tranches of the placements it announced during Q4. The final tranche consisted of 1.73 million hard dollar units issued at C$0.14 consisting of one common share and ½ warrant with an exercise price of C$0.20 for a period of two years.

Additionally, the final tranche of the flow-through portion of the placement resulted in an additional C$1.8M being raised by issuing 12.1 million flow-through units at C$0.15 with each unit consisting of one flow-through share and ½ non-flow-through warrant at the same terms as the hard dollar raise.

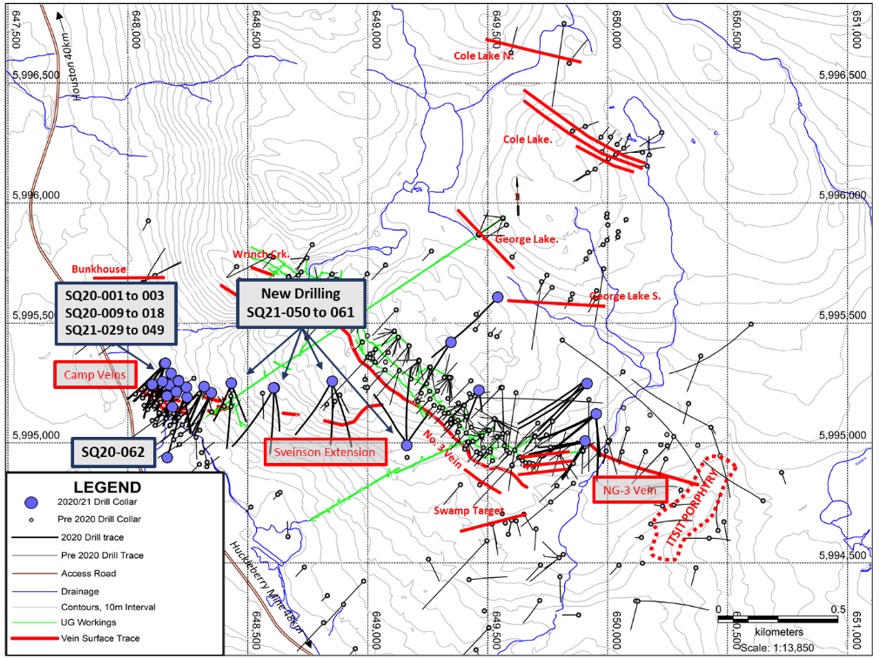

As of the end of August (which is the end of the company’s financial year), Equity had about C$1.85M in working capital on the balance sheet but the cash position was obviously decreasing fast as Equity Metals is aggressively drilling the flagship Silver Queen project in British Columbia’s Golden Triangle. The recent capital raise will help the company to continue its exploration activities aiming to improve the value of Silver Queen project and updating the existing resource which contains about 150,000 ounces of gold, 9.9 million ounces of silver and 206 million pounds of zinc in a high-grade narrow vein system.

Disclosure: The author has a long position in Equity Metals and participated in the first tranche of the financing. Equity Metals is a sponsor of the website. Please read our disclaimer.