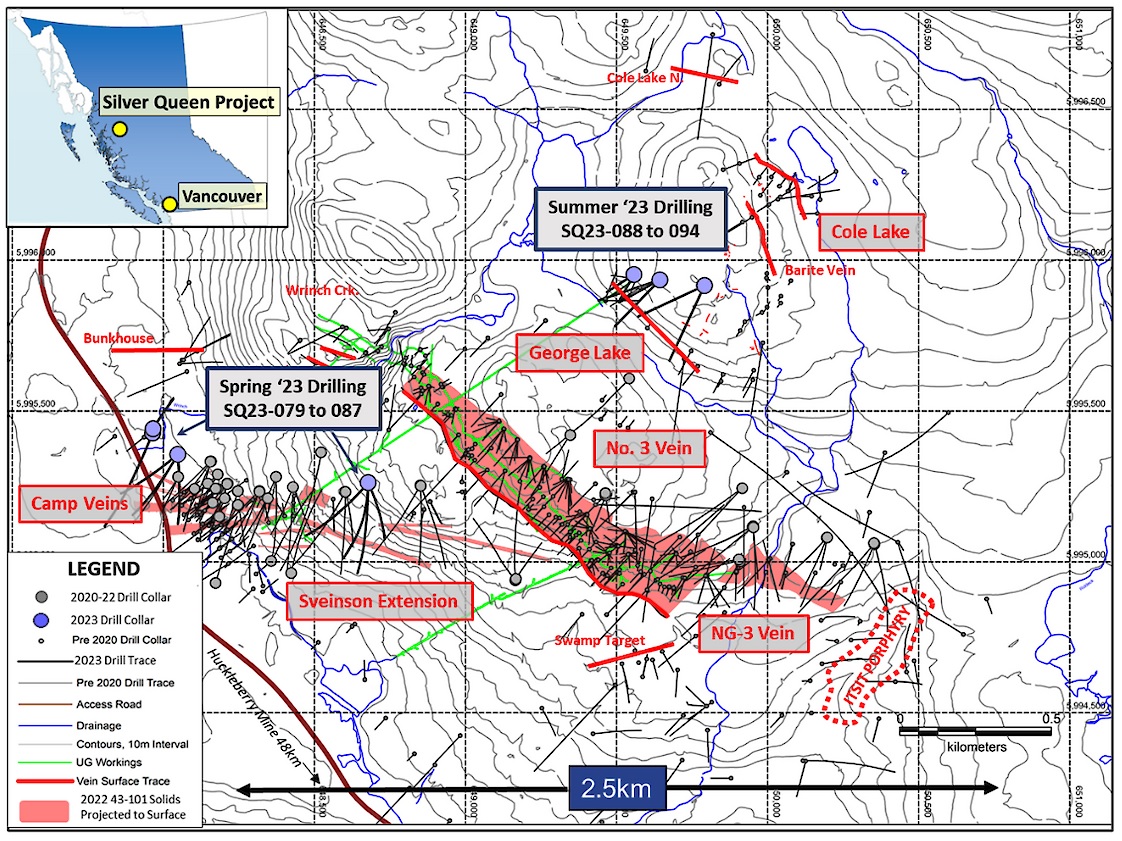

Equity Metals (EQTY.V) has expanded its exploration focus at its flagship Silver Queen project in British Columbia. While the company was focusing on the known mineralized structures before, the 2023 exploration program included a budget to drill-test some of the regional targets, including the George Lake target.

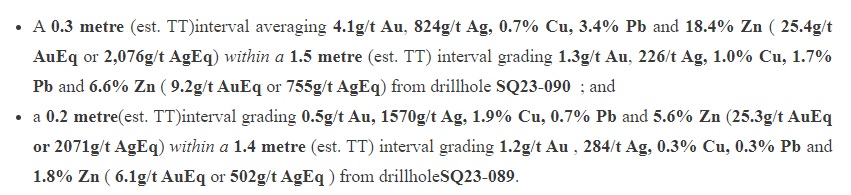

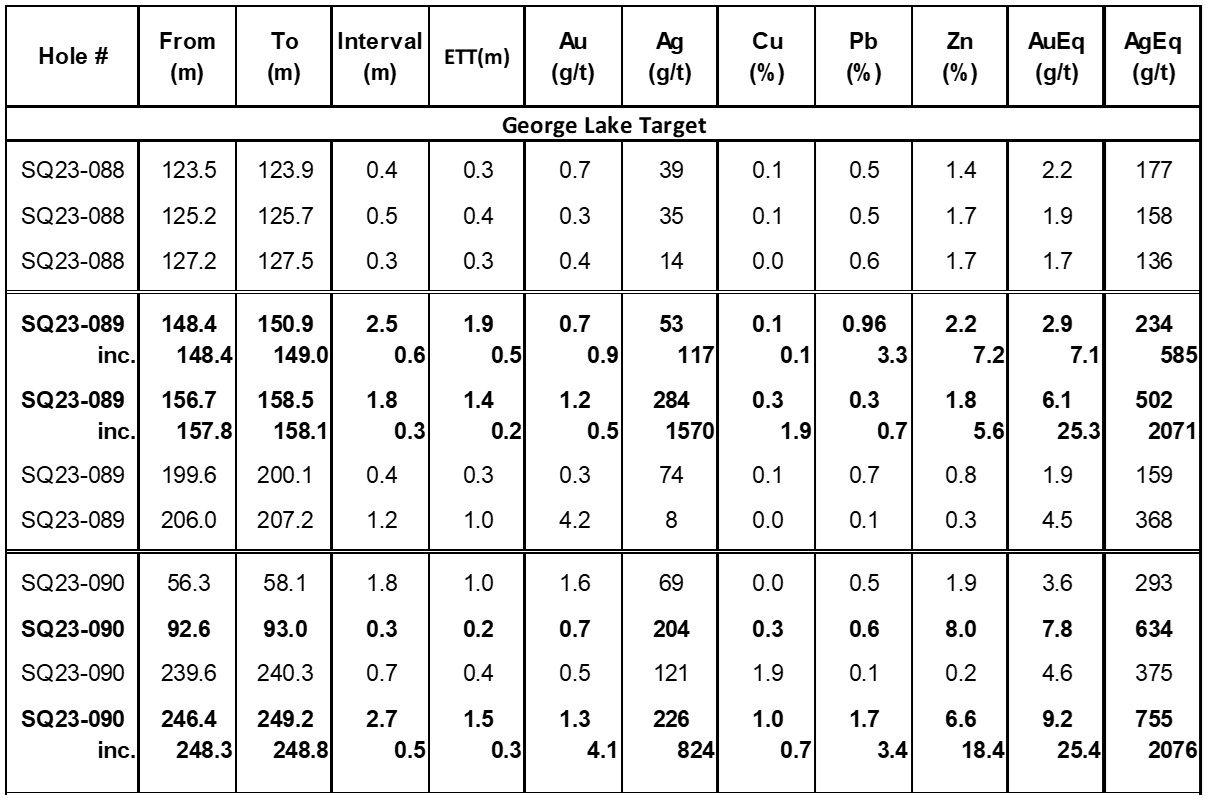

George Lake is not a new discovery but this target hasn’t been drilled in over 30 years and Equity Metals was keen on having another look at the mineralized occurrence. The company completed almost 2,500 meters of drilling in 7 holes at George Lake and the assay results of the first three holes have now been released. The company highlighted two high-grade but very narrow intercepts in its bullet points

Equity Metals’ technical team appears to be quite pleased with these results as the drill bit ‘confirmed the overall tenor of mineralization’ around the Bulkley Crosscut to a depth of up to 200 meters below surface. The company also intersected additional narrower veins and the preliminary interpretation by Equity is that this suggests the potential for the development of hanging wall and footwall zones.

As mentioned earlier, the company is still waiting for the assay results from the four other holes that were drilled at George Lake and we should see those results come in in the near future. Those four holes have confirmed the lateral projection of visually mineralized veins approximately 300 meters to the SE of the Bulkley cross-cut and to a depth of up to 250 meters below surface, indicating the mineralization remains open laterally to the southeast and to depth.

The drill rig has now moved to the Cole Lake target where Equity metals will rill-test two segments of the vein that was traced over a 700 meter strike length. The initial plan is to complete up to 3,000 meters of drilling at Cole Lake. This means Equity Metals will have plenty of drill results to report on in the current quarter.

Disclosure: The author has a long position in Equity Metals. Equity is a sponsor of the website. Please read the disclaimer.