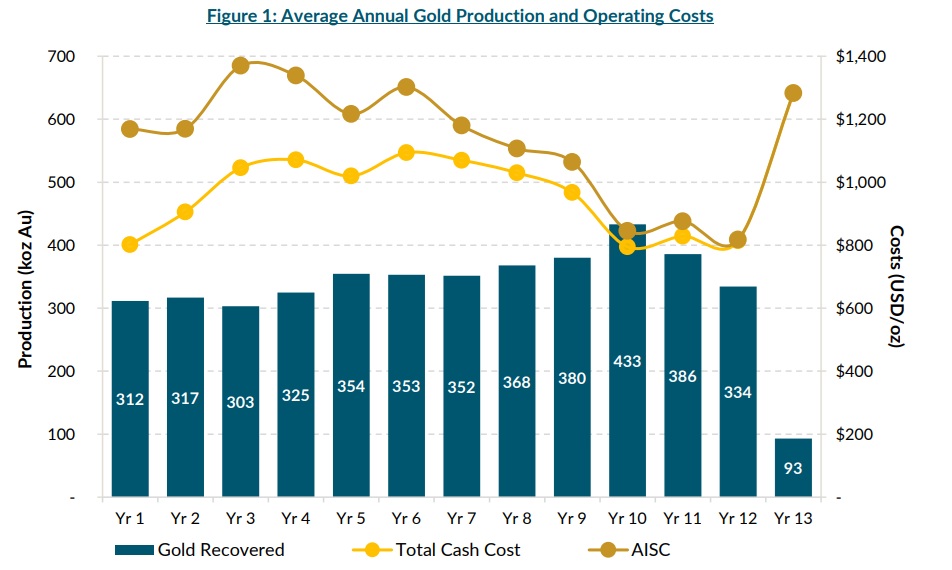

G Mining Ventures (GMIN.TO) has released the results of the feasibility study on its fully owned Oko West gold project in Guyana. The current mine plan consists of a combined open pit and underground phase and requires an initial capex of just US$972M with an additional US$650M in sustaining capex. This allows the mine to produce an average of 350,000 ounces of gold over a 12 year mine life, at an AISC of $1123 per ounce.

This results in an after-tax NPV5% of US$2.16B and an IRR of 27% while the payback period is just 2.9 years. All three parameters are substantially better than the scenario outlined in the Preliminary Economic Assessment but the previous study used a much lower gold price of $1950/oz. At $2000 gold, for instance, the NPV5% drops to $1.16B while the IRR dips below 20%, but at the current spot price of $3400/oz, the after-tax NPV5% jumps to almost $4B while the after-tax IRR increases to 40%.

The company expects to secure the remaining environmental permits in the current quarter and G Mining Ventures is expected to make a construction decision in the second semester.

Disclosure: The author has no position in G Mining Ventures. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.