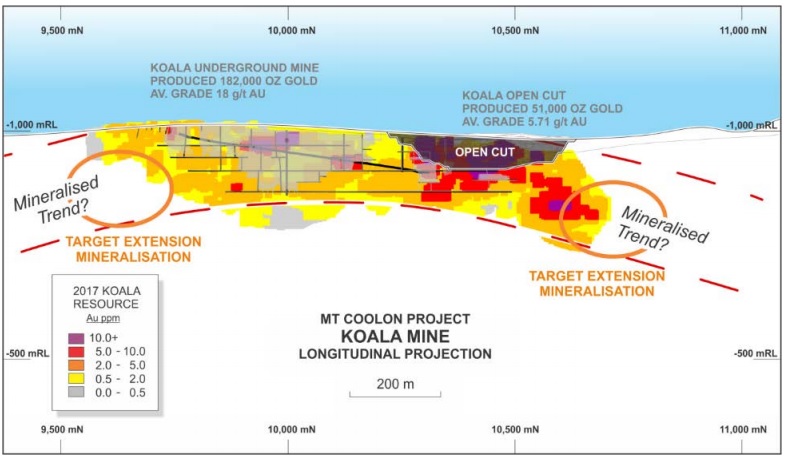

GBM Resources (ASX:GBZ) has published the results of a scoping study which was aiming to determine the viability of the Mt Coolon gold project where the three zones (Koala, Glen Eva and Eugenia) will be mined and processed using a combination of heap leach and CIL.

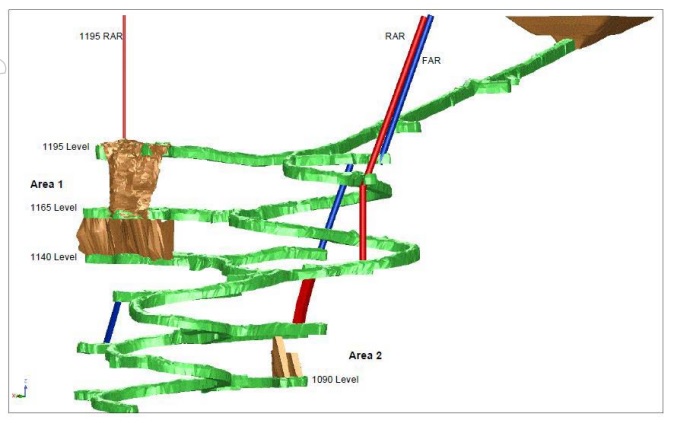

A total of 155,000 ounces are expected to be recovered (including 21,800 ounces from the Koala underground mine at a diluted grade of 4.6 g/t gold) over a 5.5 year mine life at an average all-in sustaining cost of A$1020 per ounce. The initial capex appears to be very low at just A$25.2M, resulting in a respectable pre-tax NPV8% of A$41.1M. No post-tax NPV’s have been shared, but we would expect the post-tax NPV8% to be higher than the initial capex indicating this could be a good first step to unlock the potential of the gold project as the incoming cash flows could be spent on a regional exploration program to extend the mine life and increase the value of the property.

Right before Christmas, GBM also announced it signed an agreement with Minjar Gold to acquire its Twin Hills gold project for A$1.5M in deferred payments and 50 million shares of GBM Resources. The project is particularly attractive for GBM as the 400,000 ounces are located close to the Mt Coolon project and could be processed at the planned production facility at Mt Coolon. Although we aren’t fully convinced an underground mine at 3.9 g/t will work (that being said, a lot of the underground infrastructure is already in place), the 204,000 ounces of gold at an average grade of 2.1 g/t in the open pit should definitely be able to add value to Mt Coolon.

Go to GBM’s website

The author has no position in GBM Resources. Please read the disclaimer