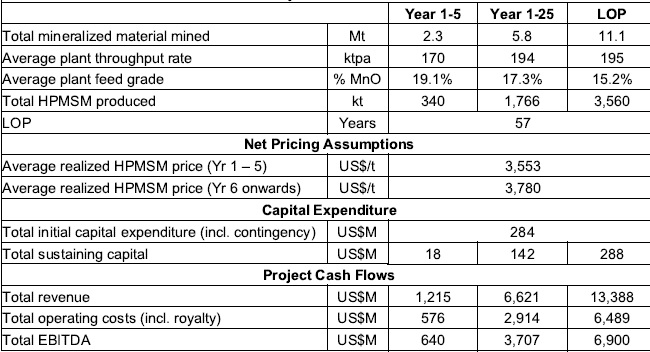

Giyani Metals (EMM.V) released the results of an updated PEA on its K.Hill manganese project in Botswana earlier this summer. The base case scenario now includes the impact of the resource update which allowed it to expand the mine life to 57 years assuming a feed capacity of 200,000 tonnes per year. The economics are boosted by pushing rock with an average grade of 19.1% through the processing plant in the first five years of the mine life, compared to an average grade of 16.9% during the subsequent 20 years.

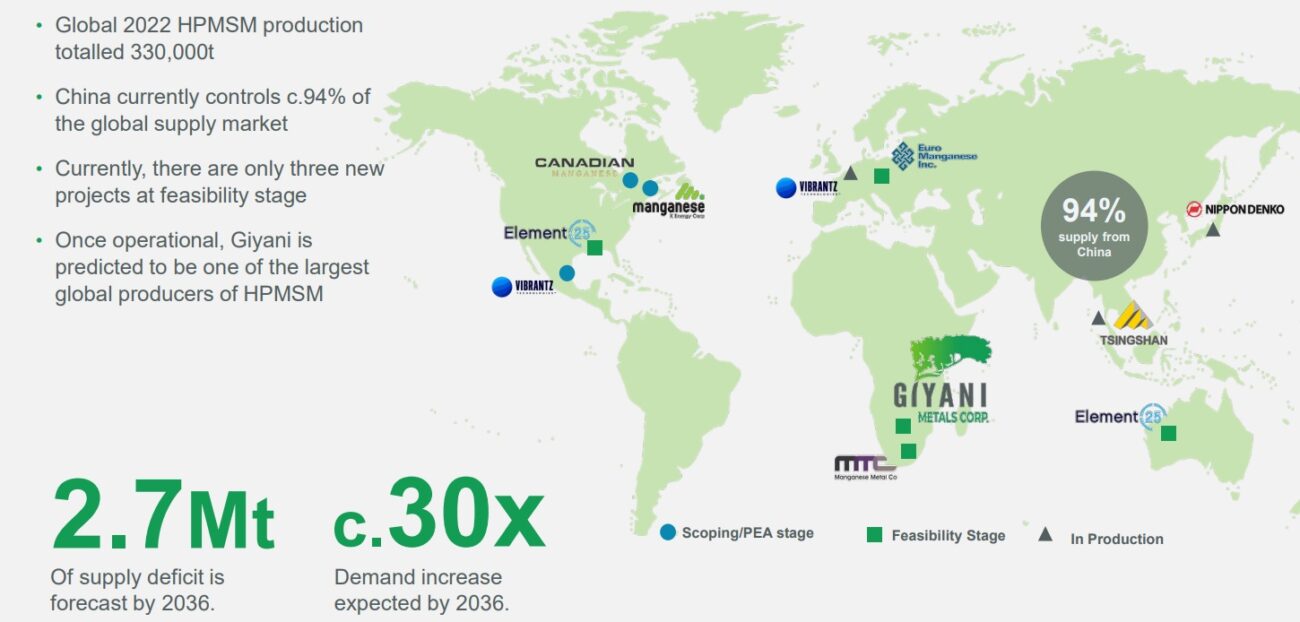

As the initial capex is estimated at less than US$300M (with an additional US$208M required in Y4 to fund the potential expansion of the production capacity), the project appears very financeable, especially considering the IRR is estimated at almost 30% in the base case scenario. The after-tax NPV8% came in at US$983M or C$1.3B using the current exchange rate (excluding the potential expansion of the plant. The project will produce a total of 3.6 million tonnes of high-purity manganese sulphate monohydrate over the 57 year mine life with an anticipated sales price of just over US$3,500 per tonne in the first five years of the mine life, escalating to US$3,780/t in Y6-57.

As mentioned above, Giyani has the option to double the throughput to 400,000 tonnes per year for an additional US$208M investment. This would increase the NPV by about US$600M indicating the US$208M investment would generate about US$800M in after-tax discounted cash flows. This makes the Upside Case very appealing, especially if it could be funded using the incoming cash flows from Y1-3.

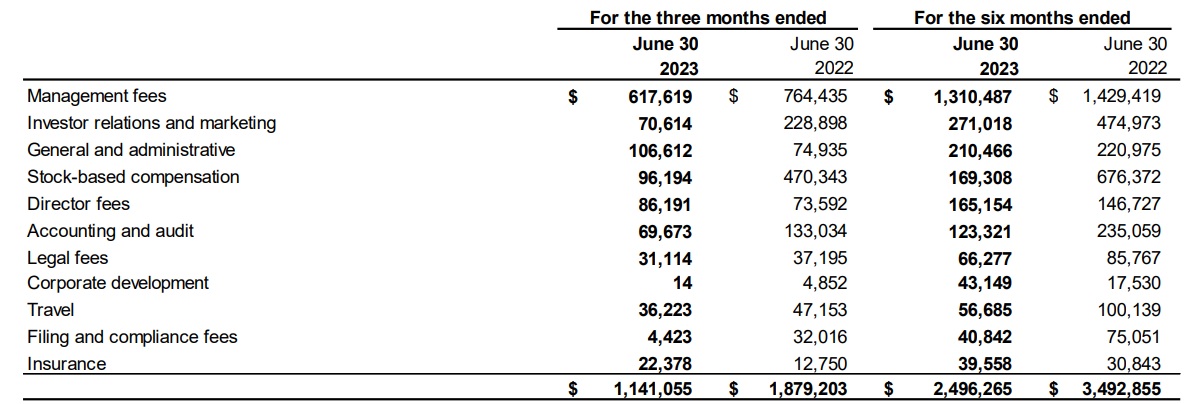

A very intriguing project, but it’s too bad Giyani Metals has very high overhead expenses. In the first half of the year, its G&A expenses came in at C$2.5M and unfortunately that’s almost all cash (stock-based compensation totalled less than C$0.2M in the first semester). In fact, the overhead expenses were higher than the amount spent on the property during the first half of the year. As of the end of June, the company had a healthy working capital position of C$5.7M but with a cash burn of C$4.5M in the first semester of this year, Giyani may have to come back to the market before the end of this year.

Disclosure: The author has a long position in Giyani Metals. Please read our disclaimer.