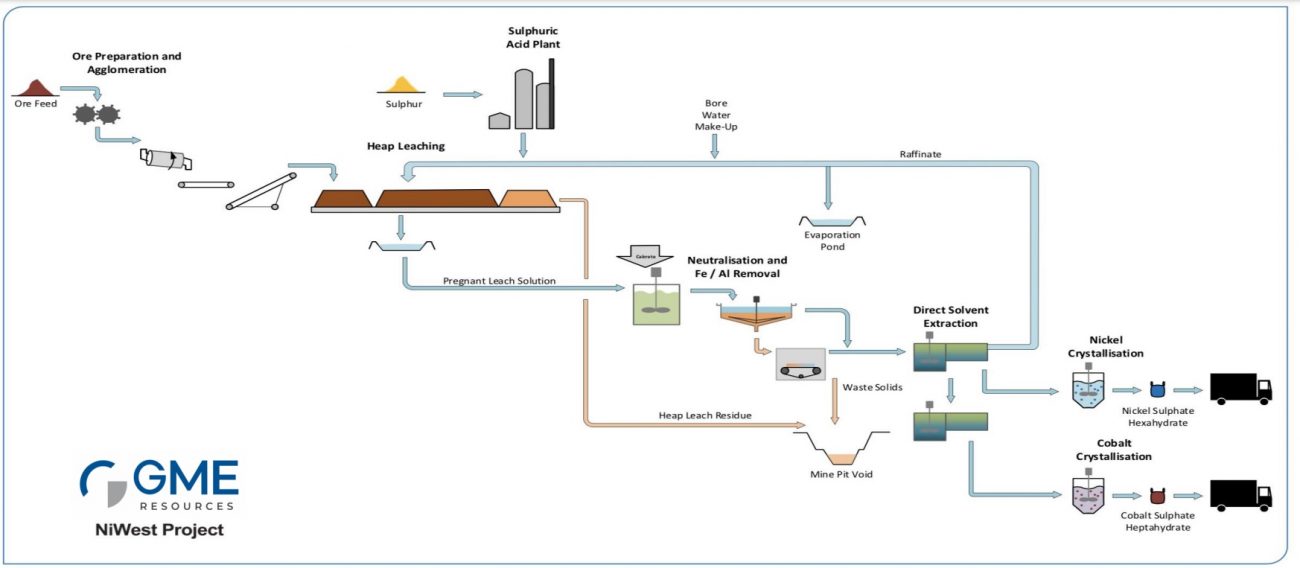

And Queensland Pacific Metals (QPM.AX) isn’t the only Australian company that attracted a large car manufacturer to sign an offtake agreement for nickel and cobalt. Just two days before QPM announced its deal with General Motors (GM), GME Resources (GME.AX) announced it was able to attract Stellantis (STLA.PA, STLA) as partner at the NiWest nickel-cobalt project.

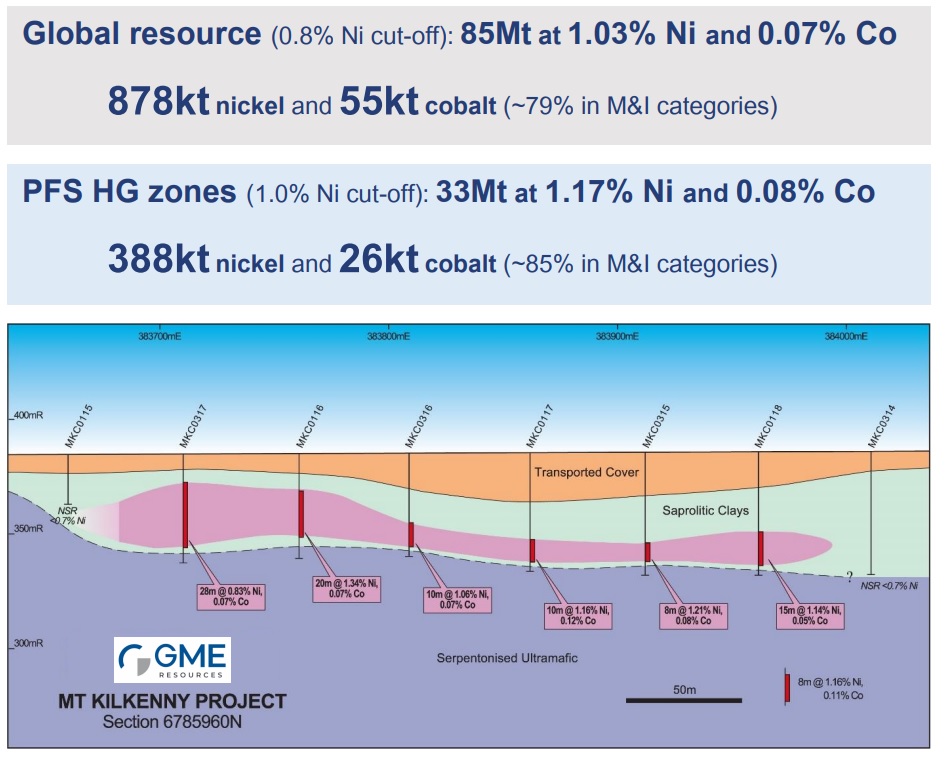

GME Resources is now currently working on converting a non-binding MOU into a binding agreement for the future supply of battery grade nickel and cobalt sulphate projects from the NiWest project. That’s an advanced stage project as the company has recently kicked off the feasibility study on the project in an attempt to further finetune the results of the pre-feasibility study. GME recently engaged Ausenco to complete the definitive feasibility study on the project.

It’s not a coincidence large Western car manufacturers are looking at Australia to protect their supply chain. They don’t want to be relying for too much on third party suppliers in Tier-2 and Tier-3 jurisdictions, and these agreements clearly show that at least two of the largest manufacturers in the world are going down pretty low on the pyramid to secure the supply of raw materials.

Disclosure: The author has no position in GME or Stellantis. Please read our disclaimer.