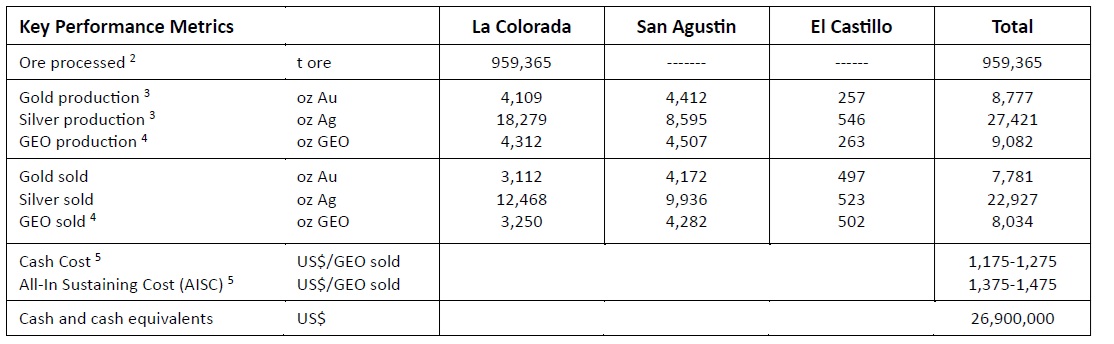

Heliostar Metals (HSTR.V) has announced it has produced just under 9,100 gold-equivalent ounces in the first quarter of the year, and sold just over 8,000 of those gold-equivalent ounces and the gold was sold at almost $2,900/oz. This of course means the company remains well on track to achieve its previously disclosed sales guidance of 31,000-41,000 gold-equivalent ounces this year. The robust production result and the high gold price are obviously very advantageous for Heliostar, and the company ended the quarter without any debt and about US$27M in cash on its balance sheet. The gold was produced at an average AISC of around $1375-1475/oz on a gold-equivalent basis which means the net cash flow generated during Q1 was pretty substantial.

The production result in the second quarter will be lower due to a drawdown of inventory on the leach pad at San Agustin before the company restart its primary mining activities later this year.

CEO Charles Funk will host a webinar on May 13th at 11 AM Eastern Time to discuss these results. Q1 of calendar year 2025 also is the final quarter of FY 2025, and Heliostar will be in a position to release its full-year financials in July.

Disclosure: The author has a long position in Heliostar Metals. Heliostar is a banner sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.