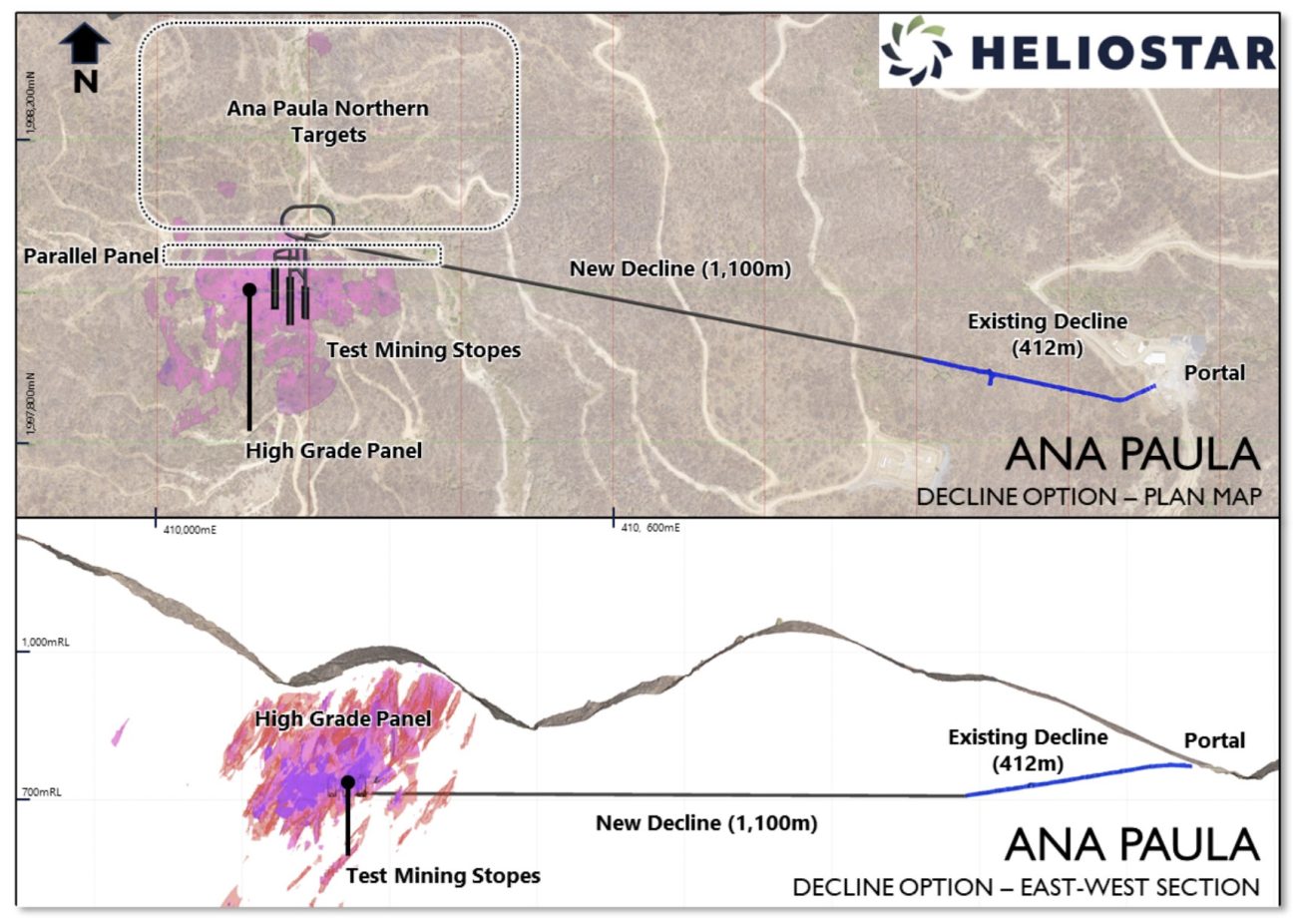

Heliostar Mining (HSTR.V) is currently reviewing the potential to complete the existing decline towards the high-grade underground gold mineralization at Ana Paula and complete a bulk mining sample. According to the company’s technical team, the 412 meter long decline would have to be extended by approximately 1,100 meters while an additional 317 meters of spiral and stope development would have to be completed to access a portion of the high grade panel that would be amenable for the bulk sampling program.

The company has outlined several mining scenarios which show the potential to recover in excess of 20,000 ounces of gold by mining rock at an average grade of 7-10 g/t gold. At the current gold price this would result in approximately US$40M in revenue and given the grade of the mineralization about half of the revenue could potentially be converted in cash flow to the company. Note: these are our own interpretations: the company has NOT completed a technical study or economic study on the bulk mining plans. As those plans come closer to reality, hopefully Heliostar will be in a better position to communicate on the anticipated cash flows but in its press release HSTR mentioned ‘the recovered gold value exceeds the development costs’ and that’s a fair assessment. In any case, even if the potentially recovered gold would just cover the development of the decline and the stopes, we would consider the bulk mining sample already a success as that means the initial capex in the upcoming PEA (slated for completion in the second semester of 2024) can be reduced by the anticipated capex to complete the decline. Additionally, processing the underground mineralization will allow the company to learn even more on the metallurgical front.

Heliostar will complete the review by the end of the current quarter, and hopefully we see this side project getting the green light from its board of directors. And we obviously hope Heliostar will be in a position to share more financial details to see how far off our assumptions are.

Disclosure: The author has a long position in Heliostar Metals. Heliostar is a sponsor of the website. Please read the disclaimer.