Hochschild Mining (HOC.L) remains on track to produce 457,000 gold-equivalent (or 37 million silver-equivalent) ounces this year from its main producing assets. For next year, Hochschild expects the output to decrease to 432,000 gold-equivalent ounces as it had to reduce its expectations on the Pallancata project where permitting delays have resulted in production estimates coming in 7 million ounces silver-equivalent below previous estimates.

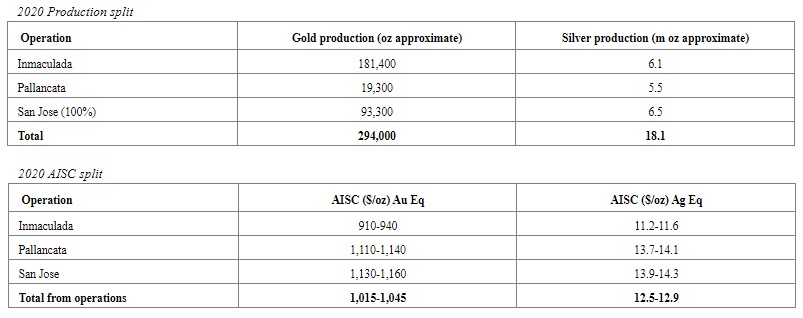

The impact of the lower production at Pallancata will be mitigated by a record output at Immaculada where Hochschild anticipates a production of 257,000 gold-equivalent ounces (divided in 181,400 ounces of gold and 6.1 million ounces of silver). Unfortunately, the lower production at Pallancata (and a $22M one-time investment at Immaculada) will push the AISC higher and Hochschild’s mines will have an average AISC of $1015-1045 per gold-equivalent ounce. The San Jose and Pallancata mines will both have an all-in sustaining cost exceeding $1100/oz while the Immaculada mine should continue to be a cash flow champion as its net margin should exceed $500/oz on all of the 257,000 gold-equivalent ounces. And if we would strip the $22M one-time investment off the AISC, the Immaculada AISC per gold-equivalent ounce would drop to just around $850/oz AuEq.

Disclosure: The author has no position in Hochschild at this time.