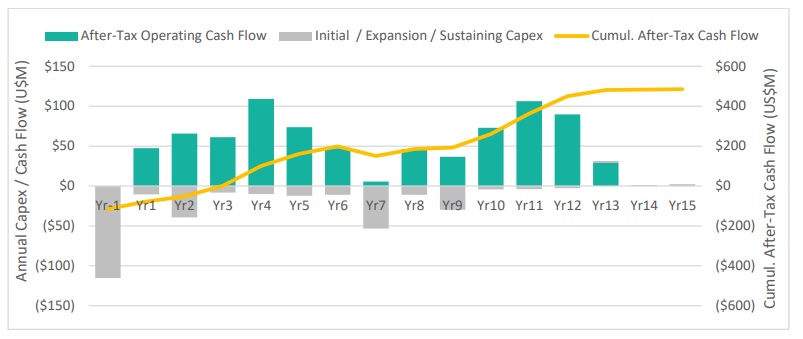

Integra Resources (ITR.V, ITRG) has released the preliminary economic assessment for the Wildcat and Mountain View gold projects in Nevada. Both projects will be developed simultaneously (i.e. as one large project but obviously in different phases and stages) and thanks to the excellent access to existing infrastructure, the initial capex is anticipated to come in at just US$115M on the Wildcat project (the Mountain View capex is included in the sustaining capex and will likely be funded using the Wildcat cash flows).

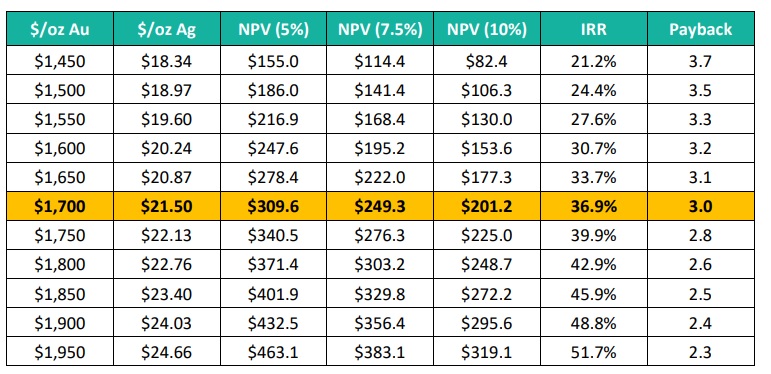

Despite the low capex (or perhaps, thanks to the low capex), the after-tax NPV5% using a gold price of US$1700/oz is pretty impressive at US$310M while the after-tax IRR comes in at a very respectable 37%. Using spot prices ($1920 gold and $22 silver), the after-tax NPV5% jumps to US$442M (C$584M) while the IRR increases to just under 50% (obviously still on an after-tax basis.

The project will produce a total of 1.04 million ounces gold-equivalent over a 13 year mine life which works out to an average annual production of 80,000 ounces gold-equivalent per year but the annual output jumps to 94,000 ounces gold-equivalent in the first five years of the mine life (which definitely has a positive impact on the NPV and IRR). The all-in sustaining cost per ounce is estimated at US$973 per ounce gold-equivalent.

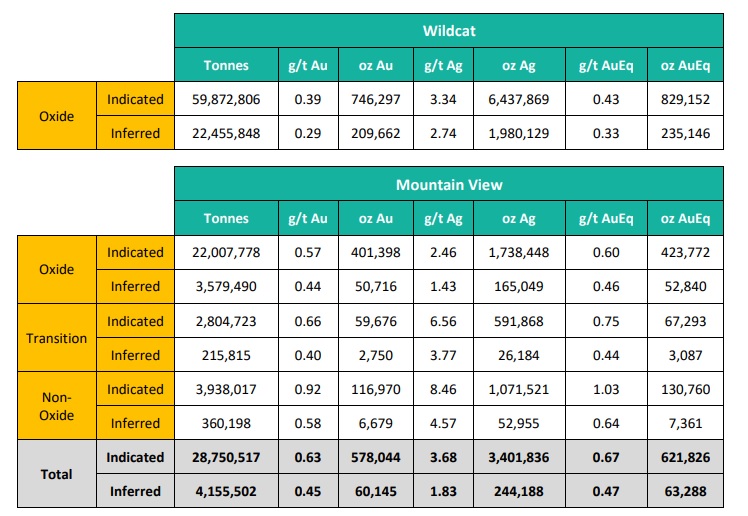

There are two elements that are driving the NPV. First of all, the relatively low strip ratio (less than 1.5 throughout the entire mine life and less than 0.3 at Wildcat) and the total resource increase. According to the company, the respective resources at Wildcat and Mountain View have increased by 23% and 49% respectively, compared to their November 2020 resource calculations.

The PEA will make it easier for Integra to explain the value of the Nevada projects as this is the very first time an NPV has been calculated on Wildcat and Mountain View.

We will dig deeper into the Preliminary Economic Assessment in the near future and we will discuss it in more detail with new CEO Jason Kosec.

Disclosure: The author has a long position in Integra Resources. Integra is a sponsor of the website. Please read our disclaimer.