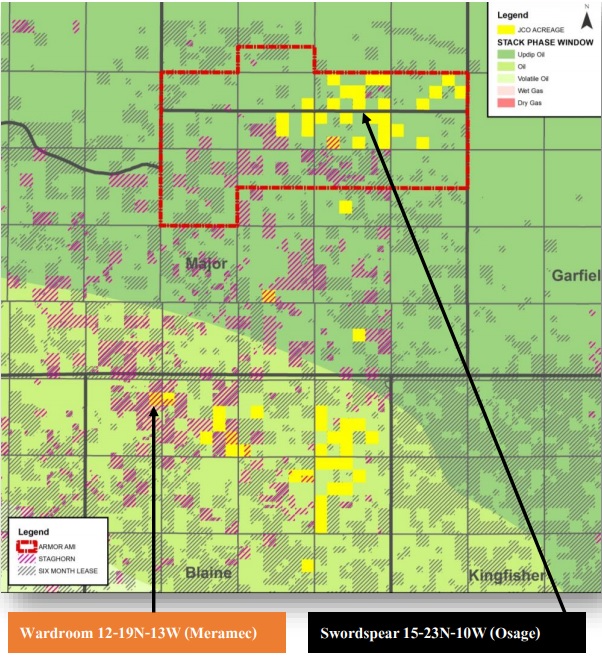

Jericho Oil (JCO.V) has a nice surprise for us last week, as the company announced an update on its STACK drill program in Oklahoma. The Wardroom well, which was drilled on the western flank of the STACK JV land package, produced an average of 405 barrels of oil-equivalent per day over the first 60 days. That’s a total of 24,300 barrels of oil that have been produced in the past two months, and 405 barrels per day could definitely be seen as a success.

A second well has been completed on the northeastern flank, and is currently still in the flow-back mode. This could take an additional few weeks, as only 10% of the fluids that have been injected in the well have been recaptured so far. According to a recent study by Alta Mesa on the Lower Osage wells, it usually takes 60-100 days from the start of the flow-back moment to reach peak production. So it’s still early days for the second well, and we would hope to see some oil flowing by the end of this month or early July.

It looks like the market didn’t care too much about these results. In one way, it’s understandable as Jericho’s economic interest in the Wardroom well is just 12.46% (26.5% of the STACK JV’s 47% well interest) which equates just 50 barrels of oil attributable to Jericho. Whilst we wholeheartedly agree this doesn’t move the needle for Jericho Oil, we do think it’s important it confirms the acreage owned by Jericho (and the STACK JV) is prospective and these two wells will help to de-risk the STACK JV’s own drill and development plans.

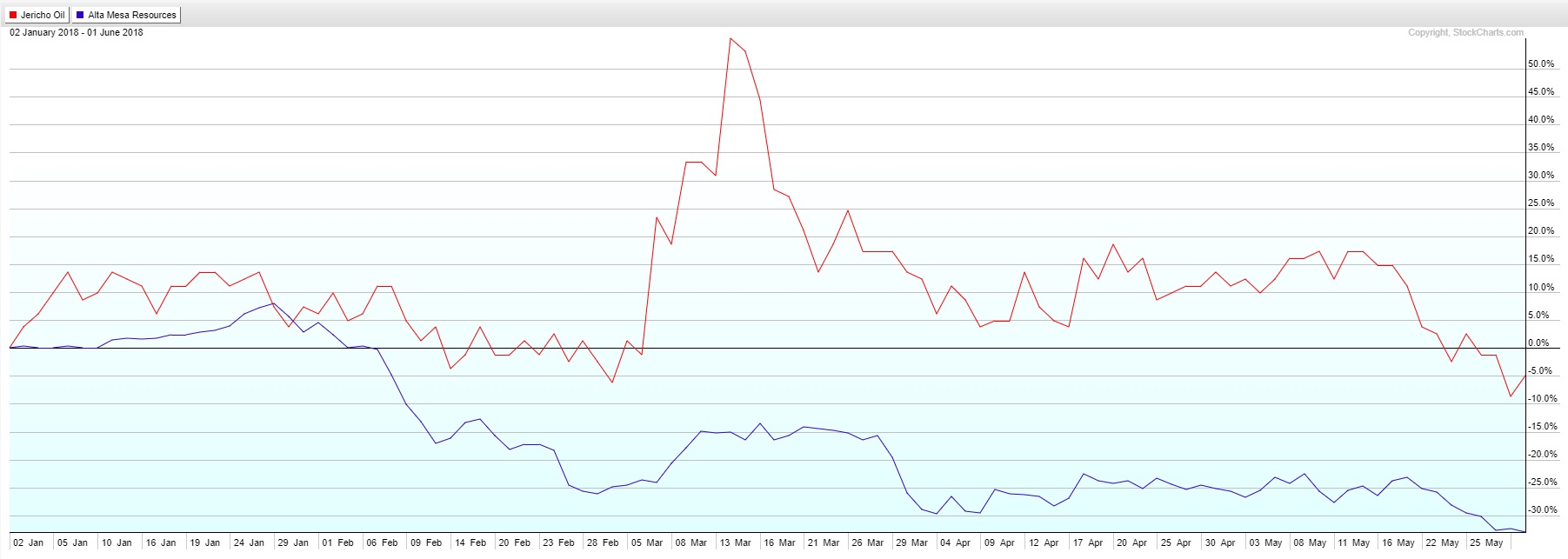

And it’s not just Jericho’s share price that has been sliding. The share price of Alta Mesa (AMR), perhaps one of the best ‘competitors’ to use as a benchmark has seen relentless selling pressure as well. In fact, on a YTD basis, Jericho is actually still outperforming Alta Mesa.

Go to Jericho’s website

The author has a long position in Jericho Oil. Jericho is a sponsor of the website. Please read the disclaimer