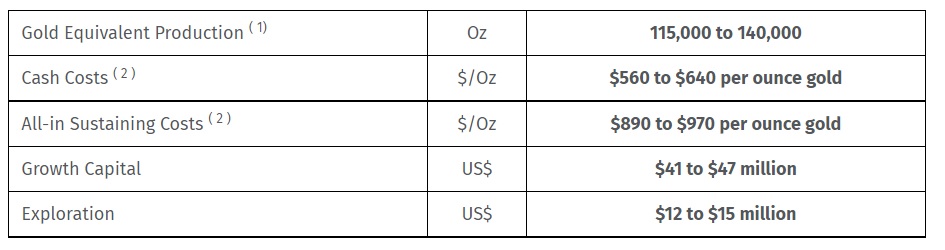

As companies are wrapping up 2021 and are getting ready to publish their financial results, we are also already seeing the first few guidances for the current financial year. K92 Mining (KNT.TO) is now expecting the produce 115-140,000 ounces of gold equivalent. Unfortunately the company did not provide a breakdown as it provides its production guidance in gold-equivalent ounces, but its AISC guidance per ounce of gold.

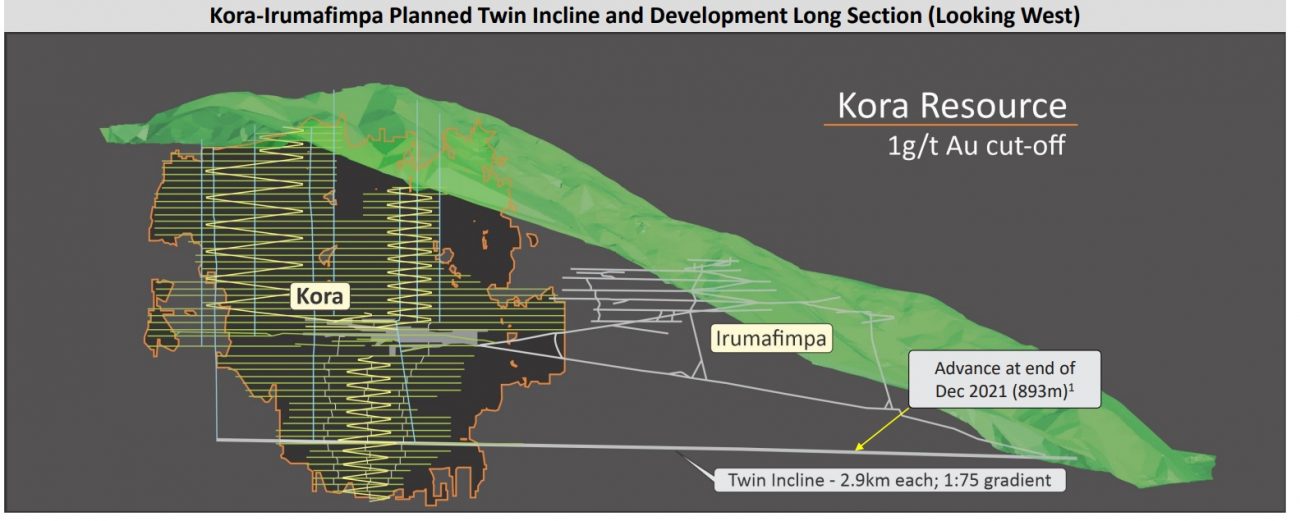

In 2021, about 90% of the gold-equivalent production consisted of gold so we can likely continue to use this ratio which would indicate there will be around 100,000-125,000 ounces of gold produced at an AISC of $890-970/oz. So at $1800 gold and assuming 100,000 ounces of gold at a $970/oz AISC (the more conservative scenario), the net free cash flow on the mine level should be around US$80M. This will go a long way to cover the $41-47M in growth capex the company expects to spend this year. This will fund the Stage 2A expansion (with a throughput increase to 500,000 tonnes per year) and provide a platform for further growth into the Stage 3 Expansion. K92 will also spend US$12-15M on exploration activities.

Disclosure: The author has no position in K92 Mining. Please read our disclaimer.