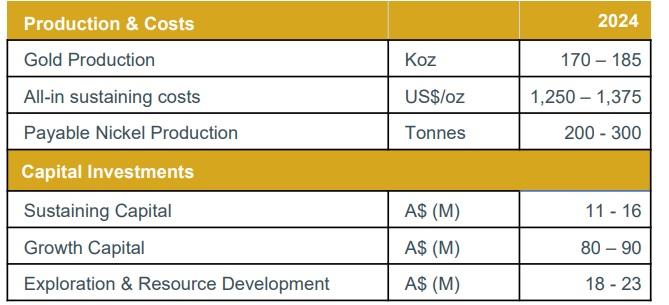

Karora Resources (KRR.TO) has released an updated 2024 guidance. It now expects to produce 170,000-185,000 ounces of gold at an all-in sustaining cost of $1250-1375 per ounce. Using a gold price of $2100/oz, this will likely deliver approximately US$140M in mine-level free cash flow.

Only a portion of that cash flow will actually hit Karora’s balance sheet. The company also plans to spend A$80-90M on growth capex while it has earmarked A$18-23M for exploration and resource development activities. Using the higher end of that range (A$113M combined) and the current exchange rate of 1.52 AUD per USD, the growth capex and exploration capital will require approximately US$75M, thus absorbing approximately half of the mine-level free cash flow generation.

The growth capex will prove to be useful as the company plans to bring the mine to a 2 million tonnes per year mining operation which will feed the two upgraded mills. The expansion to 2M tpa should be completed by the end of this year.

Disclosure: The author has no position in Karora Resources. Please read the disclaimer.