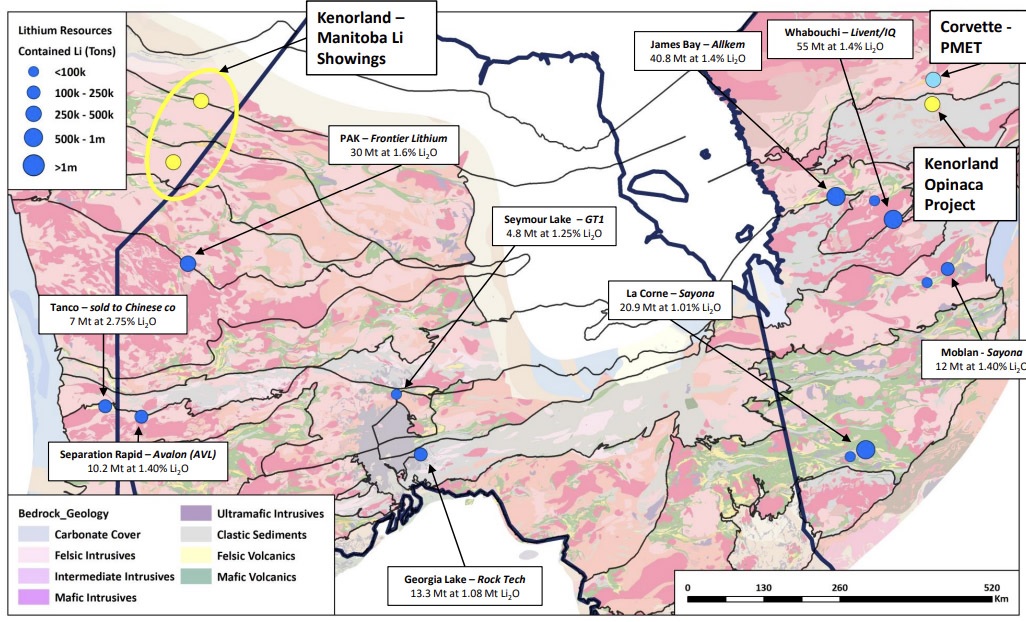

Kenorland Minerals (KLD.V) and Targa Exploration (TEX.C) have entered into an agreement whereby Kenorland Minerals will be the operator and will provide technical advice on the Opinaca and Superior Lithium projects, which Targa is acquiring from Kenorland. This agreement again shows one of Kenorland’s main strengths: while it doesn’t just find a joint venture partner, it usually is able to generate some additional cash by being the operator of the exploration programs. Although no financial details were provided, the operator fee is traditionally 10% of the exploration expenditures.

Kenorland is also generating operator fees on other projects, and the cash inflow helps to cover its own overhead expenses. This means Kenorland Minerals will generate a few hundred thousand dollars on the winter drill program at the Regnault discovery on the Frotet project. The joint venture partners (Kenorland and Sumitomo) have agreed to complete 22,000 meters of diamond drilling in 25 holes (indicating the average depth will be close to 900 meters per hole) for a total of C$6.5M in drilling.

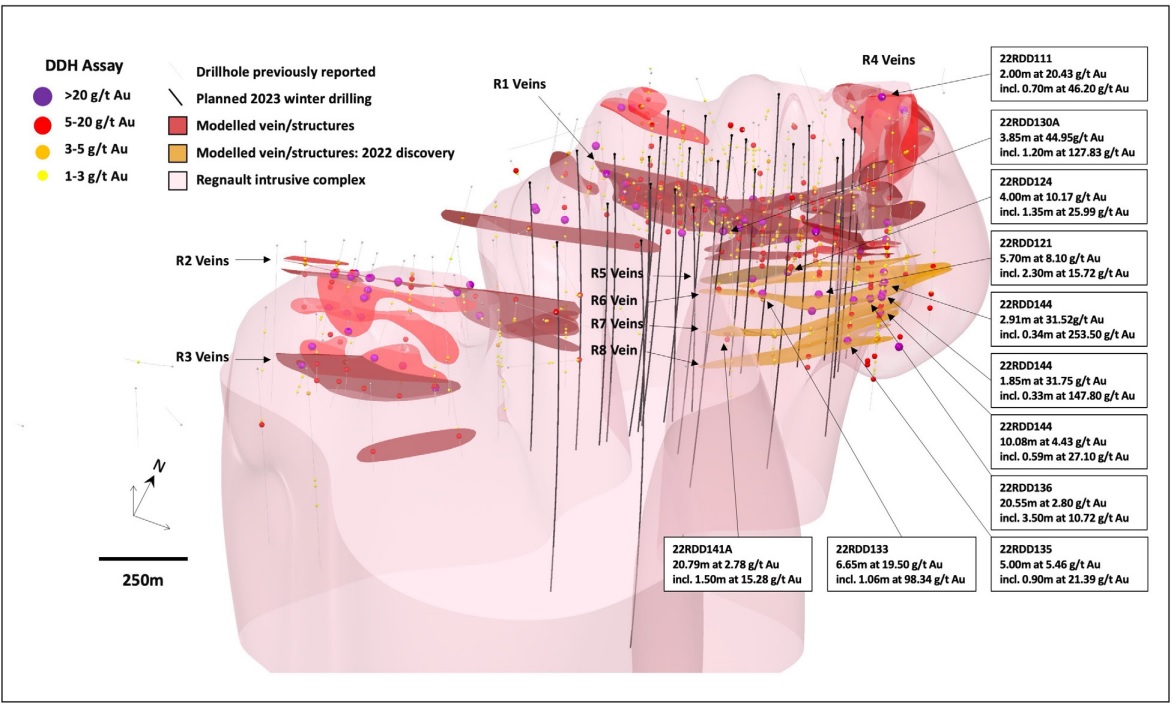

About half of the drilling at Frotet will focus on stepping out from the known veins along the R5, R6, R7 and R8 structures and the 13 holes earmarked for this are planning to extend the mineralization at depth by about 150 meters to 650 meters. In order to reach those zones, pretty much all holes will pierce through the R1 structure and Kenorland and Sumitomo will gain valuable information from doing so as the confidence level in the R1 structure will increase.

About 9,000 meters of drilling is designed to expand the mineralization in the 450 meter Gap between the R5-R8 and R2-R3 structures. Ten holes will be drilled and are designed to test the gold mineralization to a depth of 1,000 meters below surface.

The final 10% of the drilling (approximately 2,000 meters in 10 holes) will be focusing on an untested zone to the south which could potentially host mineralization parallel to the currently known veins.

As both parties have now formed an 80/20 joint venture, Kenorland will be on the hook for 20% or C$1.3M of the planned exploration program. However, as Kenorland is the operator and assuming the standard operator fee of 10% applies, it will recoup about half of its required contribution as an operator fee which means the cash outflow to maintain its 20% stake in Frotet is pretty low.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland is a sponsor of the website. Please read our disclaimer.