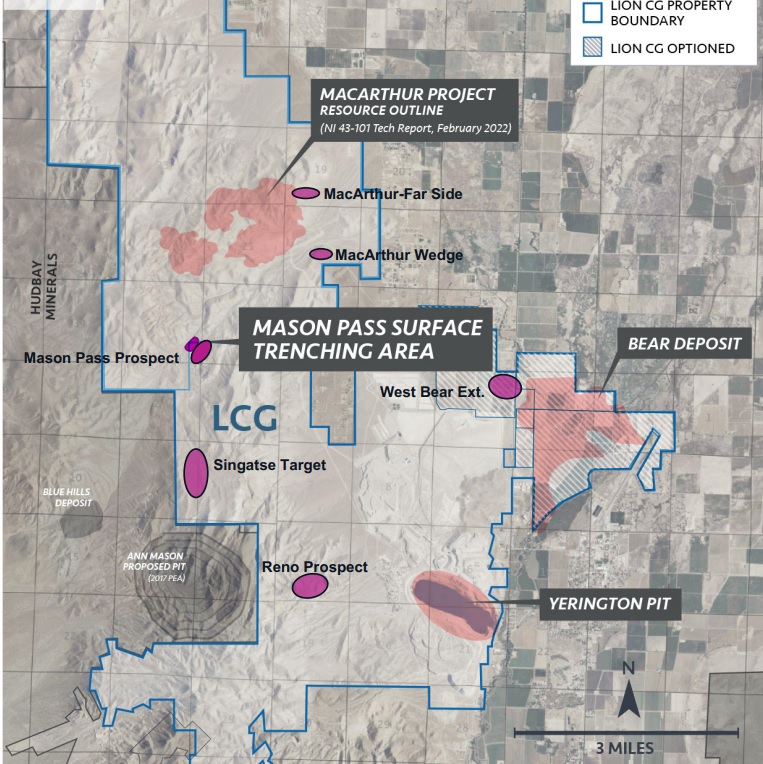

Lion Copper and Gold (LEO.V) has released the outcome of a preliminary Economic Assessment on its flagship Yerington copper project in Nevada. The PEA incorporates the findings of applying the Nuton technology provided by Rio Tinto which allows for the successful leaching of sulphide-hosted mineralization.

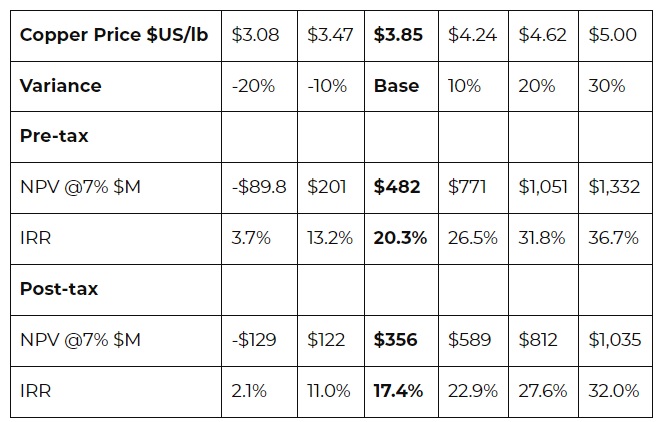

According to the mine plan, approximately 1.4 billion pounds of copper will be produced over a 12 year mine life. The initial capex is estimated at US$413M and as the anticipated production cost is US$2.20 per pound of copper (but the sustaining capex will add about $0.50 per pound of copper), the payback period is approximately 5 years, using a copper price of $3.85 per pound. The after-tax IRR is estimated at 17.4% while the after-tax NPV7% at that copper price is US$356M. This decreases to just $122M at $3.47 copper while a 10% copper price increase to $4.24 increases the NPV to $589M while the IRR comes in at almost 23%.

Disclosure: The author has no position in Lion Copper & Gold. Please read the disclaimer.