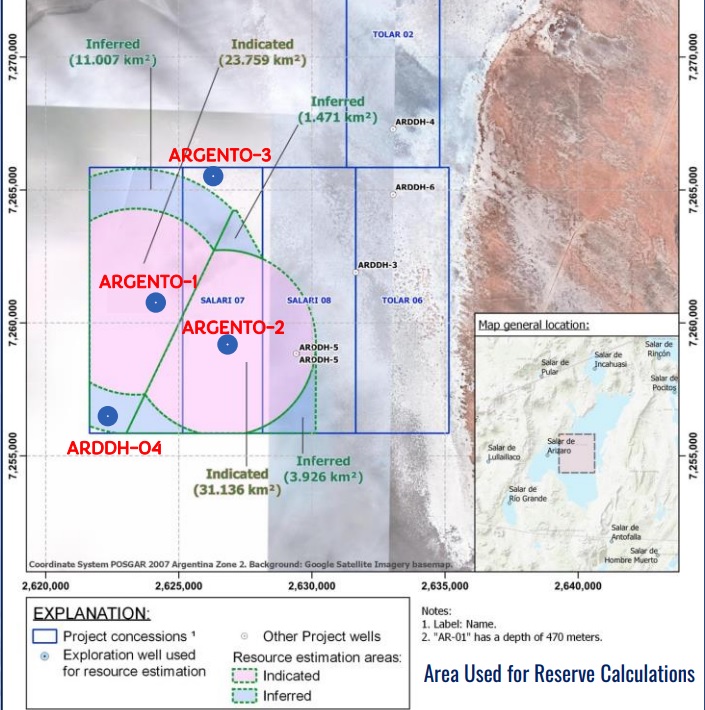

Lithium Chile (LITH.V) has announced it has engaged Ausenco Engineering to coordinate and produce the Preliminary Economic Assessment on its Salar de Arizaro lithium project in Argentina. That project is Lithium Chile’s most advanced project and currently contains about 1.3 million tonnes of LCE in the indicated category at an average grade of 284 mg/l and an additional 1.25 million tonnes of LCE in the inferred category at a grade of 310 mg/t. This resource estimate was based on just two wells (Argento 1 and Argento 2) while the assay results from a third production well, Argento 3 should be available shortly. Additionally, a new exploration hole drilled to the south-southwest of the first two Argentos is underway as well and assay results should be out pretty soon as well. These two new wells have the potential to significantly increase the total Arizaro resource estimate.

Lithium Chile is in an interesting spot. Its largest shareholder, Chengze Lithium, sold its 19.35% stake to Gator Capital at C$0.91 per share, a substantial double digit premium to the share price upon announcing the deal. Chengze was forced to sell its stake due to the pressure from the Canadian federal government which outlawed Chinese ownership of stakes in Canadian lithium companies.

It is encouraging to see the stake was sold at a premium to market which further strengthens the credibility in Lithium Chile’s assets. 2023 could be a very pivotal year with an Arizaro resource upgrade and the completion of a PEA on the asset.

Disclosure: The author has a long position in Lithium Chile. Please read our disclaimer.