Wheaton Precious Metals (WPM, WPM.TO) has been pretty active lately with the support of and investment in the Integra Resources (ITR.V, ITRG) 2.0 (after the ‘original’ Integra Resources combined with Millennial Precious Metals).

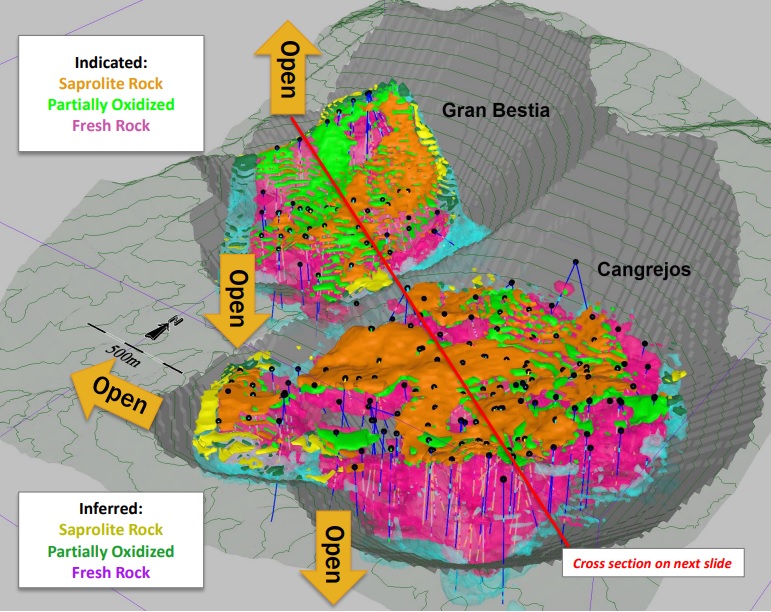

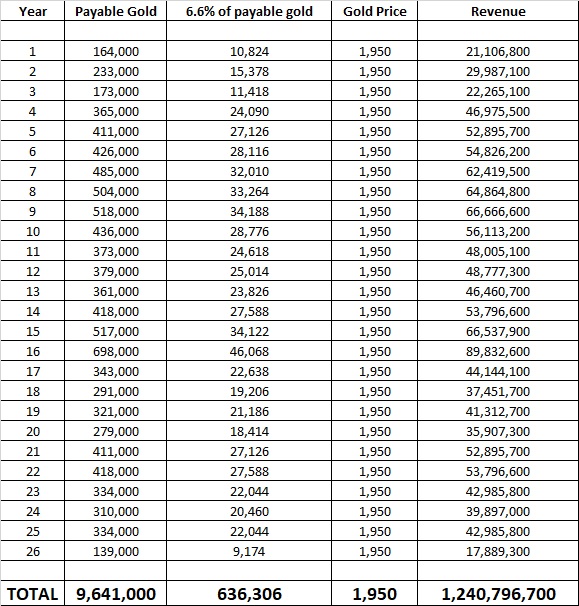

The most recent deal announced by Wheaton is the purchase of a 6.6% gold stream on Lumina Gold’s (LUM.V) Cangrejos copper-gold project in Ecuador. Lumina will receive US$48M in cash up front and an additional US$252M in cash during the construction period. In return for the US$300M cash contribution, Wheaton will receive 6.6% of the payable gold at a price of 18% of the spot price until 700,000 ounces of gold have been delivered into the streaming agreement. Once that milestone has occurred, Wheaton will be entitled to 4.4% of the gold production from Cangrejos for a cash payment of 22% of the spot price. Based on the current gold price of around $1950/oz, the initial 700,000 ounces will yield $1.1B in net revenue for Wheaton Precious Metals, which isn’t a bad trade-off. Of course those ounces will be delivered over a mine life of almost 30 years but based on the mine plan as outlined in the recently filed technical report on Cangrejos, a total of 636,000 ounces of gold will be delivered to Wheaton Precious Metals. At a gold price of $1950/oz, the total undiscounted and pre-tax revenue will be US$1.24B.

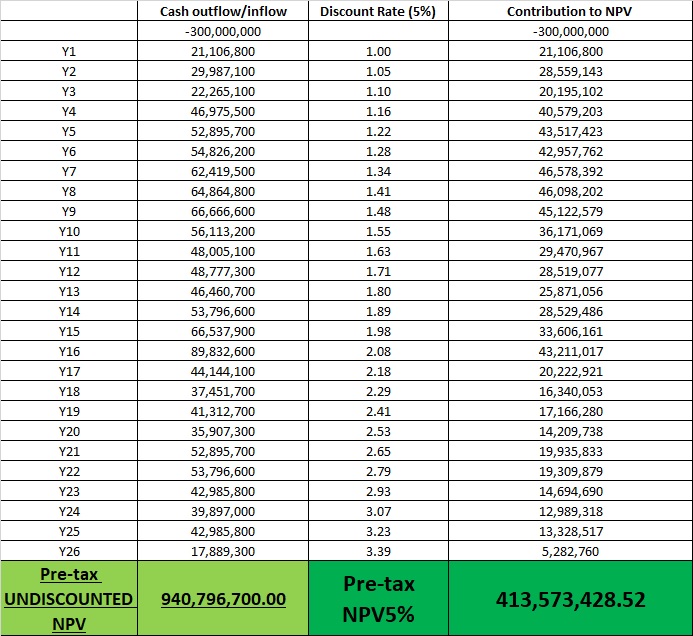

The pre-tax IRR of the gold stream is about 14% (the first delivery was used as the starting point) and the pre-tax NPV5% of the stream is just over US$400M. If you’d further discount this by 10% per year for the next three years, the current value of the NPV5% at the start of the production would be around US$300M. A nice payday for Wheaton but definitely not outrageous considering the almost 30 year long mine life.

While this isn’t low (most recent gold streams had an IRR of 5-6%), there likely is a risk premium for doing business in Ecuador while it is without any doubt a cheap equity component for Lumina Gold. And considering the initial capex is estimated at just US$925M, Lumina has actually secured a large chunk of the required equity to build the mine. This means dilution could remain limited. And let’s face it, no matter how much upside Lumina is giving away, it will make the life of the company with a market cap of less than US$150M much easier to actually have a shot at building the mine.

Disclosure: The author has a small long position in Lumina Gold. Please read our disclaimer.