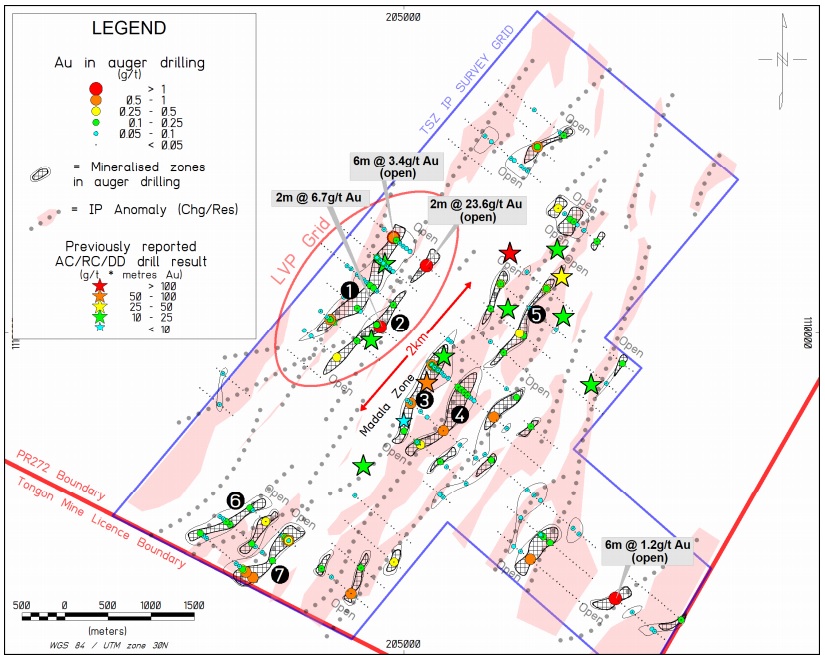

Manas Resources (MSR.AX) released preliminary assay results from an auger drill program on the Mbengue gold project in Ivory Coast at the end of last year. The drill program identified no less than seven mineralized zones with a strike length exceeding 600 meters with the largest mineralized zone reaching a strike length of in excess of 1.5 kilometers. Another important takeaway is the initially estimated width of in excess of 300 meters while the encountered mineralized zones remain open along strike and at depth (which is logical considering the limited drilling capacity of auger drill equipment, the average depth of the holes was just 6 meters).

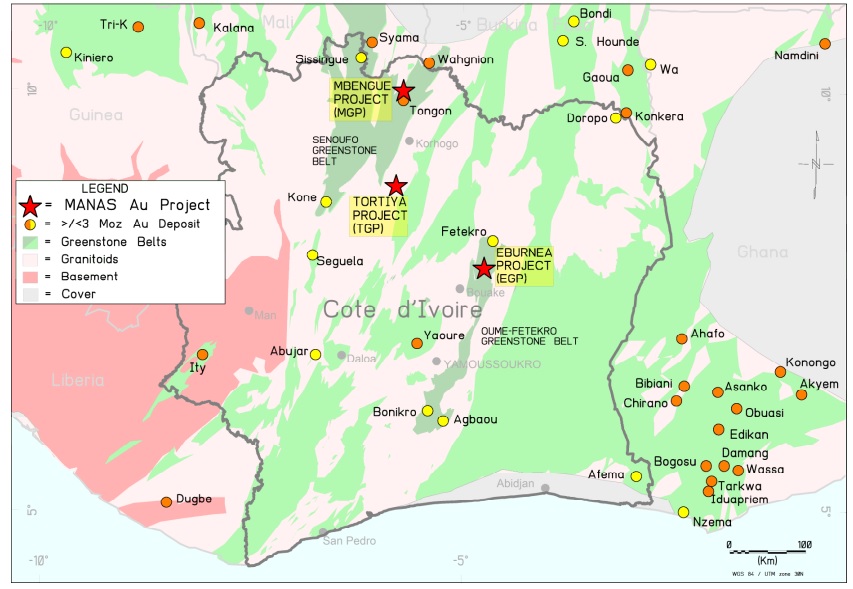

The 4,400 meter auger drill program was focusing on a southern portion of the Mbengue gold project in an area less than 10 kilometers away from the producing Tongon gold mine, currently owned and operated by Barrick Gold (GOLD, ABX.TO). With drill results including 6 meters of 3.4 g/t gold, 2 meters at 6.7 g/t gold and 2 meters containing 23.6 g/t gold, the drill program is a success as it confirmed the previously encountered gold mineralization. Manas is now gearing up for a final auger infill drill program which should be the final step before committing to a Reverse Circulation drill program after the rainy season.

With a market capitalization of just A$15M, A$5M in cash and with Alan Campbell (former managing director of Papillon Resources, which was acquired by B2Gold (BTG, BTO.TO)) as chairman, Manas Resources seems to offer intriguing upside potential if the upcoming drill programs confirm the presence of wide-spread gold mineralization.

Disclosure: The author has no position in Manas Resources.