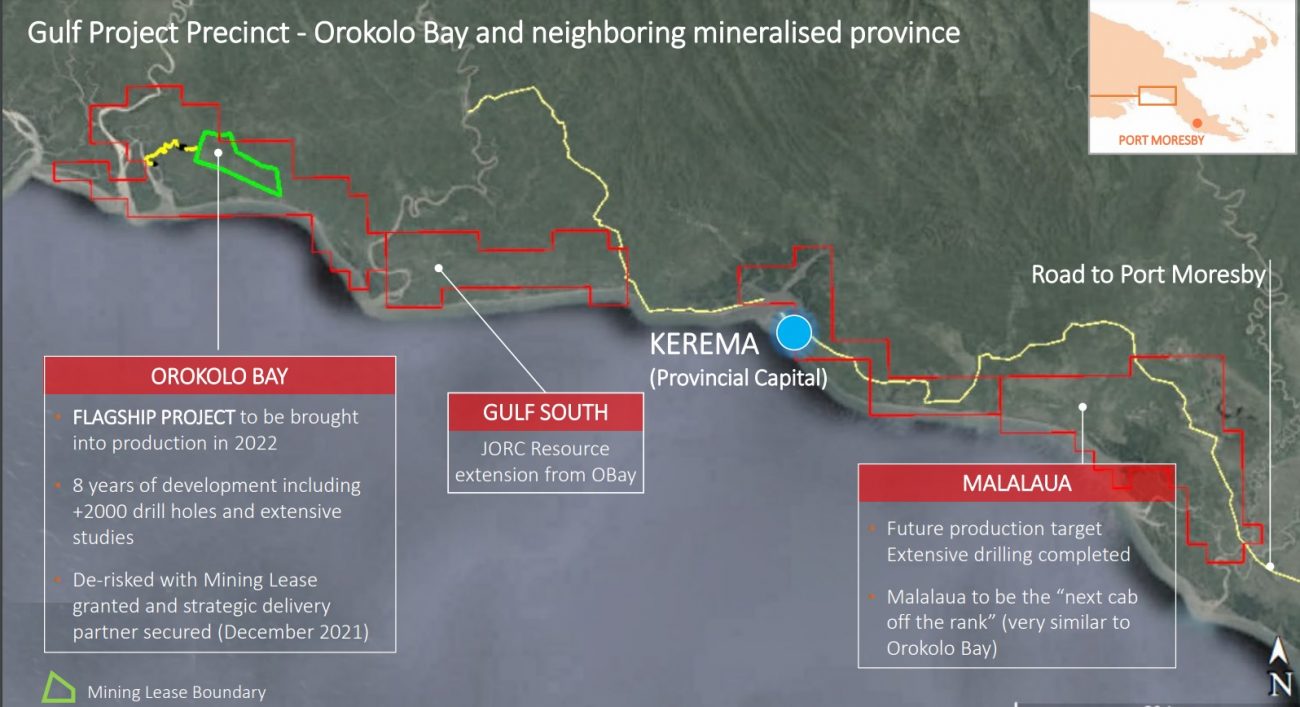

Mayur Resources (MRL.AX), the Australian company which aims to get its Orokolo Bay mineral sands projects in Papua New Guinea into production has obtained a 20 year mining lease for its project. Orokolo Bay is expected to produce 0.5 million tonnes per year of magnetite, up to 10,000 tonnes per year of zircon concentrate and one million tonnes per year of construction sand.

Now the mining license has been received, Mayur reiterated its plan to ship the first magnetite by the end of 2022 with the sand and zircon concentrate shipments to start shortly there after. The initial capex for this project was anticipated to be just around US$21M, and the mining license was one of the final parts to get the ball rolling.

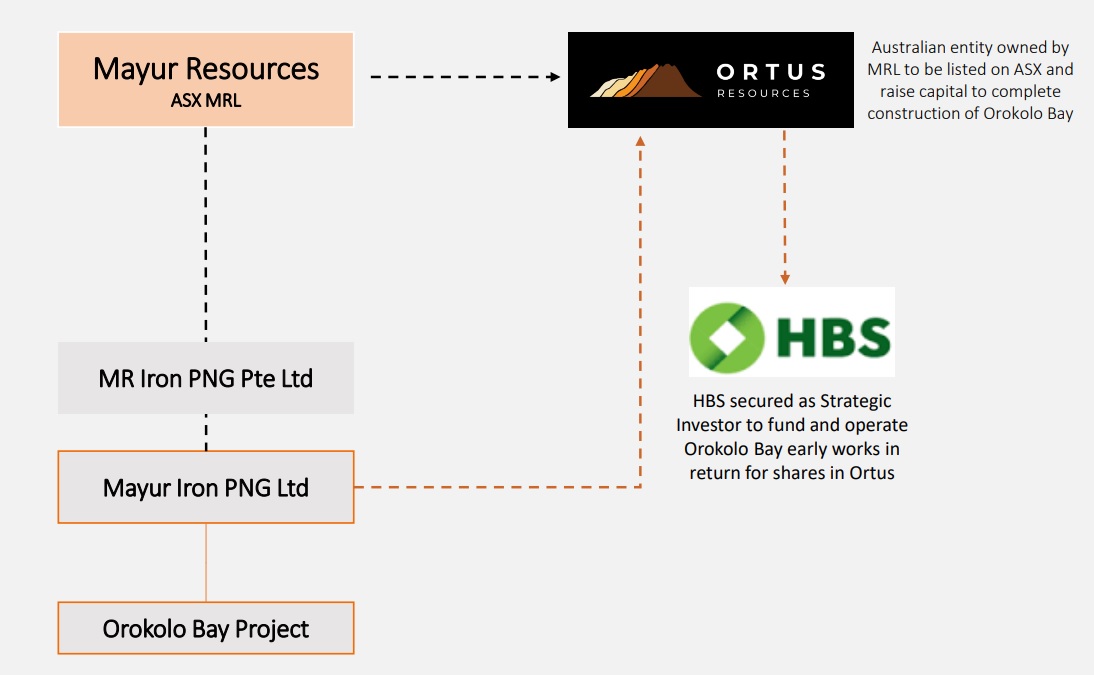

Immediately after receiving the mining license, Mayur announced it signed a term sheet with a Japanese trading house for its 0.5 million tonne per year magnetite output. The terms of the agreement weren’t provided so the jury is out as to how good the offtake agreement is, but the main takeaway here is that Mayur is rapidly ticking important boxes. Not only did it start working towards a definitive offtake agreement for the iron ore concentrate, it also executed an agreement woth a local construction and mining contractor which will fund a portion of the initial capex in return for an equity stake in the subsidiary which owns Orokolo Bay. That subsidiary will soon complete an IPO on the ASX whereby the IPO proceeds will be an important stepping stone towards funding the initial capex.

Disclosure: The author has no position in Mayur Resources. Please read our disclaimer.