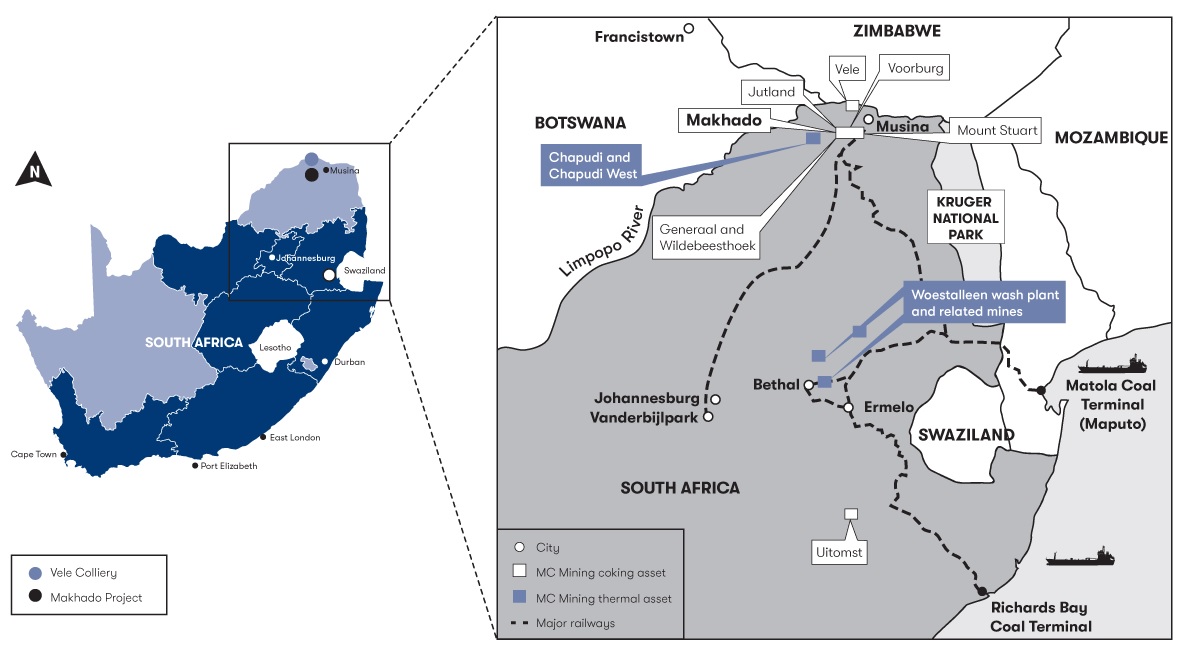

MC Mining (LON:MCM) has completed an offtake agreement with ArcelorMittal South Africa which will use the Makhado mine as its domestic supplier for steel as until now, it had to import the vast majority of its coking coal needs.

Initially, ArcelorMittal commits to purchase 350,000 tonnes of hard coking coal per year for a period of 10 years, but also has the right to purchase an additional 100,000 tonnes per year, all on a Free On Rail basis as the coal will be railed from Musina to ArcelorMittal’s operations. The agreement is still subject to a few conditions, and MC Mining is required to confirm it has secured funding for the development of Phase I by December 15th of this year, while it will have to confirm to Arcelor before June 30 it will be able to start delivering coking coal within 6 months.

An offtake agreement for 350,000 tonnes is an important step for MC Mining, as this is by far the most valuable coal that will contribute most to its underlying cash flows. The Makhado project will produce 2 million tonnes of coal, of which just over half a million tonnes will be coking coal, so Arcelor is committing to purchase between 60% and 80% of MC’s total expected coking coal output.

Go to MC Mining’s website

The author has no position in MC Mining. Please read the disclaimer