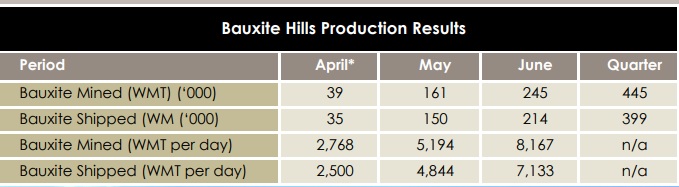

Metro Mining (ASX:MMI) has now already shipped several batches of bauxite to Xinfa in China, and according to the company, the ramp-up process on its Bauxite Hills mine continues to accelerate. Xinfa is the company’s main offtake partner, but Metro Mining has also sold more bauxite on the spot market, taking advantage of what it says are ‘attractive sales prices’. Unfortunately the company hasn’t provided an exact sales price per tonne (the sales price to Xinfa is confidential, but it would have been nice to see the spot prices, or a hint at the discount on the benchmark prices), so we are unsure how the current revenues and cash flows are holding up against the expectations in the feasibility study. According to the quarterly financials, Metro Mining generated a revenue of A$25.2M from selling almost 400,000 tonnes of Bauxite. This implies an average price north of A$60/t, and this would be fantastic. However, the Appendix 5B table shows Metro Mining received just A$18M from its customers, which probably indicates an additional A$7M was added to the balance sheet as a receivable.

Metro Mining has advised the ramp-up of the production rate at Bauxite Hills is accelerating, so there should be no issue to ensure it fulfills its promises to ship 1 million tonnes to Xinfa this year. However, due to the delay related to the start-up of the mine earlier this year, Metro Mining issued a cash call and raised A$17.5M at A$0.20 per share.

For calendar year 2018, Metro Mining still expects to produce and ship approximately 2 million tonnes of bauxite, and this will increase to 3 million tonnes in 2019 (of which 2/3rd will be shipped to Xinfa). Using an all-in production cost of A$33/t and an average sales price of A$50/t (which allows for a discount on the spot market), Metro Mining’s 3Mtpa scenario should generate A$50M in operating cash flow next year. Sustaining capex levels will be minimal, so we are pretty certain the company will move ahead with its expansion plans to boost the output to 6 million tonnes per day.

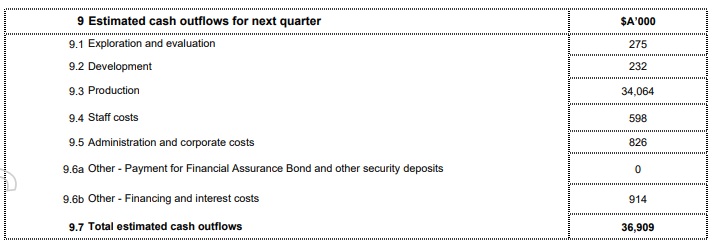

Looking at the expectations for the current quarter, Metro Mining expects to ship 825-875,000 tonnes of bauxite. Applying an average sales price of A$55/t would result in a revenue of A$47M, and considering Metro Mining expects to incur A$37M of expenses in the quarter (including G&A and interest expenses), the company should be making A$9-10M in free cash flow this quarter.

Metro Mining claims the ‘operating costs were not representative of long-term expectations’, but Metro’s guidance doesn’t seem to show any improvement. In the June Quarter, the average production cost was A$34/t (A$15.1M in production expenses divided by 445,000 tonnes). For the current quarter, Metro Mining expects to spend A$34.1M on production-related expenses to mine 850,000 tonnes, indicating a production cost of A$40/t. So something seems to be a bit off, unless Metro will be expensing some things that could otherwise be capitalized…

Go to Metro Mining’s website

The author has a long position in Metro Mining. Please read the disclaimer