Minera Alamos (MAI.V) has released the results of the long-awaited Preliminary Economic Assessment for the Cerro de Oro gold project in Mexico’s Zacatecas state. As this is the next stepping stone in Minera’s production growth process, it was pretty interesting to actually see some official numbers as Minera’s currently producing Santana mine was brought into production without an official study.

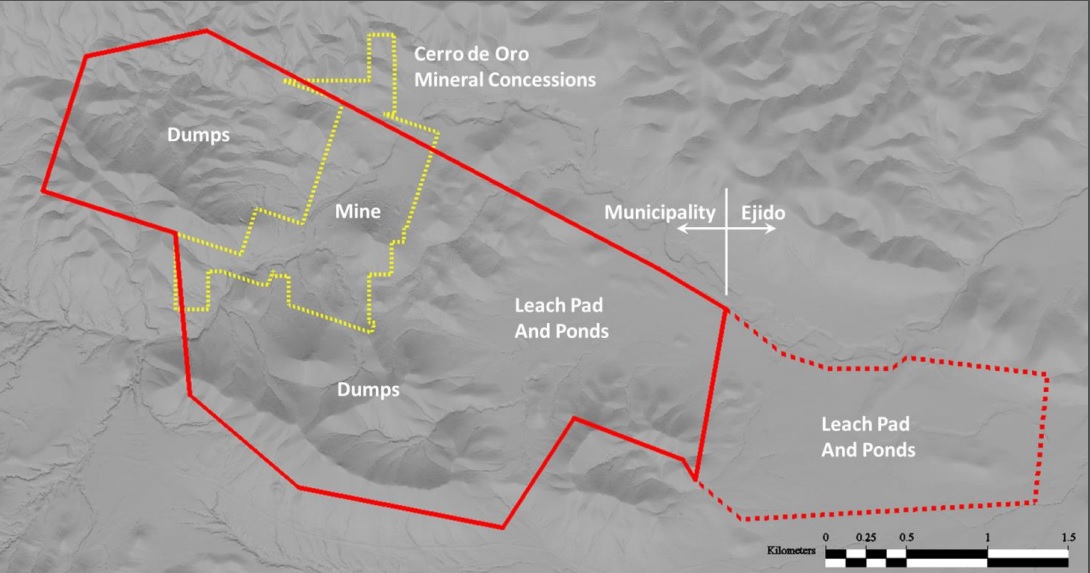

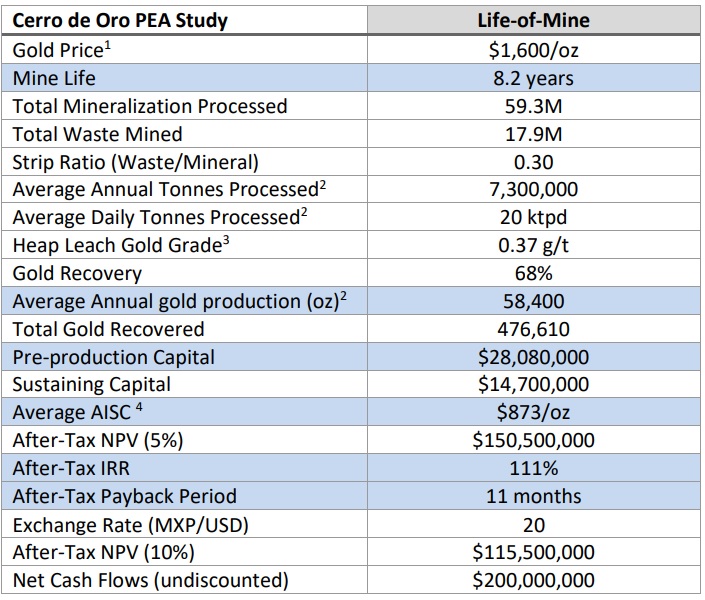

The mine plan at Cerro de Oro calls for a total of 59 million tonnes of rock to be processed at an average grade of 0.37 g/t gold which should result in approximately 477,000 ounces of gold loaded in carbon/doré.

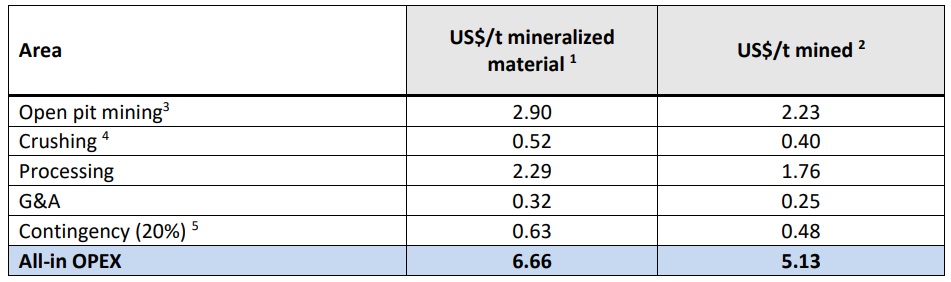

The operating cost is estimated to be less than US$7/t and thanks to a very low strip ratio (0.3:1) the all-in sustaining cost is estimated at less than US$900/oz. Although less than 500,000 ounces of gold will be produced, the combination of a low production cost and a low initial capex (estimated at just US$28M with an additional $14.7M or just around $30 per produced ounce of gold) means the economics of the mine are excellent. The after-tax NPV5% is estimated at US$150.5M (roughly C$200M at the current exchange rate) while Minera Alamos also disclosed a triple digit after-tax IRR. The IRR came in at 111% and the payback period is just 11 months.

It is also nice to see the company release an NPV10% number as we aren’t sure if the ‘standard’ discount rate of 5% for precious metals projects is feasibly for much longer. If the 5 year US treasury yield is 4% (it’s actually 4.18%), we don’t think 5% is an appropriate discount rate for a mining project as the mark-up to the risk-free interest rate would be less than 100 base points. Notwithstanding the problems one can have with the high debt levels of the United States, the ‘standard’ 5% discount rate is likely doomed.

And that’s fine for Minera Alamos as the after-tax NPV10% still comes in at in excess of US$115M, that’s just how good the project is, based on the PEA.

Disclosure: The author has a long position in Minera Alamos. Please read our disclaimer.