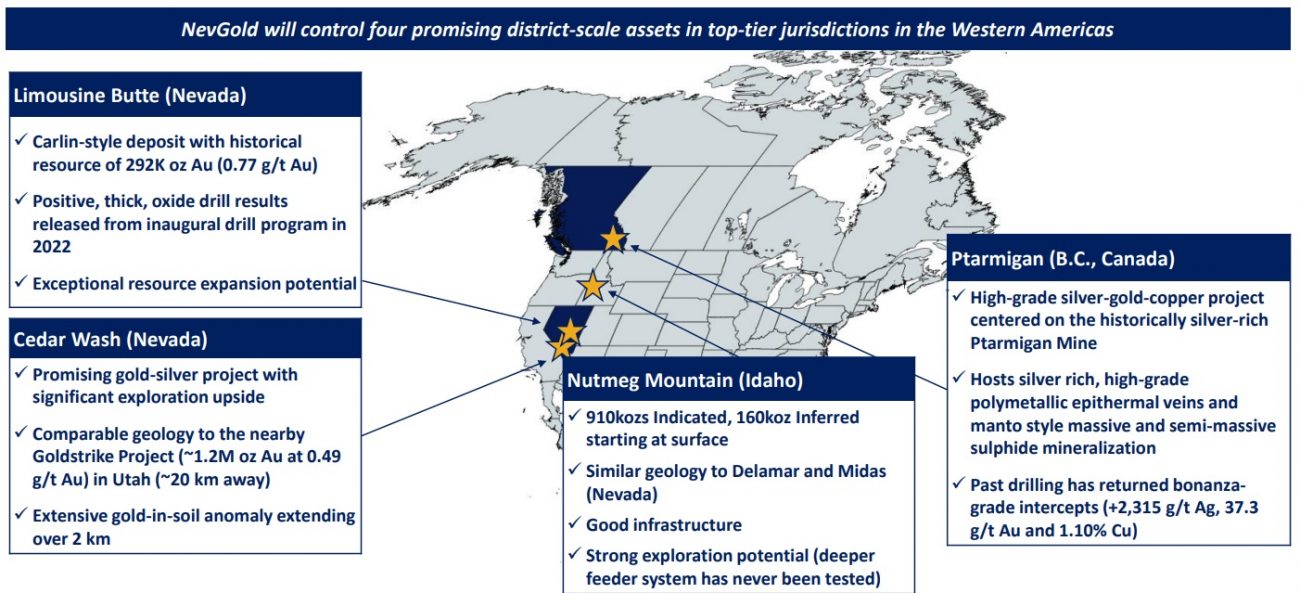

NevGold (NAU.V) announced on Tuesday it planned to raise C$1M in a flow-through financing priced at C$0.65. Each unit will consist of one flow-through share and half a non-flow-through warrant with an exercise price of C$0.85 for a period of 24 months. This financing is the direct result of an expression of interest from an investor after seeing the GoldMining cash injection on the back of the Nutmeg Mountain acquisition and we expect the total amount of placees in this financing to be low. And a positive side note: on the back of the announcement of the financing, CEO Bonifacio purchased an additional 10,000 shares at C$0.50 in the open market. This may not sound like much but it is encouraging to see insiders continuously buying more shares, even when the amounts are moderate.

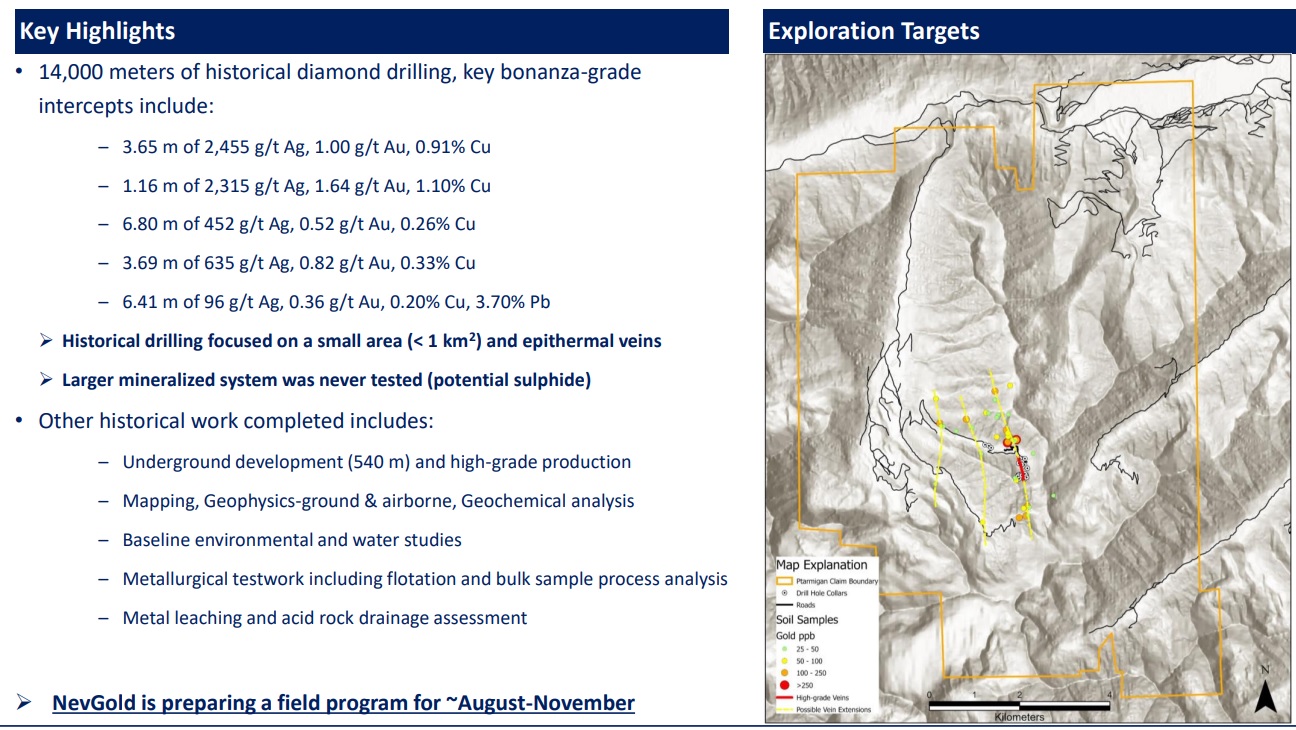

As NevGold wants to spend its hard dollars – which are more difficult to raise – on its US-based projects, it makes a lot of sense to fund the Ptarmigan exploration program using flow-through funds as it is slightly easier to raise those funds (although the current financing does come with half a warrant, a sign of the times). From a corporate governance perspective, this likely is NevGold’s best possible move as it will allow the company to move forward with all three projects simultaneously while keeping an eye on the treasury and share count.

NevGold is waiting for the assay results of an additional 2,500 meters of drilling at Limousine Butte and these should be released in the next few weeks.

Disclosure: The author has a long position in NevGold. NevGold is a sponsor of the website. Please read our disclaimer.