NextSource Materials (NEXT.TO) has been trying to fund the construction activities on its Molo graphite project for the past two years, and has now finally reached a deal with Vision Blue, a Guernsey based investment vehicle created by Mick Davis a former high-ranking executive at almost all the big mining companies.

The financing comes at a very hefty price tag. There’s no debt involved which could be seen as a positive (no lender that can just take the asset away in case of a default), but Vision Blue still clearly is the winner here. It will be allowed to purchase 120M shares at C$0.065 followed by 232M units priced at C$0.07 consisting of one common share and a full warrant at C$0.10. This means Vision Blue will end up owning almost 400 million shares as well as 232M warrants in the company.

A third element of the financing package is the royalty. Vision Blue is advancing US11M for a 3% GSR which required NextSource to pay 3% of the graphite revenue while making minimum payments of US$1.65M in case the GSR would result in an attributable cash flow of less than that amount. There is a tiny buyback possibility: NextSource can repurchase 0.75% of the GSR for US$20M. Indeed, right off the bat, the royalty is valued at $80M (4X US$20M) if NextSource wants to repurchase it. On top of that, Vision Blue is entitled to a 1% GSR for the potential vanadium production for a period of 15 years. A sweet deal for Vision Blue, that’s for sure.

And it doesn’t end there; Vision Blue will receive a US$1.5M financing fee which means that NextSource Materials will only receive US$28M in proceeds.

We were hoping the recent resurrection of the battery metals space would allow NextSource to secure funding at a reasonable cost. But giving away 40% of the company (the share count post placements will increase to 1B shares of which Vision Blue will own 400M shares) is a high price to pay.

Let’s also take a moment to discuss the royalty. NextSource will have to pay a 3% GSR or a US$1.65M payment per year (and we hope the minimum payment doesn’t kick in right away. The press release did not mention a grace period but we hope the NextSource management was smart enough to avoid having to pay the US$1.65M right off the bat).

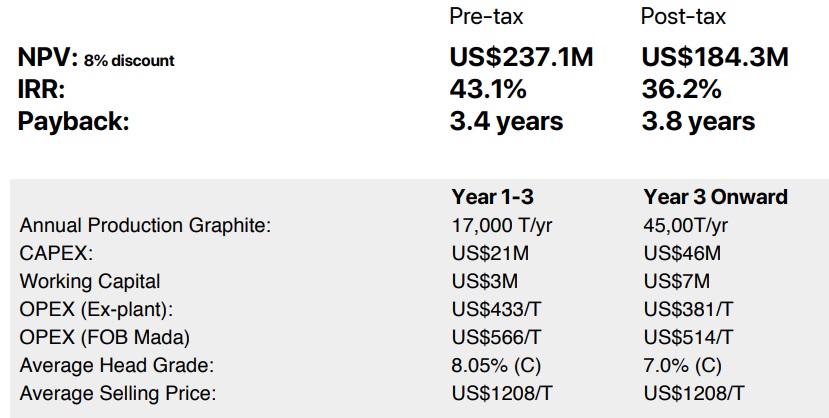

Looking at the feasibility study, the initial module will produce 17,000 tonnes per year at an average selling price of US$1200/t (let’s just use the metrics used on the feasibility study for now). That results in an annual revenue of US$20.5M. 3% of that is just over US$0.6M which is under the US$1.65M threshold which means NextSource will have to pay Vision Blue the minimum amount of US$1.65M per year. This means that of the US$11M net margin (selling price minus the FOB production cost), about 15% of the net margin will have to be paid as a royalty to Vision Blue.

Great for Vision Blue, but annoying for NextSource because it means it will not be able to self-fund the expansion to 45,000 tonnes per year which would require an additional US$53M and was expected to be ready in Y3. This means that in case NextSource wants to expand to 45,000 tonnes per year by Y3, additional funding to the tune of US$30-35M will be needed.

And to estimate the impact of the GSR on the NPV. The after-tax NPV8% was estimated at US$184.3M. However, at 45,000 tonnes per year sold at $1208/t, a 3% GSR will be payable over a revenue of US$1.63B which means there will be about US$50M in royalty payments to Vision Blue. This means the after-tax NPV8% will likely come in at around US$150-160M (assuming all warrants are exercised and assuming the unlikely scenario NextSource is able to fund the Phase 2 on time without issuing additional shares) the total sum of the cash flows will likely be around US$175-180M (we need to add the initial capex back to the NPV to end up with the total sum of the cash flows). Divided by 1.3 B shares, the NPV/share discounted at 8% will come in at around US$0.14/share, which is C$0.175 using the US$1208 average selling price. This means that at the current share price of C$0.21, the market is already pricing in A) the Molo mine exceeding expectations B) a flawless financing of Phase 2 and C) a higher graphite price.

We also think the current funding package may not be sufficient for the initial 17,000 tonnes per year plant. The company will raise US$28M after taking care of the Vision Blue financing fee, and we would expect there are some additional costs involved (lawyers, etc) so let’s say NextSource raises US$27.5M net. The initial capex at Molo was estimated at US$24M. The company had a negative working capital position of minus US$0.3M as of the end of September and is burning through about US$0.3M per quarter (which is very reasonable, so that’s not an issue), so we can assume the current working capital position stands at a negative US$1M. This already reduces the available working capital position to US$26.5M. And that’s too low to be comfortable: during the US$24M construction (assuming there hasn’t been any inflation pushing the capex up), the overhead expenses obviously continue to run at US$0.3M per quarter.

In a best case scenario, NextSource sees the C$0.065 warrants (30M of those are outstanding) being exercised as this could bankroll the G&A expenses until the summer of 2022. Additionally, the 232M warrants owned by Vision Blue at C$0.10 will also bring in an additional C$23M if exercised, so NextSource has a shot at avoiding another placement.

So yes, NextSource has secured funding to finally get going at Molo. An exciting chapter for the company. But at what price?

Disclosure: The author has a long position in NextSource Materials and although we do not trade in company securities within 72 hours of the publication of a blog post or a report, this will be an exception. The entire position will be liquidated today as NextSource is trading at the highest level in almost seven years and the financing deal isn’t that great. NextSource Materials is not a sponsor of the website, but has been a sponsor until March 2020. Please read our disclaimer.