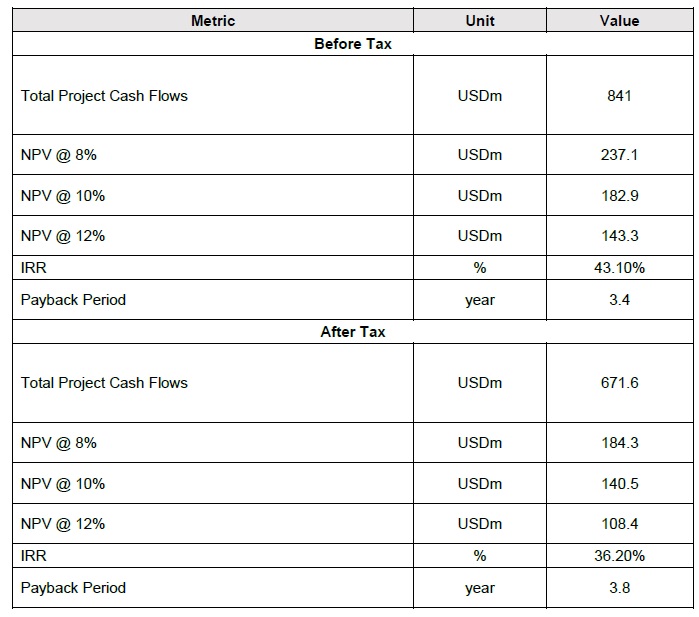

NextSource Materials (NEXT.TO) has now updated its feasibility study on the Molo project using the most recent available data to calculate the operating expenses and expected cash flows based on the updated graphite prices. The result is quite impressive as the after-tax NPV8% increases to US$184M with an IRR of 36% while on a pre-tax basis, the NPV8% is an excellent US$237M with a 43% IRR. The base case graphite price is $1208/t which probably is a FOB Port Dauphin price.

The base case consists of an initial 17,000 production profile which will increase to 45,000 tonnes per year by the third year. A staged production increase as NextSource would obviously want the cash flows from the initial 34,000 tonnes in the first two years to help fund the bill of the Phase 2 expansion.

The initial capex for the 17,000 tpa scenario is now US$21M, while the additional cost for the subsequent increase to a combined 45,000 tonnes per year will be around $39M for a combined capex of just US$60M. Indeed, a very low capex level which has now reached an accuracy level of 12.5% for both phases.

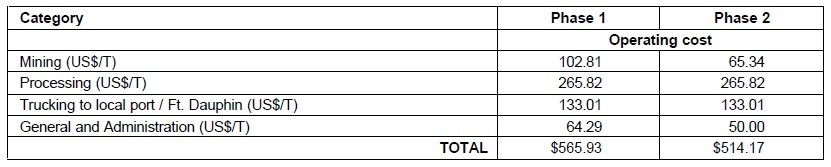

The pure production cost is expected to be around US$350/t while an additional $133/t has been allocated to transportation expenses. Note, these estimates are based on Y3 and beyond, so the initial opex in the small 17,000 tonnes per year scenario will be higher ($367 + transportation expenses) due to the lack of economies of scale. Surprisingly, there are no economies of scale in the processing costs which remained completely unchanged. We checked in with Nextsource to figure out how this is possible, and apparently the company just didn’t take any potential economies of scale into consideration and just used the Phase I processing cost in order to avoid losing more time. Doing a more detailed study on defining the economies of scale in Phase 2 would have resulted in an additional delay, which Nextsource wanted to avoid. This means the Phase 2 opex will probably come in a bit lower than the estimates as we think it’s very unlikely there will be no economies of scale whatsoever.

We noticed the entire technical report has already been filed, so you can expect a more extensive update in the near future once we have checked the technical details. But the headline results appear to be excellent and the relentless selling by Dundee lately (which totally killed the share price last week) has now made it very tough for NextSource to raise additional funds, as the bank account will be running on fumes by now. An excellent feasibility study, but a poor timing to sell by Dundee (probably because it needed to clean out the books before the end of Q3).

Disclosure: The author has a long position in NextSource Materials, which also is a sponsor of the website.