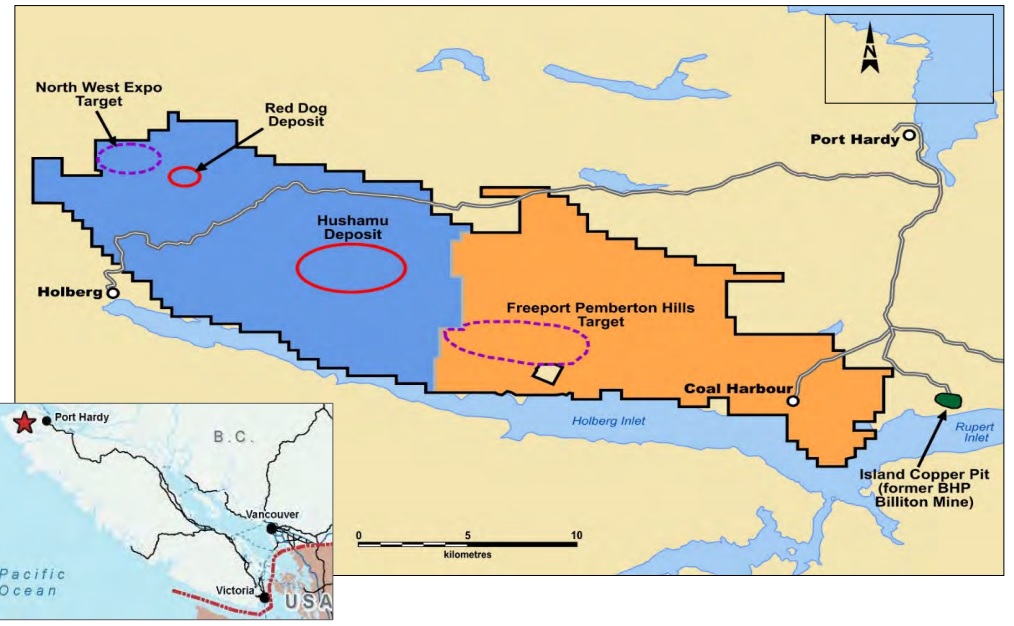

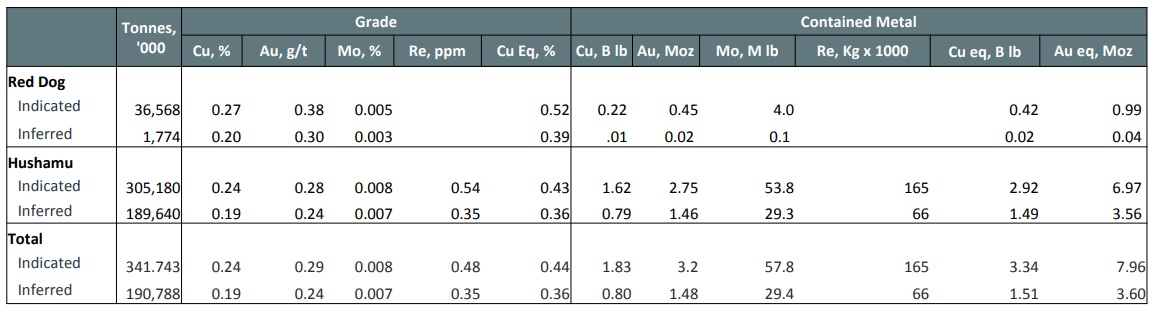

The case for a low-grade copper-gold project stands or falls with metallurgy. A lower than average recovery rate can easily kill a project and it’s hardly a surprise companies with low grade resources spend a lot of time and effort on getting things right. Northisle Copper and Gold (NCX.V) for instance has a large resource on the North Island copper-gold porphyry project on Vancouver Island but despite an impressive tonnage (342 million tonnes in the indicated resource and an additional 191 million tonnes in the inferred resource category), the grade remains very low, as you can see below.

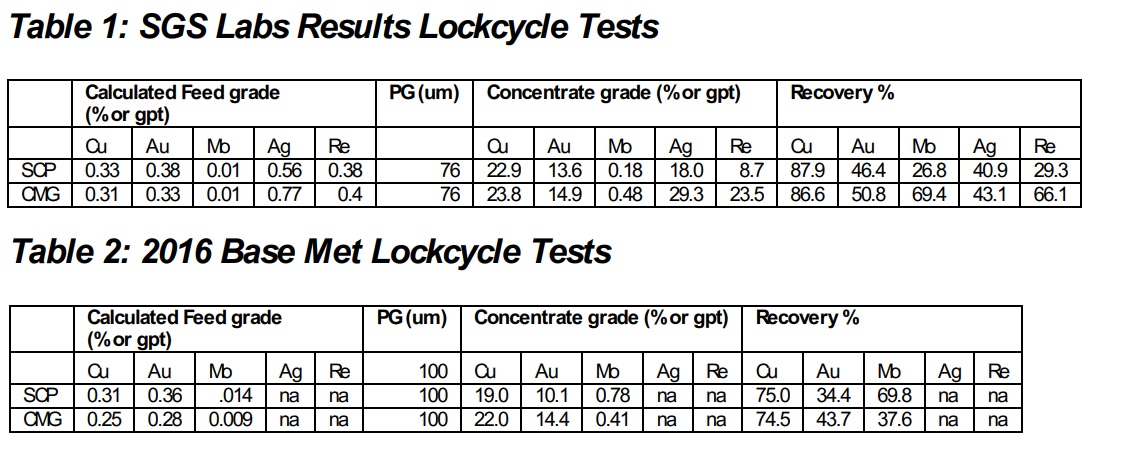

Although a 2017 PEA indicated the project was viable at $3.10 copper and $1300 gold , the after-tax NPV8% was still just US$413M with an IRR of just 14%. Needless to say the project economics could use a little boost and the 2020 met work is an important step in the right direction. The company completed additional test work on both the low pyrite and high pyrite mineralization and was able to boost both the copper and gold recoveries in both cases, as you can see in the tables below. The SCP zone is the high pyrite mineralization, CMG is the low-pyrite mineralization.

Seeing how both the copper and gold recovery rates were boosted, this bodes well for the project economics as the annual production (82M pounds copper and 79,000 ounces of gold) can now easily increase by 10-15% without incurring more operating expenses. Metallurgy was always going to be decisive for the project as the low grade doesn’t allow for errors, so the only way to improve the project was to boost the metallurgy to recover more metals. More work is needed to confirm the recovery rates can be boosted throughout the project, but this clearly is a step in the right direction.

Northisle Copper used the improved metallurgical results from the Hushamu deposit (discussed above) and the Red Dog deposit (where the copper and gold recoveries increased by respectively 5% and 65%) to raise money. The initially announced C$3M placement was increased to C$3.2M, priced at C$0.13 on a straight-share basis (no warrants will be issued). As the current share price is trading around C$0.20, this placement should be filled and closed soon.

Disclosure: The author has no position in Northisle Copper and Gold