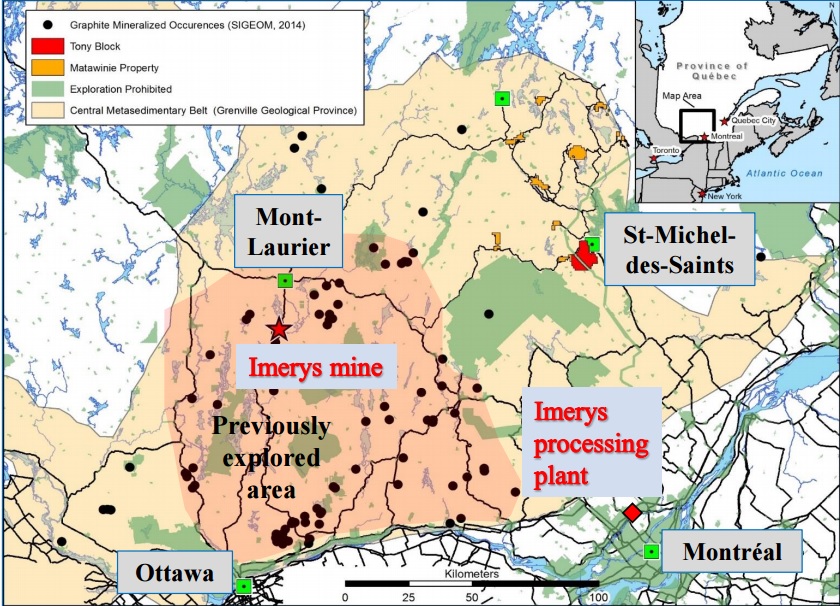

We haven’t been excited about a graphite company and project in a long time, but after meeting with Eric Desaulniers, the CEO of Nouveau Monde Mining (NOU.V), we think this company has a very good chance to really become Canada’s next graphite mine.

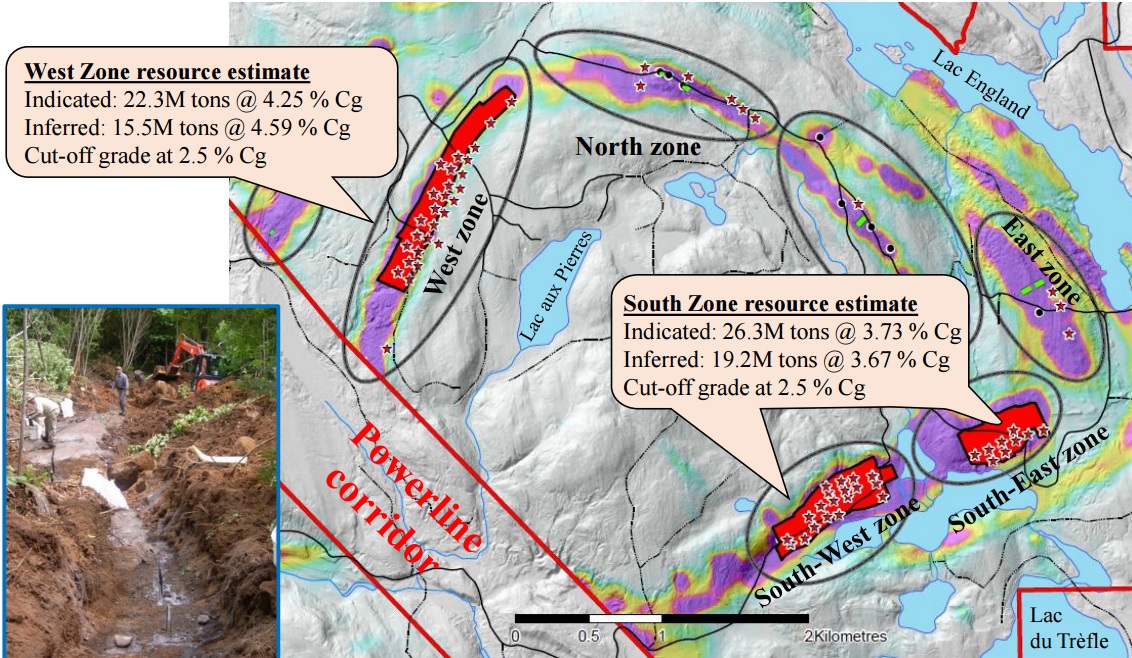

The company’s Matawinie project is a new discovery, and even though a lot of companies claim their graphite projects are ‘world class’, this description seems to fit the bill for Nouveau Monde, as the company’s resource estimates on the West zone (38Mt at almost 4.5% Cg) and the South zone (45Mt at approximately 3.7% Cg) give you a pretty good indication of how big this system is (as these two zones are just a part of the Matawinie ‘district’ and no resource estimate has been completed for the North and East zones just yet.

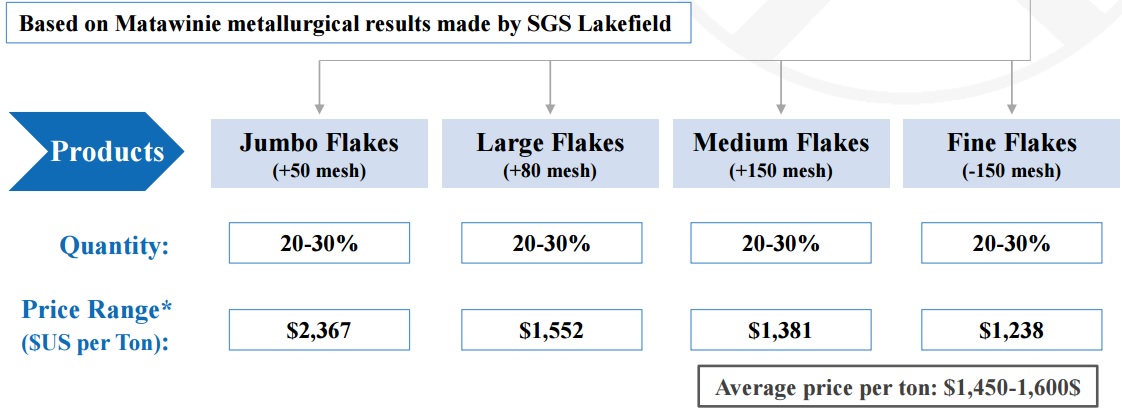

Enough about the basics, in this blurb we’d like to draw your attention to the company’s upcoming PEA which could be released any week now. We tried to figure out how good this PEA could be, and our back of the envelope calculations were a positive surprise to us. If we would use an initial capex of $100M for a 50,000 tpa production scenario in our conservative calculation, our after-tax NPV8% is approximately US$49M using an average sales price of $1200/t (compared to the $1450-1600/t expected by Nouveau Monde, see here below) and a total (all-in sustaining) production cost of $875/t. Sure, a net present value of C$65M doesn’t sound too exciting, but keep in mind that’s our conservative calculation.

In our base case scenario we would use an initial capex of $90M, a sales price of $1300/t (which still is relatively conservative as Nouveau Monde is targeting an average sales price of $1450-1600/t) and an AISC of $650/t (which we think is achievable given the characteristics of the Matawinie deposit), the after-tax NPV8% increases to US$131M (or approximately C$170M). Despite the relatively high discount rate, the additional NPV in Y21-25 (in our NPV calculations we kept the mine life limited to 20 years) would add an additional C$23M to the NPV.

Of course, these are just our simplified back of the envelope calculations and the final parameters and inputs might be quite different, but we are really looking forward to see the official Preliminary Economic Assessment on the Matawinie project, as we think it might surprise quite a few people. Our minimum requirements to make us ‘happy’ would be an after-tax NPV8% of C$150M (or C$200M+ if a discount rate of 5% is being used) and a payback period of less than 4 years (depending on the ramp-up schedule).

Go to Nouveau Monde’s website

The author currently has no position in Nouveau Monde. Please read the disclaimer