Nouveau Monde Mining Enterprises (NOU.V) has released the results of its Preliminary Economic Assessment at the end of June, and we were looking forward to try to compare the official results with our back of the envelope calculations we shared with you a few weeks before the publication of the PEA.

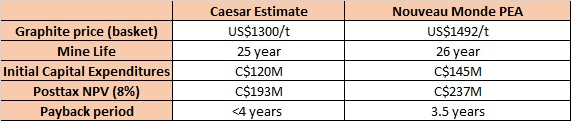

The company’s after-tax NPV8% came in at C$237M based on a 26 year mine life and an initial capital expenditure of C$145M (including C$22M in contingency). That’s higher than what we anticipated due to the longer mine life and the higher graphite sales price. Whereas we used a graphite price of US$1300/t, Nouveau Monde’s consultants are a bit more optimistic and have used an average price of $1492/t. Just to make the comparison easier for you, we have put both our expectations and the final results of the PEA in the following table.

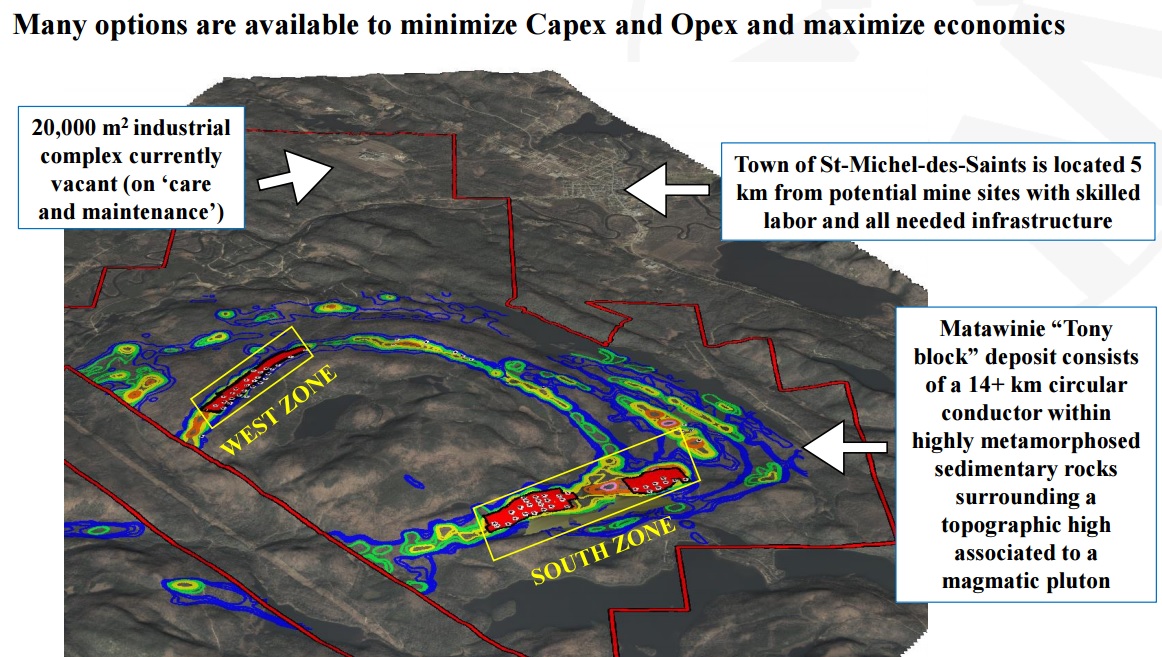

Keep in mind this PEA is just a first step towards developing a final mine plan and to go ahead with the development of the mine. This PEA was also only based on the West Zone of the claims using an in-pit resource of 31 million tonnes at an average grade of in excess of 4.5% Cg. It wouldn’t make a lot of sense to include the other zones in this PEA as the additional value to the Net Present Value would be pretty marginal, but we are quite convinced the total mine life will be much longer than the 26 years used in the NPV calculation.

Go to Nouveau Monde’s website

The author has no position in Nouveau Monde just yet, but could initiate one at any time. Please read the disclaimer