Oroco Resource (OCO.V) has released assay results from almost 2,700 meters of drilling in five holes drilled on the North Zone, further confirming the strike length of the North Zone to approximately 1,600 meters. As always, Oroco’s bullet points explaining the location and targets of the five holes is excellent as it provides investors with more color on the importance of these holes.

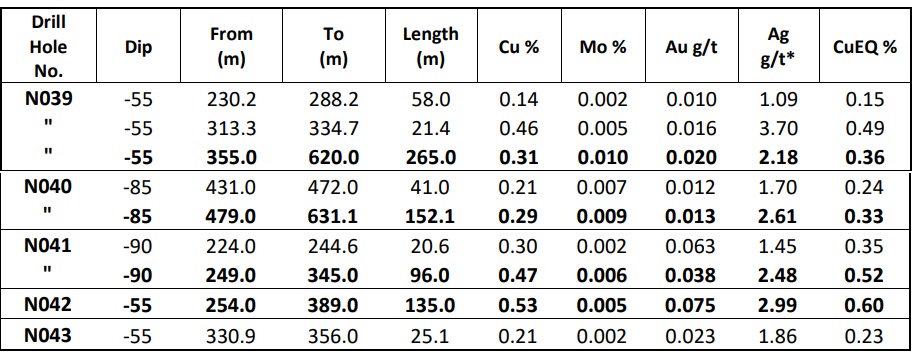

We like hole N042 the best. With a total length of 135 meters containing 0.53% copper and 0.60% copper-equivalent, this interval is pretty high grade for what will be a lower grade deposit. Even hole N041 with 96 meters containing 0.47% copper and 0.52% copper-equivalent should be considered ‘relatively’ high grade for Santo Tomas. The other intervals in holes N039 and N040 are lower grade but pretty thick so all five holes will add value.

The company has now reported assay results for 43 holes at the North Zone (in excess of 21,000 meters of drilling), 7 holes at Brasiles (5,100 meters of drilling) and 3 holes at the South Zone (for just over 2,000 meters of drilling). The 43 holes on the North Zone will further increase the confidence in the consistency of the mineralization and will have a positive impact on the Preliminary Economic Assessment which will be completed once all the data is available. Oroco has now started a horizontal drill program into the side of the North Zone, which could easily add tonnes to a combined resource estimate as well.

While most of the tonnage will come from the North Zone, let’s not forget about the South Zone either. The company only released assay results from just three holes but has completed an additional 16 holes (for a total of approximately 9,000 meters) and results for those 16 additional holes are still pending. Once assay results from all holes (including the horizontal holes drilled at the North Zone) will be released, Oroco should get a pretty idea of the total tonnage and the potential mine plan it can incorporate in the PEA. And now the copper price is trading above $4 per pound again, the entire copper space will likely be the subject of more attention.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our disclaimer.