Oroco Resource Corp. (OCO.V) has just closed a private placement consisting of 12.1 million units priced at C$0.60. Each unit consists of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.90 for a period of two years (subject to an acceleration clause).

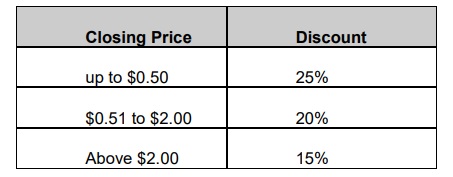

We received some enquiries about the low financing price this placement was conducted at, considering the issue price of C$0.60 is more than 20% below the C$0.86 closing price the day before the announcement. This would violate the TSX rules as the maximal allowed discount is 20% (see below) as the maximum permittable discount of 20% on an 86 cent share price would have forced Oroco to price the financing at C$0.69 (C$0.688 rounded up to the nearest full cent).

However, this placement has been in the works for several weeks, and Oroco must have filed for a price reservation with the TSX, as mentioned in the exchange’s placement policy. If Oroco didn’t correctly complete the price reservation procedure, the financing will be rejected by the exchange, it’s as simple as that. And of course, anyone who knew about the placement and sold shares on the market before the official announcement was operating illegally. Which makes today’s share price increase even more strange as we would have expected a net selling day (from investors participating in the financing that were previously not allowed to sell) rather than a high-volume day where the share price increases by roughly 20%. At least it’s a positive surprise.

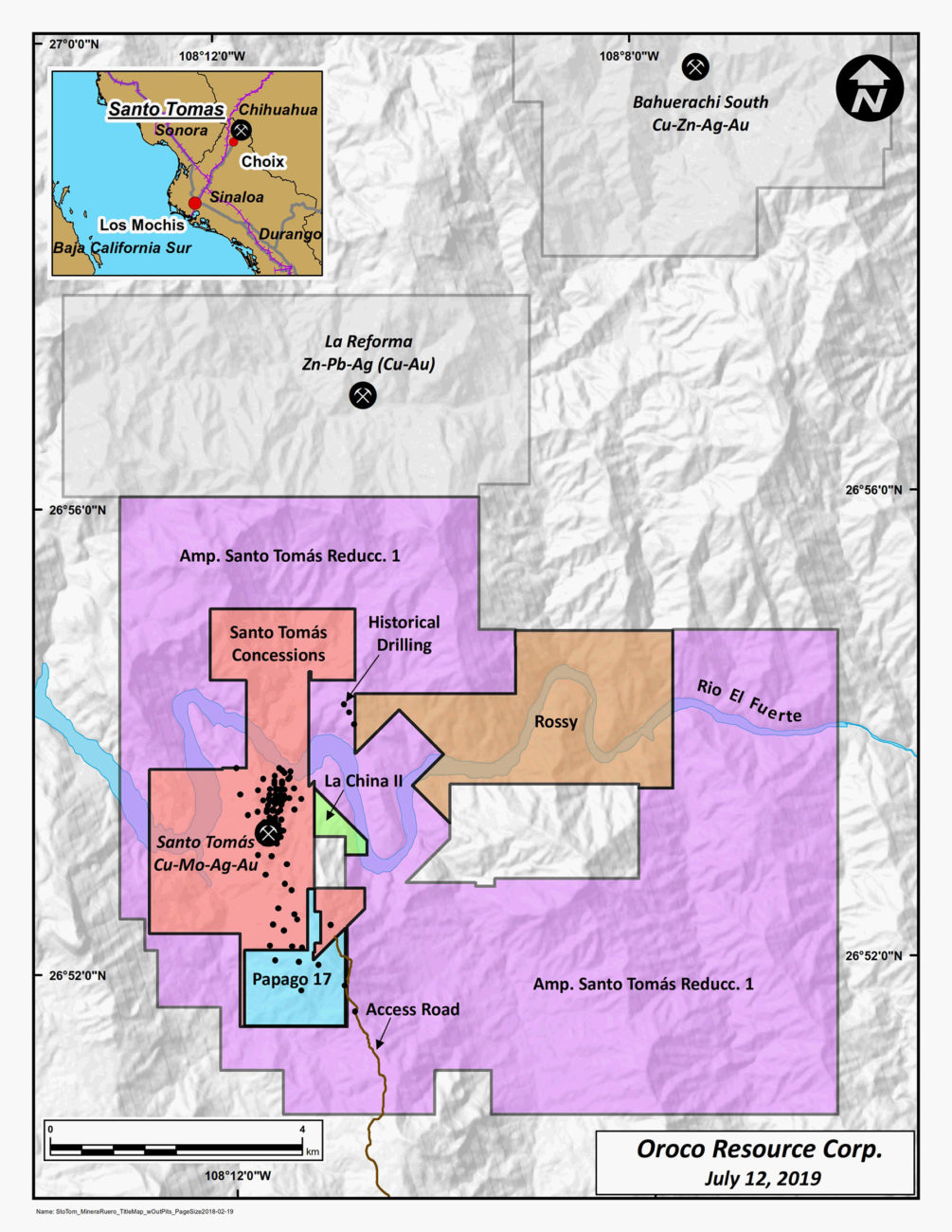

With the current cash infusion, Oroco should now have enough cash on hand to further increase its economic interest in the project to the 71.9% threshold. A 3D survey is currently underway, and Oroco should be drilling soon.

Disclosure: The author has a long position in Oroco and participated in the financing. Oroco is a sponsor of the website.